Despite Winehouse's well-documented personal struggles, industry insiders say she was no fool when it came to her business. In 2009 she even started her own label, Lioness Records, which grew to hold a roster of three performers - including Winehouse's 13-year-old goddaughter, Dionne Bromfield, who has since released two albums.

"[Winehouse] had a relatively practical sense about managing her business," says Lori Landew, an entertainment attorney at Fox Rothschild in Philadelphia. "There was a general sense that even with her apparent issues and trouble, she was very smart and very capable in certain areas of her life … other areas, not so much."*** As for Winehouse's legacy, there are reports that a posthumous album is already in the works. It seems demand for such an offering would be high, as Back To Black shot up to the top of Britain's iTunes charts immediately after her death.

Given these strong sales and heavy radio play, along with the fact that Winehouse likely hadn't yet received an advance for her new album, it's probable she'll earn in excess of seven figures this year from beyond the grave.

It's hard to tell how much she left behind, or who's slated to inherit it. But there's no doubt that death can do wonders for a musician's earnings prospects - just look at Michael Jackson, whose estate has taken in $400 million in the two years since his passing.

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Sunday, July 31, 2011

Posthumous Amy Winehouse Album Rumored And Expected

Posted By Milton Recht

From "The Sad Business of Amy Winehouse" by Zack O'Malley Greenburg, Forbes.com:

Bloomberg Reporting Tentative Debt Ceiling Deal Reached

Posted By Milton Recht

From Bloomberg, "White House, Republicans Reach Tentative Debt Deal" by Heidi Przybyla:

The White House and congressional Republicans have found the framework of an agreement to increase the nation’s debt ceiling that would raise borrowing authority through the next presidential election, a person familiar with the talks said late last night.Read the entire article here.

Saturday, July 30, 2011

Over 160 Municipal Governments Risk Loss Of Top Bond Rating Over US Debt Ceiling Impasse And US Credit Downgrade

Posted By Milton Recht

From Gannett's lohud.com, "Westchester [New York], 161 other governments risk loss of top bond rating over D.C. debt fight" by Gerald McKinstry:

Westchester County is among 162 governments in 31 states at risk of losing its top bond rating from Moody's Investors Service if the federal government doesn't reach a deal on the debt ceiling.

Moody's recently announced that governments such as Westchester with "high economic dependence on federal activity, would be vulnerable" if the U.S. government rating is lowered.

Mammograms Do Not Reduce Breast Cancer Deaths

Posted By Milton Recht

From Bloomberg, "New Drugs Trump Mammograms for Fewer Cancer Deaths, Study Says" by Charles Mead:

Scientists studying the link between screening and mortality over the past two decades said widespread use of mammograms didn’t play any “direct part” in reducing deaths from the most common malignancy in women. Their findings were published today in the British Medical Journal.

Mammograms -- low-dose X-rays of the breast that doctors use to look for early signs of cancer -- catch more tumors that are less dangerous and often miss the “real killers,” said Philippe Autier, research director at the Lyon, France-based International Prevention Research Institute and lead author of the study. He said research shows most instances of breast cancer are initially found by women themselves. Instead of a nationwide screening system with mammograms, more money should be aimed at new treatment and imaging methods, he said.

US Homeownership Falls To 1998 Levels

Posted By Milton Recht

From Bloomberg, "U.S. Homeownership Falls to Lowest Since ’98" by Kathleen M. Howley:

The U.S. homeownership rate fell to the lowest level since 1998 in the second quarter as stricter lending standards blocked purchases and foreclosures forced people out of their residences.

The ownership rate through June was 65.9 percent, the lowest since the same rate 13 years ago, the U.S. Census Bureau said in a report today.

Friday, July 29, 2011

US Debt Default Could Prevent Necessary FDIC Deposit Insurance Payments

Posted By Milton Recht

As of December 31, 2010, the financial statements for the FDIC Deposit Insurance Fund (DIF) showed the fund holding a face value of $12.3 billion of US Treasury obligations. The DIF also holds $27.1 billion of cash and cash equivalents, which consists of overnight US Treasury obligations. In total, 49 percent of the deposit insurance fund's assets of $81.1 billion are US debt.

The US debt is likely also the most liquid part of the insurance fund total holdings. Additionally, the DIF received $205 million in income from interest payments on its US debt holdings.

If there is a US default on its debt obligations and also a bank failure, will the FDIC have the needed liquid assets to pay insured depositors and deal with any bank failures during the period of default? There could easily be bank failure situations where the FDIC is cash constrained and unable to pay deposit insurance claims during a US debt default, effectively delaying payments on deposit insurance claims.

As stated in the FDIC deposit insurance fund financial statements:

The US debt is likely also the most liquid part of the insurance fund total holdings. Additionally, the DIF received $205 million in income from interest payments on its US debt holdings.

If there is a US default on its debt obligations and also a bank failure, will the FDIC have the needed liquid assets to pay insured depositors and deal with any bank failures during the period of default? There could easily be bank failure situations where the FDIC is cash constrained and unable to pay deposit insurance claims during a US debt default, effectively delaying payments on deposit insurance claims.

As stated in the FDIC deposit insurance fund financial statements:

Investment in U.S. Treasury Obligations

DIF funds are required to be invested in obligations of the United States or in obligations guaranteed as to principal and interest by the United States. The Secretary of the Treasury must approve all such investments in excess of $100,000 and has granted the FDIC approval to invest DIF funds only in U.S. Treasury obligations that are purchased or sold exclusively through the Bureau of the Public Debt’s Government Account Series (GAS) program.

The DIF’s investments in U.S. Treasury obligations are classified as available-for-sale. Securities designated as available-for-sale are shown at fair value. Unrealized gains and losses are reported as other comprehensive income. Realized gains and losses are included in the Statement of Income and Fund Balance as components of net income. Income on securities is calculated and recorded on a daily basis using the effective interest or straight-line method depending on the maturity of the security.

Thursday, July 28, 2011

Despite Debt Ceiling Standoff, 2012 Election Intrade Odds For Republicans To Control Congress Are High And Rising

Posted By Milton Recht

The Intrade odds for Republicans to control the US Senate after the 2012 elections are 84.9 percent. The Democrat party odds are 16.1 percent.

The Intrade odds for the Republicans to control the US House of Representatives after the 2012 elections are 71.0 percent. The Democrat party odds are 33.5 percent.

Despite many in the media and in the Democratic party portraying the Republicans in a negative light for the debt ceiling stalemate and for increasing the probability of a US default and downgrade, the Republican party's odds for control of Congress after the 2012 elections have risen during the current debate over the debt limit and budget cuts.

The Intrade odds for the Republicans to control the US House of Representatives after the 2012 elections are 71.0 percent. The Democrat party odds are 33.5 percent.

Despite many in the media and in the Democratic party portraying the Republicans in a negative light for the debt ceiling stalemate and for increasing the probability of a US default and downgrade, the Republican party's odds for control of Congress after the 2012 elections have risen during the current debate over the debt limit and budget cuts.

CBO's Assessment Of Reid's And Boehner's Debt Ceiling Budget Proposal

Posted By Milton Recht

CBO analyses for the Reid and Boehner Senate and House budget proposals for increasing the US debt limit follows, including weblinks to the full CBO reports.

The House Proposal - Boehner

CBO's analysis summary of John Boehner's (House) revised budget proposal for increasing the US debt limit:

The Senate Proposal - Reid

CBO's analysis summary of Harry Reid's (Senate) budget proposal for increasing the US debt limit:

The House Proposal - Boehner

CBO's analysis summary of John Boehner's (House) revised budget proposal for increasing the US debt limit:

SUMMARYThe entire CBO analysis of the Boehner - House proposal is available here.

The Congressional Budget Office has estimated the impact on the deficit of the Budget Control Act of 2011, as posted on the Web site of the Committee on Rules on July 25, 2011, with a further amendment proposed on July 27, 2011. The legislation would:In total, if appropriations in the next 10 years are equal to the caps on discretionary spending and the maximum amount of funding is provided for the program integrity initiatives, CBO estimates that the legislation, with the proposed amendment, would reduce budget deficits by about $915 billion between 2012 and 2021 relative to CBO's March 2011 baseline adjusted for subsequent appropriation action. As requested, CBO has also calculated the net budgetary impact if discretionary savings are measured relative to its January baseline projections. Relative to that baseline, CBO estimates that the legislation would reduce budget deficits by about $1.1 trillion between 2012 and 2021.

- Establish caps on discretionary spending through 2021,

- Allow for certain amounts of additional spending for "program integrity" initiatives aimed at reducing the amount of improper benefit payments,

- Make changes to the Pell Grant and student loan programs,

- Establish procedures for Congressional consideration of a balanced budget amendment to the Constitution,

- Establish procedures to increase the debt limit by up to $2.5 trillion,

- Reinstate and modify certain budget process rules, and

- Create a joint Congressional committee to propose further deficit reduction.

The amendment proposed on July 27, 2011, would modify the legislation proposed on July 25, 2011, by eliminating caps on discretionary outlays for fiscal years 2012 and 2013. The amendment also would make minor modifications to the procedures related to further increases in the debt limit. [Emphasis added]

The Senate Proposal - Reid

CBO's analysis summary of Harry Reid's (Senate) budget proposal for increasing the US debt limit:

SUMMARYThe entire CBO analysis of the Reid - Senate proposal is available here.

The Congressional Budget Office (CBO) has estimated the impact on the deficit of the Budget Control Act of 2011, as proposed in the Senate on July 25, 2011. The legislation would:In total, if appropriations in the next 10 years are equal to the caps on discretionary spending and the maximum amount of funding is provided for the program integrity initiatives, CBO estimates that the legislation would reduce budget deficits by about $2.2 trillion between 2012 and 2021 relative to CBO's March 2011 baseline adjusted for subsequent appropriation action.[Emphasis added]

- Establish caps on discretionary spending through 2021, including separate caps on new funding for war-related activities,

- Allow for certain amounts of additional spending for "program integrity" initiatives aimed at reducing the amount of improper benefit payments and enhancing compliance with tax laws,

- Extend and expand authority to auction licenses for parts of the electromagnetic spectrum,

- Make changes to the Pell Grant and student loan programs,

- Reduce certain payments to agricultural producers,

- Increase the debt limit by $2.7 trillion,

- Reinstate and modify certain budget process rules, and

- Create a joint Congressional committee to propose further deficit reduction.

Wednesday, July 27, 2011

Medicare Part D Resulted In Significant Savings By Reducing Hospital And Nursing Home Admissions

Posted By Milton Recht

From "Medicare Rx Benefit Cut Other Medicare Program Costs" by Emily P. Walker, Washington Correspondent, MedPage Today:

The increased medication use spurred by the creation of Medicare Part D has cut hospital and nursing home admissions, resulting in a significant savings in other parts of the Medicare program, a new study found.

The study -- published in the July 27 issue of the Journal of the American Medical Association (JAMA) -- found that after Medicare's drug benefit went into effect in 2006, spending on nondrug medical coverage significantly decreased for seniors who had limited drug coverage before Part D.*** The study found that spending on nondrug medical expenses for Medicare beneficiaries who had limited drug coverage before Medicare Part D was 10% less than it would have been had Medicare not been expanded to include prescription drug coverage.

The average savings on nonmedication costs per Medicare beneficiary who had poor drug coverage before 2006 was about $1,200 per year.

Tuesday, July 26, 2011

US Does Not And Did Not Have the Best Country Risk Ratings

Posted By Milton Recht

Despite what one hears and reads in the media and from politicians, that the US will lose its premier financial rating as the best credit risk in the world if it defaults on its debt, the US does not and did not have the lowest country risk in the world.

For example, Euromoney rated US country risk in its second best tier, tier 2, below the least risk country tier, tier one.

The US is rated as a higher risk than Canada, Germany, Australia, New Zealand, Denmark, Sweden, Norway, Finland, Austria, Switzerland and the Netherlands.

Euromoney puts the US in the same risk grouping as Spain, UK, France, Italy, Poland, Czech Republic, Hungary, Oman, United Arab Emigrates, Malaysia, Japan, South Korea, and Chile.

Coface, which measure trade risk, rates the US country risk as A2, a step below the lowest risk A1.

While we would like to believe that the US is the safest and least risky place to put money, the US has not held the top country risk rating for some time.

For example, Euromoney rated US country risk in its second best tier, tier 2, below the least risk country tier, tier one.

The US is rated as a higher risk than Canada, Germany, Australia, New Zealand, Denmark, Sweden, Norway, Finland, Austria, Switzerland and the Netherlands.

Euromoney puts the US in the same risk grouping as Spain, UK, France, Italy, Poland, Czech Republic, Hungary, Oman, United Arab Emigrates, Malaysia, Japan, South Korea, and Chile.

Coface, which measure trade risk, rates the US country risk as A2, a step below the lowest risk A1.

While we would like to believe that the US is the safest and least risky place to put money, the US has not held the top country risk rating for some time.

Sunday, July 24, 2011

Friday, July 22, 2011

Keynesians Neglect The Public's Lost Confidence In Government Spending

Posted By Milton Recht

From PileusBlog, "Long live the revolution" by Sven Wilson:

In a world where government is relatively small and constrained, attempting to run counter-cyclical policy has little consequence (it doesn’t do much good, but doesn’t do much damage, either). But what Keynesianism completely neglect is the crisis in confidence that is occurring as citizens see their government spiraling out of control–spending vast amounts of money on stimulus, creating huge new entitlement programs, and saddling markets with an ever increasing amount of regulation. In the Keynesian world, government is unconstrained; markets fail but government can’t fail. In the Keynesian world, people don’t worry about what government is going to spend the next year and the year after that. All they care about is the present.Read the entire blog post here.

But in the real world, people are terrified, with just cause, about the ability of government to meet the rapidly growing pile of obligations on its balance sheets. We know that when those obligations get paid, we (and our children) are the ones that will have to pay them. And we see a federal government that seems so completely unconstrained by constitutional limits or by reason, always willing to make promises it can’t keep, always willing to pass new productivity-killing regulations, always willing to see new ways to creep further into our lives.

In short, the continued health of the economy depends on constrained government and economic freedom.

Thursday, July 21, 2011

Perry And Romney Neck And Neck For Republican Presidential Nomination

Posted By Milton Recht

The current Texas governor Rick Perry and the former Massachusetts governor Mitt Romney are in a very close race for winning the Republican party nomination for the US presidency. These two candidates have the highest odds of winning the Republican nomination on Intrade.

The Republican presidential Intrade odds for Romney are 31.9 percent.

The Republican presidential Intrade odds for Perry are 30.8 percent.

The Republican party nomination race is a dead heat at this point in time.

The Republican presidential Intrade odds for Romney are 31.9 percent.

The Republican presidential Intrade odds for Perry are 30.8 percent.

The Republican party nomination race is a dead heat at this point in time.

Cash For Clunkers Had Zero Impact On Car Sales And Minuscule Impact On GDP And Auto Production

Posted By Milton Recht

From Federal Reserve Bank of New York, Staff Reports , "The Production Impact of “Cash-for-Clunkers”: Implications for Stabilization Policy" by Adam Copeland and James Kahn, Staff Report no. 503, July 2011:

The paper's abstract is available here.

In line with other recent studies, our analysis shows that the CARS program had only a transitory cumulative effect on sales. We estimate an initial impact of about 450,000 additional automobile sales, but these were essentially shifted from the periods before and (especially) after the program. We calculate that by January 2010, the cumulative effect of the CARS program on auto sales was essentially zero.The full paper is available here.

More important for our purposes, however, is the program’s effect on automobile production. While most studies of CARS have focused on sales, we argue that the program’s success as a stimulus to the economy hinges on its impact on production. Production increases are more likely to translate into higher GDP and employment, GDP being fundamentally a measure of production. Sales clearly rose at the outset, but given that the industry can simply let inventory stocks absorb the increase in sales, higher sales alone do not imply higher GDP or employment.

Overall, we find that the program had a very modest and short-lived effect on production. Production was about 200,000 units higher during the program (in comparison to the 450,000 increase in sales). Sales from September 2009 to January 2010 were correspondingly lower than they would have been in the absence of CARS, which allowed producers to have lower production while still replenishing their inventory stocks. Thus on a quarterly basis we estimate that the CARS program shifted production by around 100,000 units from 2009Q4 and 2010Q1 to 2009Q3.

These calculations suggest that the program had a negligible direct effect on GDP, shifting less than roughly $2 billion (or less than one-tenth of one percent of GDP) into 2009Q3 from the subsequent two quarters. This contrasts starkly with a study released by the Department of Transportation (DOT) in the immediate aftermath of the program, which concluded that CARS had given a substantial boost to both GDP and employment. In the final section of the article, we discuss why our conclusions differ from those of the DOT study.

The paper's abstract is available here.

Obamacare's Negative Effect on Private Sector Job Growth: Suggestive Or Coincidental

Posted By Milton Recht

| Source: www.PileusBlog.com |

Huge Geopolitical Repercussions From Expansion Of US Shale Gas Production

Posted By Milton Recht

From "US shale gas weakening Russian, Iranian petro-power" on Sciencblog:

“The geopolitical repercussions of expanding U.S. shale gas production are going to be enormous,” said Amy Myers Jaffe, the Wallace S. Wilson Fellow for Energy Studies and one of the authors of the study. “By increasing alternative supplies to Europe in the form of liquefied natural gas (LNG) displaced from the U.S. market, the petro-power of Russia, Venezuela and Iran is faltering on the back of plentiful American natural gas supply.”

Tuesday, July 19, 2011

86% Of The World's Energy Use Is Produce By Carbon-Based Fuels

Posted By Milton Recht

From "Four Dirty Secrets about Clean Energy" by Alex Epstein:

Clean energy advocates want to force us to use solar, wind, and biofuels, even though there is no evidence these can power modern civilization.Read about the four clean energy secrets in the complete article here.*** 86% of the world’s energy--the energy we use to make food, clothing, shelter, medical care, and everything else our livelihoods depend on--is produced by carbon-based fuels (coal, oil, natural gas). 6% is produced by hydroelectric power. 6% is produced by nuclear power. Thus, 98% of the world’s power generation is regarded as unacceptable by environmentalists. All of 2%--an expensive 2%--is produced by solar, wind, and biofuels.

Monday, July 18, 2011

Historical High Marginal US Tax Rates Applied To A Higher Income And Smaller Base Than Now Proposed

Posted By Milton Recht

From The Wall Street Journal, "Get Ready for a 70% Marginal Tax Rate" by Michael J Boskin:

Some argue the U.S. economy can easily bear higher pre-Reagan tax rates. They point to the 1930s-1950s, when top marginal rates were between 79% and 94%, or the Carter-era 1970s, when the top rate was about 70%. But those rates applied to a much smaller fraction of taxpayers and kicked in at much higher income levels relative to today.Read the complete article here.

Friday, July 15, 2011

Capitalism to The Consumers' Rescue Against E. Coli in Food

Posted By Milton Recht

From The New York Times, "Food Companies Act to Protect Consumers From E. Coli Illness" by William Neuman:

Years ago, brand names in food, such as Kraft, Hershey, etc., became successful because they promised and delivered unadulterated quality and if necessary pasteurized products to the consumer without any government intervention or regulation.

The federal government has spent years considering whether to take steps to help keep dangerous strains of E. coli bacteria out of the food supply, a question that has become even more urgent in the face of a deadly wave of E. coli sickness that swept through Europe and raised alarms on both sides of the Atlantic.Greed, the desire to make a profit, to keep customers, to prevent competition, to protect a brand name, to keep sales, or in other words, everything that is capitalism and free markets protects consumers as well if not better, cheaper and quicker than government safety regulations.

Enlarge This Image

Now, two major American companies, Costco Wholesale and Beef Products Inc., have gotten tired of waiting for regulators to act. They are proceeding with their own plans to protect customers.*** The company also plans to test all of the ground beef sold at its warehouse stores. Costco operates a large ground beef plant in Tracy, Calif., and Mr. Wilson said the plant recently began evaluating testing procedures to detect the broader range of E. coli in the hamburger it makes and the beef trimmings that go into it. As an added step, the company plans to ask suppliers of the trimmings to do their own testing, starting later this summer, he said.

Years ago, brand names in food, such as Kraft, Hershey, etc., became successful because they promised and delivered unadulterated quality and if necessary pasteurized products to the consumer without any government intervention or regulation.

Thursday, July 14, 2011

US Interference In the Foreclosure Process Was Unneeded And A Waste Of Resources

Posted By Milton Recht

Half of foreclosed home occupants remain in same home even 2 years after foreclosure. Those who do move wind up living in comparable neighborhoods and living conditions. Using federal government resources to interfere and postpone the foreclosure process seems to have been a complete and unnecessary waste of time and resources.

From Federal Reserve Board Finance and Economics Discussion Series"The Post-Foreclosure Experience of U.S. Households" by Raven Molloy and Hui Shan:

From Federal Reserve Board Finance and Economics Discussion Series"The Post-Foreclosure Experience of U.S. Households" by Raven Molloy and Hui Shan:

Although foreclosure considerably raises the probability of moving, the majority of post-foreclosure migrants do not end up in substantially less desirable neighborhoods or more crowded living conditions. These results suggest that, on average, foreclosure does not impose an economic burden large enough to severely reduce housing consumption.Read the complete paper here.*** This paper aims to provide evidence on post-foreclosure outcomes that are related to housing consumption, including household formation, homeownership, and neighborhood characteristics.*** a number of our results are fairly surprising. Only about half of borrowers whose mortgage enters foreclosure have moved even two years later, suggesting that many foreclosures are worked out through refinancing or other means. As for borrowers who do move after a foreclosure, they do not seem to end up in substantially more crowded living conditions or less-desirable neighborhoods. In particular, average household size does not increase and only a small fraction move in with older individuals (possibly their parents). Although foreclosure increases the probability that an individual will move to a multifamily building, most postforeclosure migrants remain in single-family structures. Moreover, their new neighborhood does not have significantly lower median income, median house value, or median rent than their old neighborhood. Given that housing unit quality is highly correlated with neighborhood affluence, our evidence suggests that post-foreclosure migrants do not move to substantially lower quality housing units. [Emphasis added]

Symbiotic, Parasitic Relationship Between Environmental Regulators And Utilities

Posted By Milton Recht

From The New York Times, "Utility Shelves Ambitious Plan To Limit Carbon" by Matthew L. Wald and John M. Broder:

Surprisingly, utilities need environmental watchdogs to justify increases to their rates and revenues.

Utilities cannot raise their rates to consumers unless their state utility regulators agree to the increase. A major basis for determining if a utility deserves a consumer rate increase is the utility's return on its capital base.

An expert economic and financial analysis comparing a utility's actual rate of return on its capital to its computed economically required rate of return on its capital base is used to determine if the utility deserves a price increase. Utility regulators and politicians do not like one sided rate increases. It is more palatable to politicians and regulators if a utility has to give something in return.

A utility can justify a rate increase in two ways.

The first is if the actual rate of return on its existing capital base is lower than its computed economically required rate of return on its capital base. This is a pure price increase without any change to a utilities business and without any new benefits to consumers.

The second is to accept the existing approved rate of return, but to increase the utility's capital base and ask for a rate increase based on applying the existing rate of return to an expansion of its capital base. Pollution reduction equipment and processes require new capital investment by utilities and increase the size of a utility's capital base.

Utilities satisfying a government mandated pollution abatement is an easy way for politicians and regulators to justify granting a consumer rate increase to a utility. Consumers get the benefit of less pollution, but the utility is allowed to get a rate increase to pay for the new pollution reduction investments including a return on the new capital invested in pollution abatement, which is a permanent increase in its revenues.

Environmental regulators and environmental groups get to promote their usefulness, and their need for continue funding, in abating pollution by a wrongdoing utility. They come out as the good guys, while the utility takes the money to play bad guy.

The public pulled the rug out from under American Electric Power and the government. Public opinion turned against man-made global warming and carbon dioxide reduction. Without public support for this abatement, and without public support for treating carbon dioxide as a pollutant, politicians and regulators knew they could not support a utility rate increase. Without a rate increase, the utility saw no economic benefit to reduce its carbon dioxide emissions.

Naively, one could blame the utility for lacking concern about the environment, but the real culprit and bad guy is that utility is subject to price controls. The utility's actions are a natural and expected consequence of doing business in a price regulated industry.

The parasitic relationship between utilities and environmentalist is a direct result of price controls and regulations on utilities. Utilities need to play the bad guy and pollute in order to increase their capital base and increase their revenues. Environmentalists, government, private and non-profit groups, get to play the good guys, go against polluting utilities, mandate the installation of pollution control equipment and justify their need for continued funding and existence.

In the end, the general public loses because utilities wait for actions by regulators and environmental groups before any action is taken to reduce the utility's negative effects on the environment.

Company [American Electric Power] officials, who plan an announcement on Thursday, said they were dropping the larger, $668 million [carbon dioxide capture] project because they did not believe state regulators would let the company recover its costs by charging customers, thus leaving it no compelling regulatory or business reason to continue the program.Environmental regulators and environmental organizations are self-sustaining entities that need ongoing polluters to justify their continued funding and existence.

Surprisingly, utilities need environmental watchdogs to justify increases to their rates and revenues.

Utilities cannot raise their rates to consumers unless their state utility regulators agree to the increase. A major basis for determining if a utility deserves a consumer rate increase is the utility's return on its capital base.

An expert economic and financial analysis comparing a utility's actual rate of return on its capital to its computed economically required rate of return on its capital base is used to determine if the utility deserves a price increase. Utility regulators and politicians do not like one sided rate increases. It is more palatable to politicians and regulators if a utility has to give something in return.

A utility can justify a rate increase in two ways.

The first is if the actual rate of return on its existing capital base is lower than its computed economically required rate of return on its capital base. This is a pure price increase without any change to a utilities business and without any new benefits to consumers.

The second is to accept the existing approved rate of return, but to increase the utility's capital base and ask for a rate increase based on applying the existing rate of return to an expansion of its capital base. Pollution reduction equipment and processes require new capital investment by utilities and increase the size of a utility's capital base.

Utilities satisfying a government mandated pollution abatement is an easy way for politicians and regulators to justify granting a consumer rate increase to a utility. Consumers get the benefit of less pollution, but the utility is allowed to get a rate increase to pay for the new pollution reduction investments including a return on the new capital invested in pollution abatement, which is a permanent increase in its revenues.

Environmental regulators and environmental groups get to promote their usefulness, and their need for continue funding, in abating pollution by a wrongdoing utility. They come out as the good guys, while the utility takes the money to play bad guy.

The public pulled the rug out from under American Electric Power and the government. Public opinion turned against man-made global warming and carbon dioxide reduction. Without public support for this abatement, and without public support for treating carbon dioxide as a pollutant, politicians and regulators knew they could not support a utility rate increase. Without a rate increase, the utility saw no economic benefit to reduce its carbon dioxide emissions.

Naively, one could blame the utility for lacking concern about the environment, but the real culprit and bad guy is that utility is subject to price controls. The utility's actions are a natural and expected consequence of doing business in a price regulated industry.

The parasitic relationship between utilities and environmentalist is a direct result of price controls and regulations on utilities. Utilities need to play the bad guy and pollute in order to increase their capital base and increase their revenues. Environmentalists, government, private and non-profit groups, get to play the good guys, go against polluting utilities, mandate the installation of pollution control equipment and justify their need for continued funding and existence.

In the end, the general public loses because utilities wait for actions by regulators and environmental groups before any action is taken to reduce the utility's negative effects on the environment.

Wednesday, July 13, 2011

US Children Population Share Falling To Low As Senior Share Continues To Grow

Posted By Milton Recht

From The Wall Street Journal, Associated Press, "Census: Number of Children in U.S. Hits Low":

A smaller entering workforce, as a share of the population, will have effects. There will be less need for child related workers, such as teachers, pediatricians, child carers, etc. Many of these extra workers will shift into other fields, but employers may still find areas of worker shortages and have to cope.

I think a likely effect will be an easing of immigration rules so more young workers are available in the US. The demand and pressure will come from labor intensive employers, employers who need specialized skill workers and from politicians who will see a relaxing of immigration rules as the only way to increase tax revenues. Relaxing immigration restrictions will also enable the US workforce to continue to be innovators. Also, employers will become more willing to hire and continue to employ seniors, but the increase in the percentage of seniors will increase the competition among seniors for available jobs.

And of course, many unpredictable consequences will occur as a result of the decreasing percentage of younger people and the increasing percentage of seniors in the US.

Currently, the share of children in the U.S. is 24%, falling below the previous low of 26% in 1990. The share is projected to slip further, to 23% by 2050, even as the percentage of people 65 and older is expected to jump from 13% today to roughly 20% by 2050 due to the aging of baby boomers and beyond.A lack of young people will negatively impact new entrants into the US labor force in future years. Most new business starters are young workers and they also are the innovators. US innovation will decline unless compensating efforts are taken.

In 1900, the share of children reached as high as 40%, compared to a much smaller 4% share for seniors 65 and older. The percentage of children in subsequent decades held above 30% until 1980, when it fell to 28% amid declining birth rates, mostly among whites.

A smaller entering workforce, as a share of the population, will have effects. There will be less need for child related workers, such as teachers, pediatricians, child carers, etc. Many of these extra workers will shift into other fields, but employers may still find areas of worker shortages and have to cope.

I think a likely effect will be an easing of immigration rules so more young workers are available in the US. The demand and pressure will come from labor intensive employers, employers who need specialized skill workers and from politicians who will see a relaxing of immigration rules as the only way to increase tax revenues. Relaxing immigration restrictions will also enable the US workforce to continue to be innovators. Also, employers will become more willing to hire and continue to employ seniors, but the increase in the percentage of seniors will increase the competition among seniors for available jobs.

And of course, many unpredictable consequences will occur as a result of the decreasing percentage of younger people and the increasing percentage of seniors in the US.

Broken CFL Glass Can Release Mercury For 128 Days: Room Mercury Air Concentrations Can Reach Toxic Levels And Be 10x Child Exposure Limits: Negative Effect On Home Sellers And Landlords

Posted By Milton Recht

Since it seems CFLs are here to stay and incandescent light bulbs will be no more, below is an excerpt from the 3 pages of mercury clean up instructions from the EPA for cleaning up the mercury from a broken compact flourescent light bulb (CFL) in the home.

