Short and Long Maturities

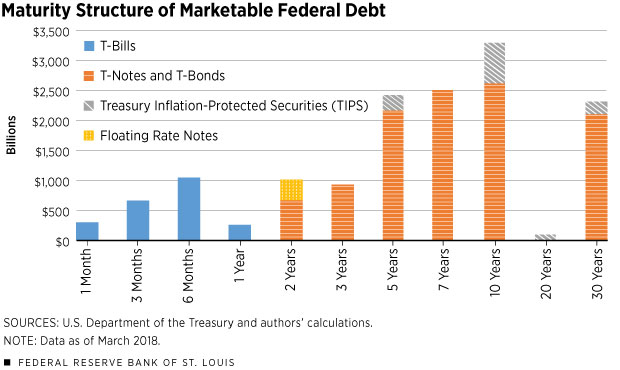

Figure 2 presents the maturity structure of marketable federal debt as of March 2018. Each bar corresponds to the value of outstanding debt issued at the given maturity.

Source: Federal Reserve Bank of St. Louis

Figure 2 also decomposes this federal debt by the type of security. Each of these securities has different characteristics, such as a particular maturity schedule or a formula for its interest payments.

The bulk of this federal debt is financed using three main types of securities: Treasury bills, Treasury notes and Treasury bonds. These three types of securities account for almost 90 percent of all marketable federal debt outstanding as of March 2018. [Footnotes omitted.]

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Tuesday, August 21, 2018

Maturity Structure Of Marketable Federal Debt

Posted By Milton Recht

From the Federal Reserve Bank of St. Louis, Regional Economist, Third Quarter 2018, "Rising Rates Impact Borrowing Costs for the U.S. Government, Too" by Miguel Faria e Castro and Asha Bharadwaj:

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment