Sunday, October 22, 2017 My Posted Comment To Larry Summers' Washington Post Piece Against Lowering Corporate Taxes Posted By Milton Recht My posted comment to The Washington Post, Wonkblog, "Lawrence Summers: One last time on who benefits from corporate tax cuts" by Lawrence H. Summers:If Larry Summers believed his argument that corporations should be taxed, he would argue for taxing not for profit corporations. His arguments are underpinned by the belief that the government is a wiser spender of the tax money than a non-governmental entity, such as a private corporation, or individual. Either Summers' argument is true for all entities or it is true for none. To tax some entities and not all entities requires the government through its tax code to be able to do a better job of picking better investments and winners over losers than our capitalistic system. Experience over hundreds of years has shown that as much as we would like to believe governments can do better than a selfish profit motive owner, the reality is that decisions affected by politics and the self-interest of politicians attempting to remain in office leads to far worse societal outcomes than capitalistic motives. Not for profits and governments are not economically self-sustaining and can only continue to fund their endeavors off the labor and profit of the private sector. Corporate owners and shareholders, who are the beneficiaries of rising asset values and stock prices, are better deciders of how to use their funds to sustain and grow our economy. Taxing corporations creates economic dead weight loss since the money spent by the consumer is less than the money received by the corporation. It also diverts monies into non-productive and inefficient attempts to reduce taxes. Even if all of Summers arguments are correct, by removing or lowering corporate taxes, the cost of government is shifted to individual taxes, and individuals will receive a truer price signal that shows how much government involvement in their daily lives really costs. With truer price signals, individuals will have a much better picture of the cost and value or lack of value of government programs.

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Monday, May 10, 2021

Argument For Lower Or Even No Corporate Taxes: A Reprint

Posted By Milton Recht

Reprint of my 2017 blog post about corporate taxes in response to a Larry Summers article in the Washington Post.

Friday, May 7, 2021

Budgets And Deficits: Spending Less On Worthwhile Projects: A Reprint

Posted By Milton Recht

A reprint of my decade old blog post about budgeting and deficits that I believe is currently relevant.

Sunday, March 13, 2011 Budgeting And Deficit Reduction Is About Spending Less On Worthwhile Projects Posted By Milton Recht A comment I posted on Econbrowser, "AP: GOP budget targets agency that warned of tsunami" posted by Menzie Chinn:Americans cannot afford to fund every worthwhile project. Budgeting is about admitting dollars are limited and setting project priorities. Just like a household that goes to the grocery with a fixed budget. The household cannot afford to buy every appealing delicious or nutritious food item in the store that catches their eye. Some items must stay on the shelf and not go in the cart. Looking at any government project or expense in isolation is unfair. You have to look at all of the items together and decide which are the ones you want to keep and fund and which are the one you want to pass on. Would you rather have a Tsunami warning system, headstart, a no fly zone over Libya, heating fuel subsidies for the poor, housing rent subsidies for the poor, incentives for converting to solar energy, etc. A great majority of the things the government spends money on are worthwhile, but which are the keepers and which are the unfunded and shelved. The choices are tough. There is no right or wrong answer or choice, but it is unfair to discuss just one project in isolation. It makes it seem as if there is no reason other than politics not to fund a project and that is not the case when one is trying to reduce a deficit and balance a budget. In budgeting, sometimes very worthwhile funding must be curtailed.It is the bright, rational do-gooder people who look at defunding of a project in isolation that are the biggest political force against budget balancing and deficit reduction. They are for deficit reduction, but they are not willing to make the hard choices, set priorities and limit funding with the understanding that some good projects will not get money.

Thursday, May 6, 2021

China's 2019 Green House Gas (GHG) Emissions Exceeded Total From OECD And All 27 EU Member States: China's GHG Emissions Were 2.5 Times US Emissions: Charts

Posted By Milton Recht

From Rhodium Group, "China’s Greenhouse Gas Emissions Exceeded the Developed World for the First Time in 2019" by Kate Larsen, Hannah Pitt, Mikhail Grant, and Trevor Houser, May 06, 2021:

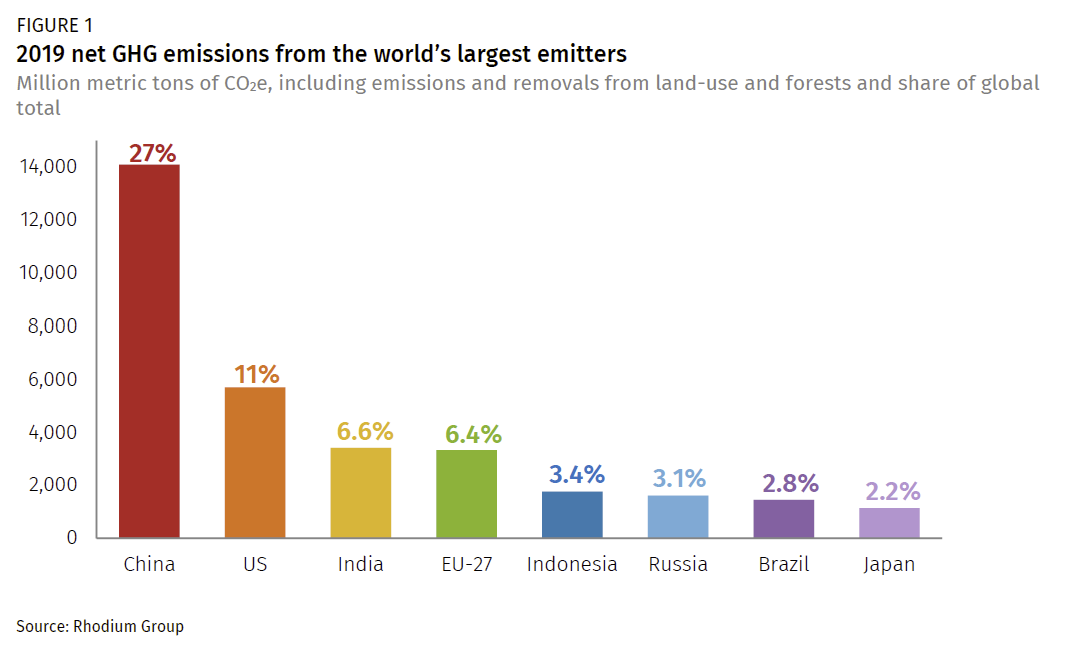

Global greenhouse gas emissions estimates for 2019*** China alone contributed over 27% of total global emissions, far exceeding the US—the second highest emitter—which contributed 11% of the global total (Figure 1). For the first time, India edged out the EU-27 for third place, coming in at 6.6% of global emissions.

|

| Source: Rhodium Group |

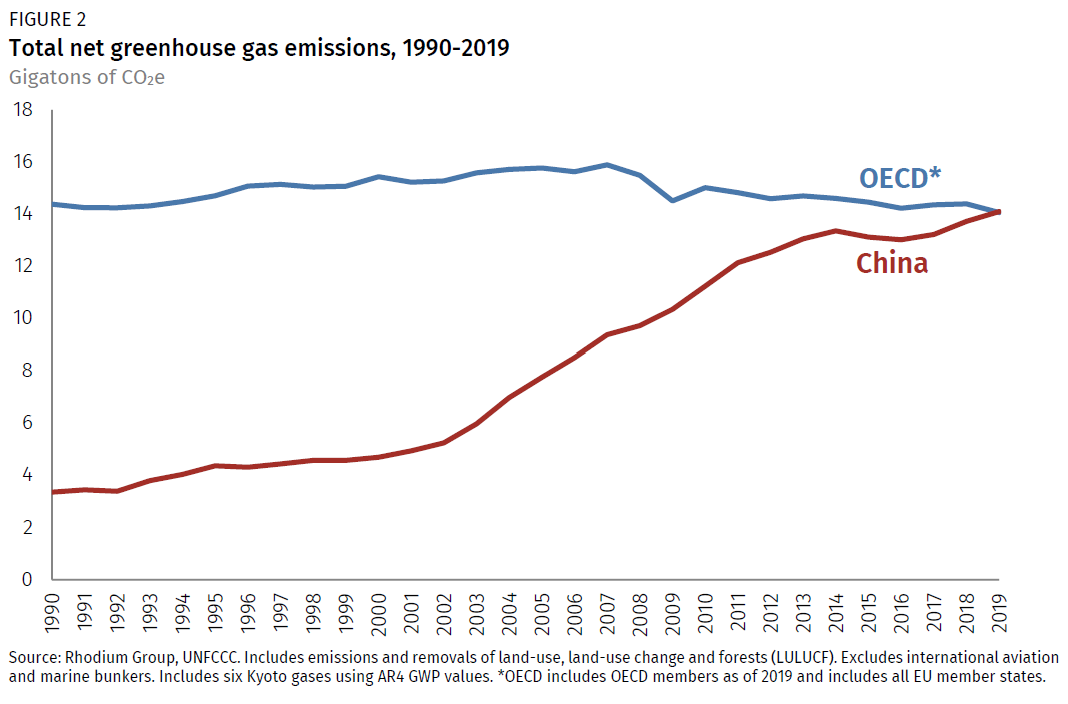

China’s emissions exceeded emissions from developed countries In 2019, China’s GHG emissions passed the 14 gigaton threshold for the first time, reaching 14,093 million metric tons of CO2 equivalent (MMt CO2e) (Figure 2). This represents a more than tripling of 1990 levels, and a 25% increase over the past decade. As a result, China’s share of the 2019 global emissions total of 52 gigatons rose to 27%. [Footnote omitted.]

|

| Source: Rhodium Group |

Tuesday, May 4, 2021

US Fuel Mix For Electric Power Generation, 1990-2019: Chart

Posted By Milton Recht

From Beyond the Numbers: Prices & Spending, vol. 10, no. 10 (U.S. Bureau of Labor Statistics, May 2021), "Trends in electricity prices during the transition away from coal" by William B. McClain:

Shifts in fuel mix over time In the United States, the generation of baseload electricity, defined by the Energy Information Administration as the minimum amount of electric power required to maintain mechanical and thermal efficiency of the grid system, historically was met through large coal-powered plants. Starting in the early 2000s, there was rapid growth in domestically produced natural gas from shale formations and other nonconventional sources. As a result, natural gas prices declined 60.1 percent between 2003 and 2019. This, combined with rapid advances in technology for renewable generation, supported a shift away from coal. In addition to being a source of baseload power itself, natural gas has the ability to quickly ramp up, which helps handle intermittency from renewable power sources like the sun or wind. Chart 3 [Below] illustrates the share of total U.S. electric power generation from 1990 to 2019, by fuel source. The chart shows the stark decline of coal and the growth in natural gas and renewable power. Relative fuel-mix contributions from nuclear and hydroelectric power sources have both remained relatively flat over the period. [Footnotes omitted.]

|

| Source: US Bureau of Labor Statistics |

Subscribe to:

Posts (Atom)