Most people do not realize that the glass of a CFL is coated with mercury and the particles of glasswith will continue, according to a scientific study, for up to 128 days to release mercury vapor into the air. The test ended after 43 days, but the glass fragments were still releasing mercury vapor at the end of the test and indications were that mercury would be released for another 10 to 85 days for a total of 53 to 128 days after breakage.

The same study found that a broken CFL could release toxic levels of 10 times the current recommended child air concentration exposure limit of mercury into a room.

Effect On Home Buyers

You know home buyers (renters) will soon start requiring measurements of mercury vapor in rooms before purchase (renting). Sellers (landlords) will need to pay for clean-ups and home buyers (renters) will sue sellers (landlords) if there is any subsequent illness in themselves or their children that could in any way be attributed to mercury.

EPA Fluorescent Bulb Mercury Cleanup Instructions

From the 3 pages of EPA guidelines for cleaning up after a broken CFL (compact fluorescent light bulb):

Most people do not realize that the glass of a CFL is coated with mercury and the particles of glass

The same study found that a broken CFL could release toxic levels of 10 times the current recommended child air concentration exposure limit of mercury into a room.

If not cleaned up, the bulb with the largest initial store of mercury could have spewed 1 milligram of the toxic metal into a room's air within 25 days; another could have reached that level within about 40 days. Li and Jin cited data by others indicating that the release of 1 milligram of mercury vapor into a 500 cubic meter room can yield air concentrations 10 times the current recommended limit for a child. Breaking a CFL can thus cause potentially toxic levels of pollution to develop, Li and Jin conclude.[Emphasis added]

Effect On Home Buyers

You know home buyers (renters) will soon start requiring measurements of mercury vapor in rooms before purchase (renting). Sellers (landlords) will need to pay for clean-ups and home buyers (renters) will sue sellers (landlords) if there is any subsequent illness in themselves or their children that could in any way be attributed to mercury.

EPA Fluorescent Bulb Mercury Cleanup Instructions

From the 3 pages of EPA guidelines for cleaning up after a broken CFL (compact fluorescent light bulb):

Cleanup Steps for Hard SurfacesRead the complete clean up instructions here.

Cleanup Steps for Carpeting or Rugs

- Carefully scoop up glass fragments and powder using stiff paper or cardboard and place debris and paper/cardboard in a glass jar with a metal lid. If a glass jar is not available, use a sealable plastic bag. (NOTE: Since a plastic bag will not prevent the mercury vapor from escaping, remove the plastic bag(s) from the home after cleanup.)

- Use sticky tape, such as duct tape, to pick up any remaining small glass fragments and powder. Place the used tape in the glass jar or plastic bag.

- Wipe the area clean with damp paper towels or disposable wet wipes. Place the towels in the glass jar or plastic bag.

- Vacuuming of hard surfaces during cleanup is not recommended unless broken glass remains after all other cleanup steps have been taken. [NOTE: It is possible that vacuuming could spread mercury containing powder or mercury vapor, although available information on this problem is limited.] If vacuuming is needed to ensure removal of all broken glass, keep the following tips in mind:

- Keep a window or door to the outdoors open;

- Vacuum the area where the bulb was broken using the vacuum hose, if available; and

- Remove the vacuum bag (or empty and wipe the canister) and seal the bag/vacuum debris, and any materials used to clean the vacuum, in a plastic bag.

- Promptly place all bulb debris and cleanup materials, including vacuum cleaner bags, outdoors in a trash container or protected area until materials can be disposed of properly.

- Check with your local or state government about disposal requirements in your area. Some states and communities require fluorescent bulbs (broken or unbroken) be taken to a local recycling center.

- Wash your hands with soap and water after disposing of the jars or plastic bags containing bulb debris and cleanup materials.

- Continue to air out the room where the bulb was broken and leave the H&AC system shut off, as practical, for several hours.

- Carefully scoop up glass fragments and powder using stiff paper or cardboard and place debris and paper/cardboard in a glass jar with a metal lid. If a glass jar is not available, use a sealable plastic bag. (NOTE: Since a plastic bag will not prevent the mercury vapor from escaping, remove the plastic bag(s) from the home after cleanup.)

- Use sticky tape, such as duct tape, to pick up any remaining small glass fragments and powder. Place the used tape in the glass jar or plastic bag.

- Vacuuming of carpeting or rugs during cleanup is not recommended unless broken glass remains after all other cleanup steps have been taken. [NOTE: It is possible that vacuuming could spread mercury containing powder or mercury vapor, although available information on this problem is limited.] If vacuuming is needed to ensure removal of all broken glass, keep the following tips in mind:

- Keep a window or door to the outdoors open;

- Vacuum the area where the bulb was broken using the vacuum hose, if available, and

- Remove the vacuum bag (or empty and wipe the canister) and seal the bag/vacuum debris, and any materials used to clean the vacuum, in a plastic bag.

- Promptly place all bulb debris and cleanup materials, including vacuum cleaner bags, outdoors in a trash container or protected area until materials can be disposed of properly.

Tuesday, July 12, 2011

College Grads Started Taking Non-College Degree Jobs Years Before Recession Started

Posted By Milton Recht

From Cleveland Federal Reserve Bank Economic Trends, "Are Underemployed Graduates Displacing Nongraduates?" by Stephan Whitaker and Mary Zenker:

In 2004, 16.3 percent of jobs that did not require a college degree were held by college grads. In 2010, the number rose to 18.2 percent. A 11.7 percent increase over 6 years, or a 1.9 percent average yearly growth rate.

In 2004, 25.82 percent of jobs that required a college degree were held by non-college grads. In 2010, the number decline to 23.7 percent. An 8.2 percent decline over 6 years, or a 1.4 percent average yearly reduction rate.

We looked at data that could reflect this trend and found that college graduates are in fact becoming more prevalent in occupations that do not require a degree. The trend actually started before the recession, though it has, if anything, increased during the slowdown.Read the complete article here.

