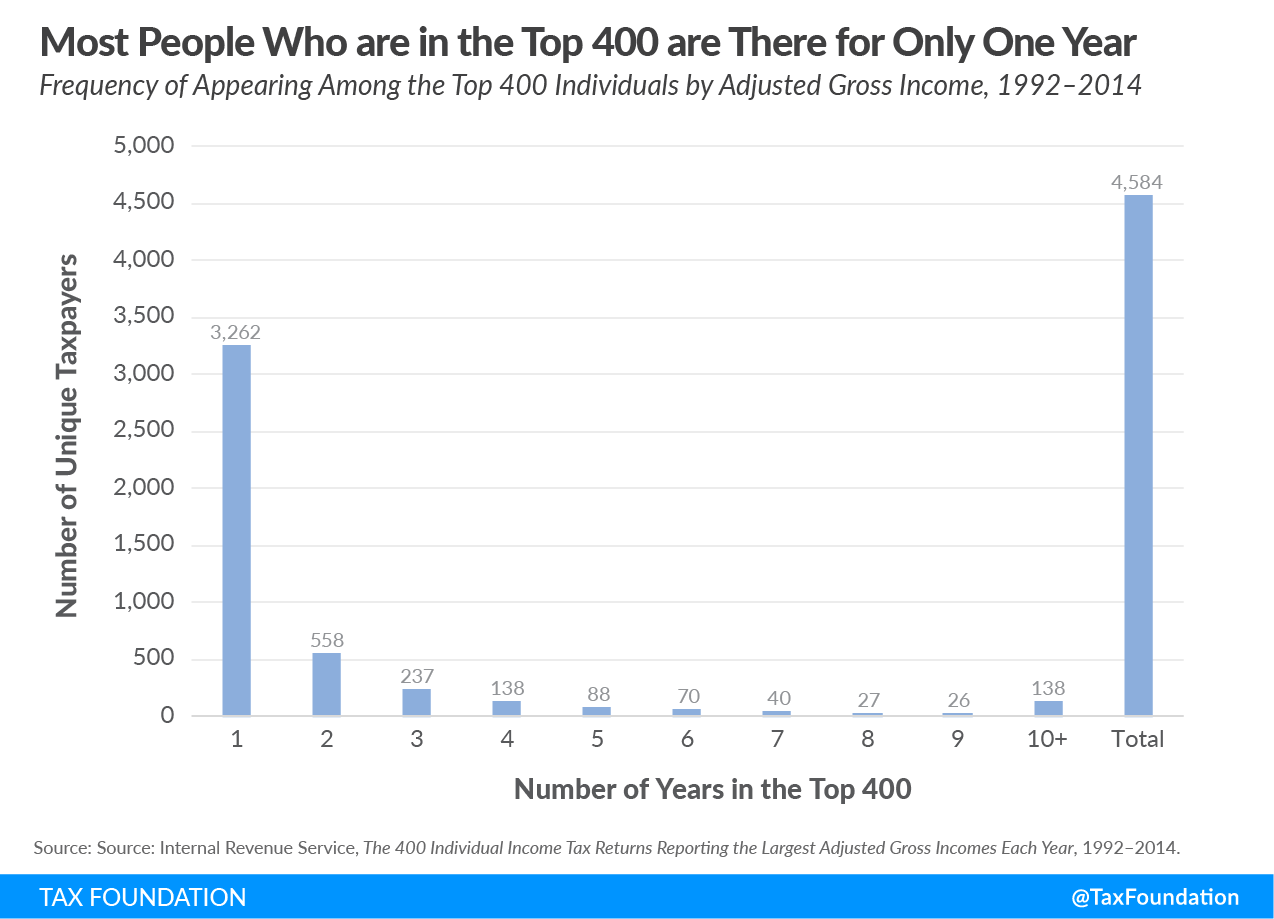

The US has a high turnover of people in the very high income brackets. A higher tax on people earning very high incomes affects many more people than elected officials lead us to believe. Over a 22- 23

12-13 year period, 4500 people entered the class of the top 400 earners for at least one year. Fifty percent of income earners are in the top 10 percent for at least one year during their lifetimes. 11 percent will be in the top 1 percent. Any higher tax on the rich will hit many more taxpayers than politicians tell us.

From Tax Foundation, "

How Much Turnover Is There Among the Richest Americans?" by Robert Bellafiore and Aida Vazquez-Soto:

As scholars and everyday taxpayers continue to debate this issue and the question of increasing taxes on the richest Americans, one observation to keep in mind is the high degree of turnover among the highest-income Americans.

The following chart, using data from the Internal Revenue Service (IRS), shows the frequency of those filing who make the top 400 individual income tax returns with the highest adjusted gross income from 1992 to 2014. Of the 4,584 people who made it into the top 400 at some point over that period, 3,262 qualified for only one year. In other words, 71.2 percent of those who were in the top 400 made it once and not again.

***

As The Cato Institute noted, "

High Turnover Among America’s Rich" by Chelsea Follett, January 8, 2016:

Your odds of “making it to the top” might be better than you think, although it’s tough to stay on top once you get there.

According to research from Cornell University, over 50 percent of Americans find themselves among the top 10 percent of income-earners for at least one year during their working lives. Over 11 percent of Americans will be counted among the top 1 percent of income-earners (i.e., people making at minimum $332,000 per annum) for at least one year.

How is this possible? Simple: the rate of turnover in these groups is extremely high.

Just how high? Some 94 percent of Americans who reach “top 1 percent” income status will enjoy it for only a single year. Approximately 99 percent will lose their “top 1 percent” status within a decade.