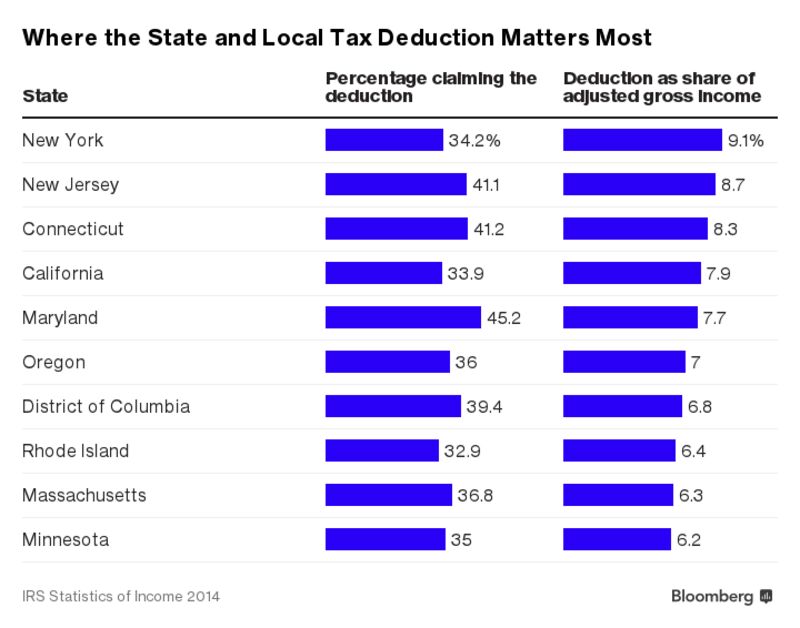

About 28 percent of tax filers claim the state and local deduction each year, according to the Tax Foundation. Of those, 77 percent deduct income taxes and the rest deduct sales taxes. The deduction ends up being far more valuable in states with the highest tax burdens.

Source: Bloomberg

Nationwide, wealthier taxpayers benefit the most from the deduction. More than 88 percent of its benefits go to Americans who earn more than $100,000 a year, according to the Tax Foundation.

Eliminating the deduction would boost federal tax collections by $1.8 trillion over the coming 10 years, the foundation calculated last month.

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Friday, April 28, 2017

Wealthier Residents In Liberal States Are Biggest Beneficiaries Of Federal Tax Deduction For State And Local Taxes: Are Wealthy Liberals Willing To Support Elimination Of A Tax Loophole That Mostly Affects Their Pockets?

Posted By Milton Recht

From Bloomberg, "Trump’s Tax Plan Could Be Painful for New York, New Jersey, and California: Wealthier residents of high-tax states would be especially hard hit if they can no longer deduct state and local taxes from their federal taxes." by Suzanne Woolley and Ben Steverman:

Subscribe to:

Post Comments (Atom)

It's not my very first time to visit this blog; I’m visiting this daily and acquire superb info from here day by day.

ReplyDeleteWixsite

This blog has very distinct features. Thanks

ReplyDeleteYolasite resource