In 2004, 16.3 percent of jobs that did not require a college degree were held by college grads. In 2010, the number rose to 18.2 percent. A 11.7 percent increase over 6 years, or a 1.9 percent average yearly growth rate.

In 2004, 25.82 percent of jobs that required a college degree were held by non-college grads. In 2010, the number decline to 23.7 percent. An 8.2 percent decline over 6 years, or a 1.4 percent average yearly reduction rate.

Monday, July 11, 2011

Let's Legislate A Weaker Gravity To Save On Energy Use: Energy Efficiency Mandates Do Not Work

Posted By Milton Recht

My Comment to the New York Times Green blog, "House to Vote on Light-Bulb Repeal" by John M. Broder:

US households use the same energy per person today as they did 40 years ago in 1970 despite mandates for energy efficiency in appliances, such as dishwashers, refrigerators, air conditioners, hot water heaters, etc. Many household appliances use about half the energy they did 40 years ago, yet household demand for energy per person has not declined.

The use of more efficient light bulbs will not decrease any household's electricity use, nor reduce our need for power generation. Efficiency means the thing is cheaper to use and when things are cheaper we use more to offset the savings from the extra efficiency.

It is a wellknowknown effect, known since at least the mid 1800s, and is called the Rebound Effect, Jevons Effect or Jevons Paradox.

Low flow water devices have not decrease water use, Increased MPGs has not decreased gasoline use and energy efficiency has not decreased energy use.

When lighting went from relatively expensive oil and candles to less expensive gas and electricity, people used more lighting in the home and other places.

Any plumber will tell you that when a household puts in a more efficient hot water heater, the household uses more hot water and does not use less energy than they did with the inefficient hot water heater.

It is a shame that the article is so one-sided and only uses data from the NRDC [Natural Resources Defense Council], which is a biased entity with its own political objective.

The only ways to reduce electricity use is to raise its price or cap its use per person. Each of these alternatives has many negative consequences.

The same people who are proponents of any efficiency law and think it will accomplish anything useful, probably also believe we can pass a law to make gravity half as strong to save on the energy used to carry things.

Saturday, July 9, 2011

Government Infrastructure Projects Grossly Understate Costs And Overstate Benefits

Posted By Milton Recht

From Bloomberg, "Too Many Public Works Built on Rosy Scenarios" by Virginia Postrel:

“Cost overruns in the order of 50 percent in real terms are common for major infrastructure, and overruns above 100 percent are not uncommon,” Bent Flyvbjerg, a professor of major program management at the University of Oxford’s Said Business School, writes in the Oxford Review of Economic Policy. “Demand and benefit forecasts that are wrong by 20-70 percent compared with actual development are common.”Read the complete [ungated] article [Virginia Postrel's Blog] here.

To draw these conclusions, Flyvbjerg analyzed results from 258 projects in 20 countries over 70 years, the largest such database ever compiled. Like the “stars without makeup” features in celebrity tabloids, his research provides a disillusioning reality check. “It is not the best projects that get implemented, but the projects that look best on paper,” Flyvbjerg writes. “And the projects that look best on paper are the projects with the largest cost underestimates and benefit overestimates, other things being equal.”

Friday, July 8, 2011

Without Incandescent Lights, Energy Use Will Not Decline

Posted By Milton Recht

My comment to The Wall Street Journal article, "New Flare-Up in Light-Bulb Wars" by Ryan Tracy and Stephanie Gleason:

Energy use in the US, per person, is at the same level it was 40 years ago, despite government mandates for energy efficient appliance, such as refrigerators, dishwashers, air conditioners, etc. Many appliances today use about half the electricity they did 40 years ago, yet we use more energy per person today.

Economists recognize this as the Jevons Effect or Jevons Paradox, which was first noted in the 1800s. When an apparatus becomes more efficient, it becomes cheaper to use. When something is cheaper, we tend to use more of it.

Households will use more light than before the mandate to switch away from incandescent bulbs because light will be cheaper to use. When households switched from candles and oil based lamps, which were expensive, to gas and electric lights, which were relatively cheaper, more lighting was used in the home.

Mandating energy conservation in a product does not reduce energy use. Households respond to the energy cost savings by using more of the same item or by using the left over household funds for energy for other energy using apparatuses.

Governmental mandates almost never achieve their intended results.

The same logic applies to autos. Increasing mpg, lowers the cost of auto travel per mile, which increases the distance people are willing to travel by car. Despite mpg increases, gasoline consumption (excluding the current economic downturn) does not go down. The trade-off is less safe, smaller cars without any total gasoline consumption benefit.

There are only two ways to reduce the use of energy or some other item; raise its price or limit its availability. Energy efficiency never reduces energy use.

Removing a choice is about control and elitism. It is not about doing good for the US, the environment or the household because it will never achieve its stated goal.

Odds Obama Faces A Primary Challenge Almost Doubled On Intrade Today

Posted By Milton Recht

The price of the Intrade security that Barack Obama will face a primary challenge jumped from 10 percent to 19.5 percent on Friday afternoon, July 8, 2011.

Closing Indian Point Nuclear Facility Will Increase NY Carbon Emissions By 15 Percent

Posted By Milton Recht

From Gannett's lohud.com, "Closing Indian Point has risks, NYC report finds" by Greg Clary:

A draft copy of the report is available here.

Closing Indian Point in the next four years would create electricity shortages, higher energy costs and dirtier air, according to a preliminary report commissioned by New York City.Read the complete article here.*** Among the key findings in the report:Though the researchers didn't examine the impact on Indian Point's 1,100 workers or possible loss of tax dollars, they did note closing the plant "may have far-reaching ancillary economic impacts."

- New York City and the state would see an approximately 15 percent increase in carbon emissions under most conventional replacement scenarios.

- The lowest-cost option would require $408 million in subsidies and if the price of electricity went down, the public support would need to be raised.

- Every replacement option studied ... including aggressive energy conservation, will result in a cost increase to energy consumers throughout the state.

- The cost of building new electricity generation would be passed to consumers; while those sums are debatable, they would be "real and significant."

A draft copy of the report is available here.

