We have seen that central planning of the production side of the economy does not work and leads to misallocation of resources and shortages. Why should central planning of the monetary side of the economy work any better? The Great Recession began in Dec 2007. M1, ready accessible cash held by banks, was flat for several years prior and velocity and private debt were increasing. Stock market indices started their decline in Oct 2007. Without available cash, banking and economy wide leverage increased. The unnoticed recession lowered home prices which prevented Bear Stearns from rolling over short term debt collateralized by housing. From then on, government interference created a crisis. The Fed needs more wisdom of the crowd, market source info, like TIPS, but related to future GDP. Markets beat models.

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Sunday, November 18, 2018

My WSJ Published Comment To "Why Central Bankers Missed the Crisis"

Posted By Milton Recht

My Wall Street Journal published comment to "Why Central Bankers Missed the Crisis: The lesson of 2008, a top economist says, is that monetary maestros don’t pay enough attention to financial markets. Are they making the same mistake again?" by Joseph C. Sternberg:

Thursday, November 15, 2018

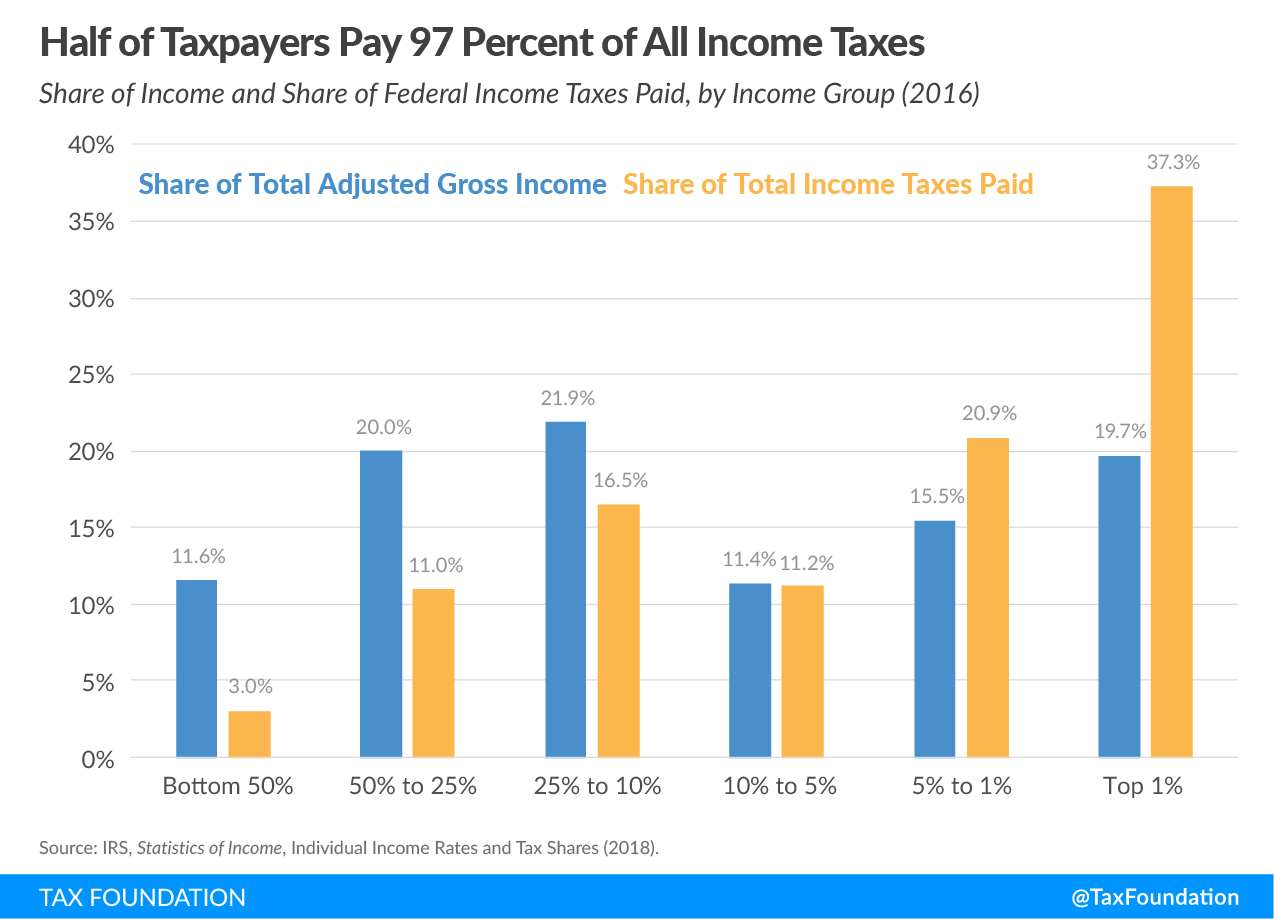

Top Half Of Taxpayers Pay 97 Percent Of Income Taxes: Top 1 Percent Pay 37 Percent: Chart

Posted By Milton Recht

From Tax Foundation, "Summary of the Latest Federal Income Tax Data, 2018 Update" by Robert Bellafiore:

The Internal Revenue Service (IRS) has recently released new data on individual income taxes for tax year 2016, showing the number of taxpayers, adjusted gross income, and income tax shares by income percentiles.***

|

| Source: Tax Foundation |

Wednesday, November 14, 2018

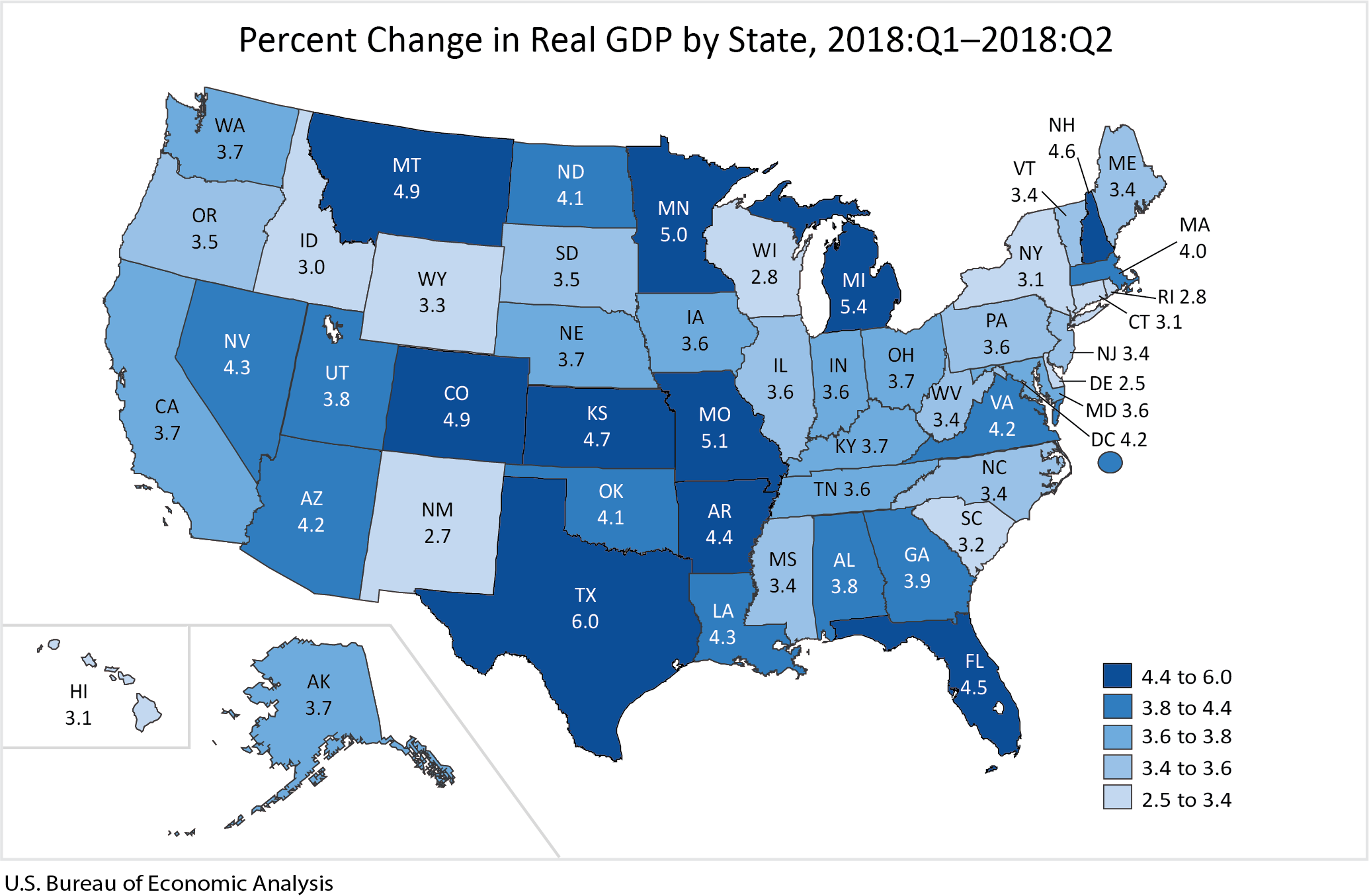

Map Of State Gross Domestic Product Percent Change, 2nd quarter 2018

Posted By Milton Recht

From Bureau of Economic Analysis, "Gross Domestic Product by State, 2nd quarter 2018: Texas Had the Fastest Growth in the Second Quarter":

Real gross domestic product (GDP) increased in all 50 states and the District of Columbia in the second quarter of 2018, according to statistics released today by the U.S. Bureau of Economic Analysis. The percent change in real GDP in the second quarter ranged from 6.0 percent in Texas to 2.5 percent in Delaware.

|

| Source: Bureau of Economic Analysis |

Monday, November 5, 2018

Fast Food Recruiting Seniors As Teenage Workforce Declines

Posted By Milton Recht

From Bloomberg, "Senior Citizens Are Replacing Teenagers as Fast-Food Workers: Amid a tight U.S. labor market, restaurant chains are recruiting at churches, senior centers and AARP." by Leslie Patton:

Restaurants are recruiting in senior centers and churches. They’re placing want ads on the website of AARP, an advocacy group for Americans over 50. Recruiters say older workers have soft skills—a friendly demeanor, punctuality—that their younger cohorts sometimes lack.

Two powerful trends are at work: a labor shortage amid the tightest job market in almost five decades, and the propensity for longer-living Americans to keep working—even part-time—to supplement often-meager retirement savings. Between 2014 and 2024, the number of working Americans aged 65 to 74 is expected to grow 4.5 percent, while those aged 16 to 24 is expected to shrink 1.4 percent, according to the U.S. Bureau of Labor Statistics.

|

| Source: Bloomberg |

*** Hiring seniors is a good deal for fast-food chains. They get years of experience for the same wages—an industry median of $9.81 an hour last year, according to the BLS—they would pay someone decades younger. This is a considerable benefit in an industry under pressure from rising transportation and raw material costs.

Subscribe to:

Posts (Atom)