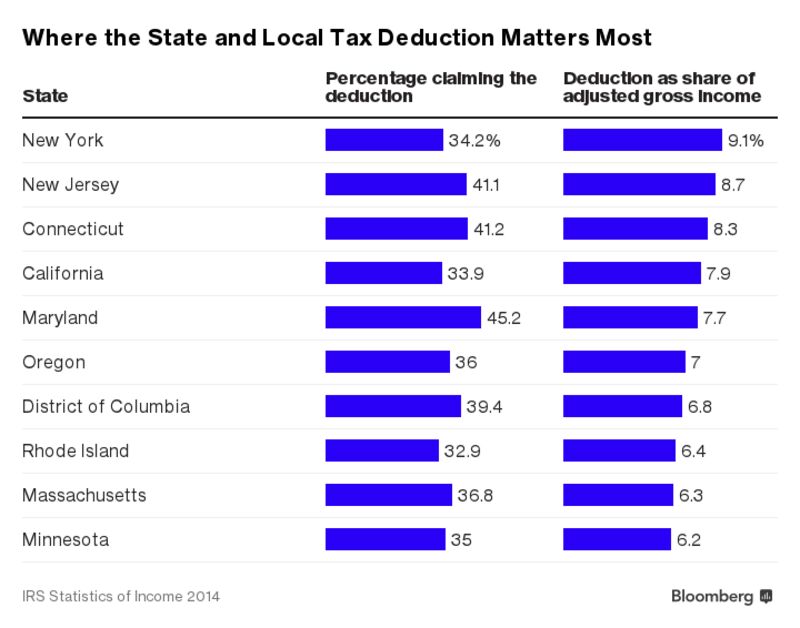

About 28 percent of tax filers claim the state and local deduction each year, according to the Tax Foundation. Of those, 77 percent deduct income taxes and the rest deduct sales taxes. The deduction ends up being far more valuable in states with the highest tax burdens.

Source: Bloomberg

Nationwide, wealthier taxpayers benefit the most from the deduction. More than 88 percent of its benefits go to Americans who earn more than $100,000 a year, according to the Tax Foundation.

Eliminating the deduction would boost federal tax collections by $1.8 trillion over the coming 10 years, the foundation calculated last month.

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Friday, April 28, 2017

Wealthier Residents In Liberal States Are Biggest Beneficiaries Of Federal Tax Deduction For State And Local Taxes: Are Wealthy Liberals Willing To Support Elimination Of A Tax Loophole That Mostly Affects Their Pockets?

Posted By Milton Recht

From Bloomberg, "Trump’s Tax Plan Could Be Painful for New York, New Jersey, and California: Wealthier residents of high-tax states would be especially hard hit if they can no longer deduct state and local taxes from their federal taxes." by Suzanne Woolley and Ben Steverman:

Thursday, April 27, 2017

Without The Inclusion Of Average Hours Worked And Worker Output, CBO's Comparison Of Public Vs Private Sector Compensation Is Meaningless

Posted By Milton Recht

My posted comment to the Wall Street Journal opinion, "The Permanent Boomtown For federal workers, the deal keeps getting sweeter." by James Freeman about the recent CBO report, "Comparing the Compensation of Federal and Private-Sector Employees, 2011 to 2015:"

From The Wall Street Journal opinion:

From The Wall Street Journal opinion:

Not only are America’s 2.2 million civilian federal employees making more than their counterparts in the private market; the compensation gap is widening between the feds and the taxpaying public they allegedly serve. A new report from the Congressional Budget Office released this week finds that “the federal government paid 17 percent more in total compensation than it would have if average compensation had been comparable with that in the private sector.” At every level of education from a high school diploma or less through a master’s degree, workers made more off the taxpayers than similar workers made while toiling away in the real economy. The one exception: private-sector workers with a professional degree or doctorate have managed to achieve higher compensation than the government gang.My posted WSJ comment:

Comparing public versus private compensation without comparing worker output is meaningless. In the private sector, the concern for profitability pushes workers to be more productive. Public workers are rarely under any deadlines. The 17 percent number is probably lower than reality. If it takes three government workers to do the work of two private sector workers, then it is costing the government an additional 33 percent in extra pay and benefits in addition to the average 17 percent CBO found. It makes sense that CBO found that private professional and doctorate degree workers are paid more than public workers. This group probably has the highest percentage of no overtime pay. These private workers are likely producing more by working later, taking work home, working on weekends and delaying vacations more than government workers and are paid a premium for their extra productivity. CBO should include average weekly hours worked and output next time to have a meaningful comparison.

Monday, April 24, 2017

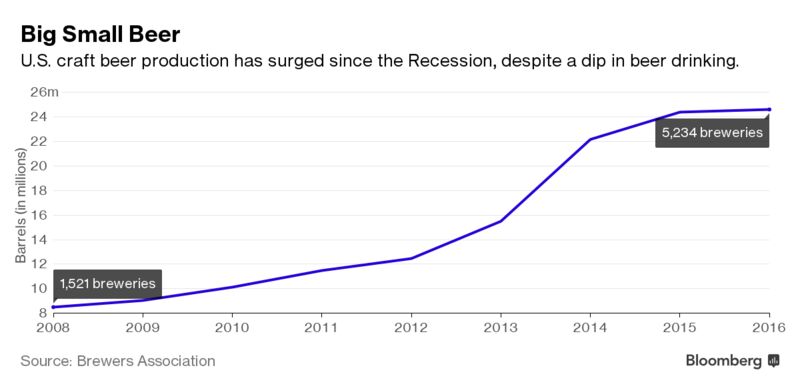

US Craft Beer Production Increasing Since Recesssion: Chart

Posted By Milton Recht

From Bloomberg, "Beer Can Rigs Are Rescuing America’s Craftiest Brews: Mobile canners help small brewers thrive while fueling a beer-drinking renaissance." by Kyle Stock:***

In the beer world, small is slowly and steadily beating big, thanks in large part to a few dozen nomadic canning operations. Charging by the can, this burgeoning industry helps hundreds of brewing startups connect with customers without buying expensive machinery they don’t have the money or space for. As a result, an increasing number of the 5,300 breweries in America today can thrive—or at least survive.

|

| Source: Bloomberg |

Friday, April 21, 2017

HUD Tells Wealthy Surburban Westchester County That Having Single Family Residential Areas Is Discrimination Against Minorities: County Should Allow More Multi-Family (Apartment) Buildings

Posted By Milton Recht

The following letter from HUD to Westchester County represents everything that is wrong with HUD and US housing policy.

In the HUD letter, the first two towns mentioned are Pound Ridge and Larchmont.

Pound Ridge has about 5200 people, about 1850 households, a median HH income of about $190,000 and a median home price of over $850,000.

Larchmont has about 6100 people, about 2300 households, a median HH income of about $150,000 and a median home price of over $1 million.

HUD Lettter excerpts:--- To HUD, it seems, being richer than the poor and living in a residential community of expensive single family homes is discriminatory.

It gets funnier (or sadder). Pound Ridge does not have sewers (homes use septic systems), a nearby commuter railroad to NYC, or other public transportation. It is one of the towns that is a signer of the EPA and DEC approved NYC Watershed Compact, which protects NYC water reservoir sources. The agreement restricts development and increases in impervious surfaces because it will increase runoff and the presence of not easily filtered pollutants (e.g., salt) into NYC water. Pound Ridge and private developers are limited by law and agreement in pursuing further development of land.

In perspective, many Westchester towns have a population equal to one or two Manhattan NYC square blocks with high-rise apartment, co-op or condo buildings. Can you imagine HUD coming into NYC and telling it that certain square blocks on the upper East Side or upper West Side of Manhattan, along Central Park West or Fifth Avenue, were discriminatory because the tenant mix of each expensive rental, co-op, or condo building did not match the national average of minorities without any showing that a member of a minority with the financial means to afford the high cost was rejected? That is about the equivalent of what HUD is saying to Westchester County.

In the HUD letter, the first two towns mentioned are Pound Ridge and Larchmont.

Pound Ridge has about 5200 people, about 1850 households, a median HH income of about $190,000 and a median home price of over $850,000.

Larchmont has about 6100 people, about 2300 households, a median HH income of about $150,000 and a median home price of over $1 million.

HUD Lettter excerpts:

Kevin I. Plunkett

Deputy County Executive

Westchester County

148 Martine Avenue, 9th Floor

White Plains, NY 10601

Re: United States ex rel. Anti-Discrimination Center v. Westchester County

06 civ. 2860 (DLC) Zoning Analysis

Dear Mr. Plunkett:

The US. Department of Housing and Urban Development has received your March 20, 2017 submission entitled "Westchester County Analysis of Impediments Supplement to Chapter 12 Zoning Analysis" ("AI Supplement"). HUD has reviewed the Al Supplement and determined that it is unacceptable because it continues to lack appropriate analyses of impediments to fair housing choice and fails to identify forward-looking strategies to overcome those impediments.*** a. Failure to Address Segregation of White Residents

The AI Supplement focuses on "concentration" of minority residents but fails to analyze areas of white segregation. The discussion regarding Larchmont illustrates the problem. Nearly half of the acreage in the Village is dedicated to "high-density single~family" housing, while only 8% is dedicated to multifamily housing. Almost all of - 90% of the Village's acres is zoned for single family residential use and has an African American population of less than 1%. This indicates that African American residents are barely represented while white residents are overwhelmingly represented. Yet, the County fails to analyze whether zoning is a factor. [Footnote omitted.]

The analysis of Pound Ridge suffers from the same narrow focus. See pages 3-60 - 64. Pound Ridge does not allow any multifamily development as of right and there are only 17 multifamily units in the Town. Pound Ridge is 93.7% white and the housing stock is 99.2%

single-family. The AI Supplement concludes that there are no concentrations of African American or Hispanic residents and, therefore, the "zoning provisions are not posing as a barrier to diversification." Page 3-63. This conclusion is highly suspect. The concentration of white residents and the impact of limited multifamily development in Pound Ridge should have been addressed.

*** Conclusion

HUD finds that the Al Supplement is unacceptable and that the AI, therefore, does not satisfy the Settlement. HUD recognizes that the County will be unable to correct the above-described deficiencies in time to meet the Court's April 10, 2017 deadline to produce an AI that is acceptable to HUD. As such, notwithstanding the long history related to this litigation, HUD would not oppose a reasonable extension should the County seek one from the Court.

Sincerely,

Jay Golden

Regional Director

Office of Fair Housing and Equal Opportunity

It gets funnier (or sadder). Pound Ridge does not have sewers (homes use septic systems), a nearby commuter railroad to NYC, or other public transportation. It is one of the towns that is a signer of the EPA and DEC approved NYC Watershed Compact, which protects NYC water reservoir sources. The agreement restricts development and increases in impervious surfaces because it will increase runoff and the presence of not easily filtered pollutants (e.g., salt) into NYC water. Pound Ridge and private developers are limited by law and agreement in pursuing further development of land.

In perspective, many Westchester towns have a population equal to one or two Manhattan NYC square blocks with high-rise apartment, co-op or condo buildings. Can you imagine HUD coming into NYC and telling it that certain square blocks on the upper East Side or upper West Side of Manhattan, along Central Park West or Fifth Avenue, were discriminatory because the tenant mix of each expensive rental, co-op, or condo building did not match the national average of minorities without any showing that a member of a minority with the financial means to afford the high cost was rejected? That is about the equivalent of what HUD is saying to Westchester County.

Tuesday, April 18, 2017

Reprint Of A 7 Year Old Blog Post "Will Health Care Reform Be Legislative Vaporware?"

Posted By Milton Recht

Below is a reprint of an over 7 year old blog post by me on December 20, 2009, "Will Health Care Reform Be Legislative Vaporware?"

The post below discussed the distinction between the passage of a well-intentioned health care law and the final desired health care benefits. Too often the media, politicians and the public act as if a law's passage and enactment is the end goal. They forget that a law is an intermediate step that sets in motion many agents to achieve the desired result. Until a law is implemented and running for several years, there is tremendous uncertainty as to the law's ability to achieve the original intended result, especially for such a large undertalking as reforming health care.

The post below discussed the distinction between the passage of a well-intentioned health care law and the final desired health care benefits. Too often the media, politicians and the public act as if a law's passage and enactment is the end goal. They forget that a law is an intermediate step that sets in motion many agents to achieve the desired result. Until a law is implemented and running for several years, there is tremendous uncertainty as to the law's ability to achieve the original intended result, especially for such a large undertalking as reforming health care.

Sunday, December 20, 2009

Will Health Care Reform Be Legislative Vaporware?

Posted By Milton Recht

Vaporware, a term from the computer industry where software companies announce their forthcoming release of new beneficial software that never materializes, appropriately applies to health care reform legislation

Congress will pass and the President will sign a health care reform law, but will it accomplish its many goals and have the many promised health care benefits or will it become a law that does not achieve its intended results? Could it actually make the machinery of our health care system function more poorly?

We must not forget that the benefit of this product called "health care" is the outcome to the patient and not its costs or insurability.

Many of us treat a law, such as whatever will pass for health care reform, as a final delivered product with all the previously promised beneficial features. Health reform requires more than the passage of a law called health reform. It requires accomplishing and solving many difficult and not well-understood health care issues.

Many laws are simple in that they do not involve modifying the process of an entire sector of the US economy. Most laws are categorizations that add to or remove from existing processes. A law that declares an action criminal, a felony, a higher fine, a health hazard, taxable, etc. and by declaration adds or subtracts from an existing framework easily achieves its intended results because the passage of the law itself achieves the results.

The well intended passage (and I give Congress and the President the benefit of the doubt that their actions are well intended) of a law in an area as large, as complex and as intertwined as health care requires more than enactment for achieving its original goals. It requires much more than a declaration of Congressional wishes and a redefinition of health care, health insurance, uninsured, etc.

Until any health care law is fully functioning, there is a lot of uncertainty as to its effectiveness, no matter how well intentioned. In the health care debate, our upset was with process and costs, but not outcomes. We never heard that doctors were doing appendectomies wrong or that too many patients with appendicitis died. We heard that appendectomies cost too much out of pocket or that someone could not or did not get affordable insurance to cover the needed medical care.

What we do not yet understand about any health care reform law that passes Congress is how that law will affect health outcomes. It is quite possible, and likely, that any health law making as much of a change to health insurance and health care as will likely pass Congress, will also likely affect delivery and choices of treatment, doctor availability, and health outcomes.

Whether the law will lower costs, decrease the number of uninsured and improve health outcomes is unknown until medicine functions for some time under the new legislation. While many will say it is in any case a first step toward improved health care outcomes, increased insurance availability and lowered costs, and that Congress will modify it as needed, a poorly laid foundation will never result in a quality home. [Emphasis not in original.]

To me, health care reform legislative passage is vaporware. It is solely a promise of beneficial outcomes and intended benefits. Until, the law is functioning for a few years, after all its provisions take effect, will I and the rest of the US know whether a real, functioning, improved, lower cost health care system exists. Until such time, passage of the law is merely an announcement of intended benefits. It is vaporware.

Posted 12/20/2009 04:53:00 AM

Sunday, April 16, 2017

Over The Last 3 Years, Investors Put 8.5 Times As Much Money In Vanguard As In The Rest of The Mutual Fund Industry: $823 Billion Vs $97 Billion

Posted By Milton Recht

From The New York Times, "Vanguard Is Growing Faster Than Everybody Else Combined" by Landon Thomas Jr.:

In the last three calendar years, investors sank $823 billion into Vanguard funds, the company says. The scale of that inflow becomes clear when it is compared with the rest of the mutual fund industry — more than 4,000 firms in total. All of them combined took in just a net $97 billion during that period, Morningstar data shows. Vanguard, in other words, scooped up about 8.5 times as much money as all of its competitors.

*** The triumph of index fund investing means Vanguard’s traders funnel as much as $2 billion a day into stocks like Apple, Microsoft and Amazon, as well as thousands of smaller companies that the firm’s fleet of funds track. That is 20 times the amount that Vanguard was investing on a daily basis in 2009. It is manageable, in large part, because no stock-picking is involved: The money simply flows into index funds and E.T.F.s, and through February of this year, nine out of every 10 dollars invested in a United States mutual fund or E.T.F. was absorbed by Vanguard.

By any measure, these are staggering figures. Vanguard’s assets under management have skyrocketed to $4.2 trillion from $1 trillion seven years ago, according to the company. About $3 trillion of this is invested in passive index-based strategies, with the rest in funds that rely on an active approach to picking stocks and bonds.

Thursday, April 13, 2017

82 Percent Of All US Actively Managed Funds And Over 90 Percent Of Actively Managed US Equity Funds Trailed Their Benchmarks Over 15 Years

Posted By Milton Recht

From The Wall Street Journal, "Indexes Beat Stock Pickers Even Over 15 Years: New data show that 82% of all U.S. funds trailed their respective benchmarks over 15 years" by Daisy Maxey and Chris Dieterich:

Most actively managed U.S. stock funds were beaten by their market benchmarks over the past decade and a half, a record of underperformance that helps explain why stock pickers are losing billions of dollars in assets each month to low-cost passive investments that track indexes.

Over the 15 years ended in December 2016, 82% of all U.S. funds trailed their respective benchmarks, according to the latest S&P Indices Versus Active funds scorecard. This was the first year that the analysis included 15 years of data, helping smooth out periods of volatility that can affect the performance of active managers.***

Source: The Wall Street Journal

Among more than a dozen categories tracked, 95.4% of U.S. mid-cap funds, 93.2% of U.S. small-cap funds and 92.2% of U.S. large-cap funds trailed their respective benchmarks, according to the data.

Tuesday, April 11, 2017

GM Is Twice As Valuable As Tesla: Confusion In The Media Between Market Capitalization And Enterprise Value

Posted By Milton Recht

The broadcast and print news media is reporting that on Monday, April 10, Tesla surpassed General Motors as the most valuable US auto company. For example, to cite just two, see The Wall Street Journal article, "Tesla Rivals GM as the Most Valuable Auto Maker in U.S." and the New York Times article, "G.M. Takes a Back Seat to Tesla as America’s Most Valued Carmaker."

Tesla's market capitalization (equity common stock outstanding times per share price) did surpass General Motor's market capitalization during the day on Monday. Market capitalization is only one of several components of a company's total value.

The total value of a company depends on a company's choice of capital structure. Different companies have different capital and financial structures that include the use of varied financial instruments, such as common stock, preferred stock, short-term and long-term debt and bonds (usually netted against cash holdings), and other funding and investment vehicles.

The inclusion of the value of all sources of funding, investment, and ownership is called Enterprise Value.

The Entreprise Value of Tesla is $55.7 billion, according to Yahoo.

The Entreprise Value of General Motors is $113.9 billion, according to Yahoo.

GM's total value is over 2 times the total value of Tesla.

To use a commonplace, everyday example to understand the difference between the two values, equity and total values, consider the following. Two buyers are looking to purchase a home. Buyer A buys a $400,000 house with a 10 percent, $40,000, downpayment and a $360,000 mortgage. Buyer B buys a $$360,000 house with a 20 percent, $72,000, downpayment, and a $288,000 mortgage.

Buyer A has $40,000 equity in the purchased house.

Buyer B has $72,000 equity in the purchased house.

Does buyer B have the more valuable house because they have more equity, $72,000 versus Buyer A's equity of $40,000?

Of course not. A $400,000 house is more valuable than a $360,000 house. The capital structure of the purchase does not change the value of the houses.

With GM being the older of the two companies and the company with more capital investment in mass production facilities, it is not surprising that Tesla, a newer company, producing many fewer vehicles than GM could have a higher amount of equity, common stock, value and much less debt than GM. Tesla has a very small amount of debt for a company in a capital intensive industry, such as the auto industry. As Tesla matures and expands its production capabilities, it will grow its vehicle market share by taking on more debt.

When both companies have similar production capacity and likely a more similar capital structure, then a more comparable comparison of value will be able to be made. Until then, GM's total (enterprise) value is twice that of Tesla's.

Tesla's market capitalization (equity common stock outstanding times per share price) did surpass General Motor's market capitalization during the day on Monday. Market capitalization is only one of several components of a company's total value.

The total value of a company depends on a company's choice of capital structure. Different companies have different capital and financial structures that include the use of varied financial instruments, such as common stock, preferred stock, short-term and long-term debt and bonds (usually netted against cash holdings), and other funding and investment vehicles.

The inclusion of the value of all sources of funding, investment, and ownership is called Enterprise Value.

The Entreprise Value of Tesla is $55.7 billion, according to Yahoo.

The Entreprise Value of General Motors is $113.9 billion, according to Yahoo.

GM's total value is over 2 times the total value of Tesla.

To use a commonplace, everyday example to understand the difference between the two values, equity and total values, consider the following. Two buyers are looking to purchase a home. Buyer A buys a $400,000 house with a 10 percent, $40,000, downpayment and a $360,000 mortgage. Buyer B buys a $$360,000 house with a 20 percent, $72,000, downpayment, and a $288,000 mortgage.

Buyer A has $40,000 equity in the purchased house.

Buyer B has $72,000 equity in the purchased house.

Does buyer B have the more valuable house because they have more equity, $72,000 versus Buyer A's equity of $40,000?

Of course not. A $400,000 house is more valuable than a $360,000 house. The capital structure of the purchase does not change the value of the houses.

With GM being the older of the two companies and the company with more capital investment in mass production facilities, it is not surprising that Tesla, a newer company, producing many fewer vehicles than GM could have a higher amount of equity, common stock, value and much less debt than GM. Tesla has a very small amount of debt for a company in a capital intensive industry, such as the auto industry. As Tesla matures and expands its production capabilities, it will grow its vehicle market share by taking on more debt.

When both companies have similar production capacity and likely a more similar capital structure, then a more comparable comparison of value will be able to be made. Until then, GM's total (enterprise) value is twice that of Tesla's.

Friday, April 7, 2017

Uber Introduction Reduced Alcohol-Related Auto Accidents In New York City

Posted By Milton Recht

From The Economist, Daily Chart, "Ride-hailing apps may help to curb drunk driving: Alcohol-related car accidents declined in New York after the introduction of Uber:"

***

| Source: The Economist |

According to a working paper by Jessica Lynn Peck of the Graduate Centre at the City University of New York, the arrival of Uber to New York City may have helped reduce alcohol-related traffic accidents by 25-35%. Uber was first introduced in the city in May 2011, but did not spread through the rest of the state. The study uses this as a natural experiment. To control for factors unrelated to Uber's launch such as adverse weather conditions, Ms Peck compares accident rates in each of New York’s five boroughs to those in the counties where Uber was not present, picking those that had the most similar population density and pre-2011 drunk-driving rate.

The four boroughs which were quick to adopt Uber—Manhattan, Brooklyn, Queens and the Bronx—all saw decreases in alcohol-related car crashes relative to their controls. By contrast, Staten Island, where Uber caught on more slowly, saw no such decrease. It shouldn’t take ride-hailing apps to curb drunk driving, but any reduction is worth hailing.

Thursday, April 6, 2017

US Budget Spending By Percentage Categories

Posted By Milton Recht

From Pew Research Center, "What does the federal government spend your tax dollars on? Social insurance programs, mostly" by Drew DeSilver:

***

| Source: Pew Research Center |

When thinking about federal spending, it’s worth remembering that, as former Treasury official Peter Fisher once said, the federal government is basically “a gigantic insurance company,” albeit one with “a sideline business in national defense and homeland security.” In fiscal year 2016, which ended this past Sept. 30, the federal government spent just under $4 trillion, and about $2.7 trillion – more than two-thirds of the total – went for various kinds of social insurance (Social Security, Medicaid and Medicare, unemployment compensation, veterans benefits and the like). Another $604 billion, or 15.3% of total spending, went for national defense; net interest payments on government debt was about $240 billion, or 6.1%. Education aid and related social services were about $114 billion, or less than 3% of all federal spending. Everything else – crop subsidies, space travel, highway repairs, national parks, foreign aid and much, much more – accounted for the remaining 6%.

Wednesday, April 5, 2017

US Physicians Earnings Vary By Region

Posted By Milton Recht

From philly●com, "How much do doctors earn? Survey finds gender, regional differences" by Don Sapatkin:

Physicians in the mid-Atlantic U.S. earn less money — pulling in an average of $282,000 — than any other region in the nation, according to a new compensation report based on a recent survey of more than 19,000 doctors.Information derived from "Medscape Physician Compensation Report."

Physicians in the north central region of the country make the most, an average of $317,000, reported Medscape, a news website for medical professionals. The national average: $294,000 ($217,000 for primary care doctors and $316,000 for specialists).

Average Physician Pay by Region

Staff Graphic

*** Pay

- Earnings were up about 5 percent from last year's survey, similar to increases each of the past several years.

- Orthopedists make the most ($489,000), pediatricians the least ($202,000).

16 US Cities That Exceed The National Average For Percentage Of People 18-34 Living at Home

Posted By Milton Recht

From Money•ish, "Proof that millennials in Middle America are more independent" by Catey Hill:

|

| Source: Money•ish |

Subscribe to:

Posts (Atom)