Thursday, July 7, 2011

Another Do Good Government Intervention Does More Harm Than Good: Automatic 401(k) Enrollment Law Decreases Retirement Savings

Posted By Milton Recht

From The Wall Street Journal, "401(k) Law Suppresses Saving for Retirement" by Anne Tergesen:

The do-gooder control freaks who think they are wiser than the general public and who think they know what is best for everyone never learn that their push for legislative and regulatory mandates just about always creates more harm and negative consequences than the situation they are trying to fix.

What we need are not more mandates, but a way to prohibit do-gooders from imposing their will on the public under the guise of helping the defenseless irrational public.

A 2006 law designed to boost employees' retirement-savings is having the opposite effect for some people.Read the complete article here.

Under the law, companies are allowed to automatically enroll workers in their 401(k) plans, rather than require employees to sign up on their own. The measure was intended to encourage more people to bulk up their retirement nest eggs—a key goal in a country where millions of people aren't saving enough.

But an analysis done for The Wall Street Journal shows about 40% of new hires at companies with automatic enrollments are socking away less money than they would if left to enroll voluntarily....

The do-gooder control freaks who think they are wiser than the general public and who think they know what is best for everyone never learn that their push for legislative and regulatory mandates just about always creates more harm and negative consequences than the situation they are trying to fix.

What we need are not more mandates, but a way to prohibit do-gooders from imposing their will on the public under the guise of helping the defenseless irrational public.

Stimulus Rearranges The Timing Of Economic Growth: Does Not Create Growth: Robert Barro

Posted By Milton Recht

From The Telegraph, "Fiscal stimulus doesn't work, claims Harvard economics professor Robert Barro" by By Philip Aldrick:

"In the long run you have got to pay for it. The medium and long-run effect is definitely negative. You can't just keep borrowing forever. Eventually taxes are going to be higher, and that has a negative effect," he [Robert Barro] said.Read the complete article here.

"The lesson is you want government spending only if the programmes are really worth it in terms of the usual rate of return calculations. The usual kind of calculation, not some Keynesian thing. The fact that it really is worth it to have highways and education. Classic public finance, that's not macroeconomics."

Turning to the $600bn (£373bn) to $800bn US package, he added it was "mainly a waste of money". Stimulus programmes, he said, offer little more than "rearranging the timing" of economic growth. "Possibly you could make an argument that it's worth it. But it's going to be a negative-sum thing overall, so you have to think it's a big benefit for boosting the recovery."

Food Calorie Counts Do Not Change Eating Habits

Posted By Milton Recht

From The Washington Post, "Calorie counts don’t change most people’s dining-out habits, experts say" by Michael S. Rosenwald:

Once again, as is often the case, laws and regulations fail to achieve their intended benefits. Unnecessary laws increase business costs and raise the specter of potential legal liability and lawsuits if a restaurant inadvertently posts an incorrect calorie count on some food item.

Evidence is mounting that calorie labels — promoted by some nutritionists and the restaurant industry to help stem the obesity crisis — do not steer most people to lower-calorie foods. Eating habits rarely change, according to several studies. Perversely, some diners see the labels yet consume more calories than usual. People who use the labels often don’t need to. (Meaning: They are thin.)Read the complete article here.

Once again, as is often the case, laws and regulations fail to achieve their intended benefits. Unnecessary laws increase business costs and raise the specter of potential legal liability and lawsuits if a restaurant inadvertently posts an incorrect calorie count on some food item.

Reducing Salt Intake Does Not Lower Mortality Rate

Posted By Milton Recht

From Bloomberg, "Consuming Less Salt Doesn’t Lead to Lower Mortality Rate, Researchers Say" by Robert Langreth:

No strong evidence exists that advising people to eat less salt or putting them on a low-salt diet reduces their death rate or cuts cardiovascular events, an analysis of seven studies found.

The report combined the results of seven previous randomized clinical trials that looked at the effects of lowering salt consumption in 6,250 people with normal and high blood pressure. While patients in the reduced-salt groups lowered their blood pressure, there was no significant difference in mortality rates, according to the analysis published yesterday in the American Journal of Hypertension.

Tuesday, July 5, 2011

Self-Employment And New Businesses Declined During Great Recession

Posted By Milton Recht

From The Cleveland Federal Reserve Economic Commentary, "The Great Recession’s Effect on Entrepreneurship" by Scott Shane:

Despite the claim that recessions are a time of opportunity for entrepreneurs, the Great Recession had a negative impact on U.S. entrepreneurship. At the end of the recession, the United States had fewer businesses and self-employed people than it had before the downturn began. While some measures indicate that a big part of this decline came from the increased closure of existing businesses, the largest effect came from a decline in new business formation, particularly for businesses with employees, the more economically substantial type of business.Read the complete article here.

Moreover, the data show that the negative effect of the Great Recession was largest on the most substantial entrepreneurial efforts, adversely affecting new employer firms more than nonemployer businesses, and incorporated self-employment more than unincorporated self-employment. By most available measures, the Great Recession’s effect on entrepreneurship was negative.

Saturday, July 2, 2011

Individual Income Tax Contains Biggest Tax Exclusions And Loopholes, Not Corporate Tax Deductions [Updated Weblinks]

Posted By Milton Recht

From Brookings "The Ugly Truth About Tax Loopholes" by William A. Galston, Senior Fellow, Governance Studies:

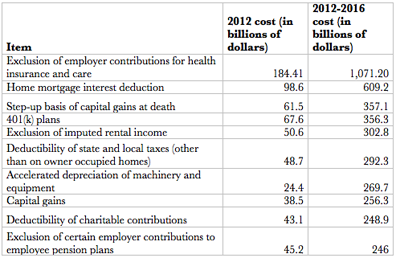

The following table contains the top ten items, which constitute more than half of all tax expenditures:

|

| Source: Brookings |

This, friends, is where the money is—not in tax breaks for corporate jets. (Indeed, all but one of the ten largest items is embedded in the personal income tax code, not in corporate taxes.) So by all means, let’s get rid of the nickel-and-dime stuff that contributes nothing to growth or well-being and offends decent moral sensibilities. But after we’re done with that, we’ll have to go after deductions and exclusions from which the majority of Americans benefit, albeit unequally.The complete article is available here.

Subscribe to:

Posts (Atom)