From NBER, The Digest, "Global Evidence on Childbearing and Women’s Employment," Summary of Working Paper 31649:

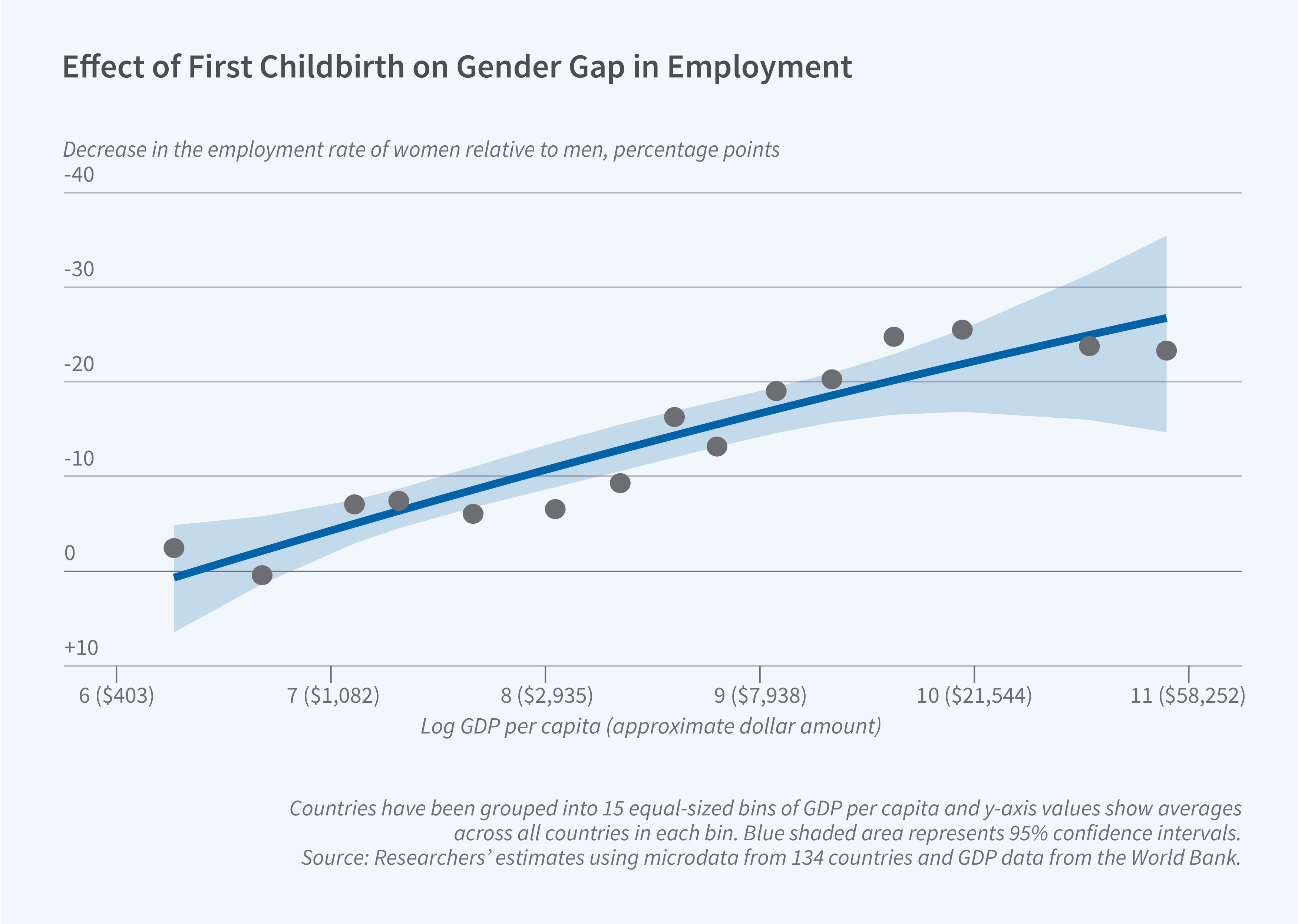

***As incomes rise and economies transition from subsistence farming toward salaried work in industry and services, childbearing has a larger negative effect on women’s employment.

From "

The Child Penalty Atlas" by Henrik Kleven, Camille Landais, and Gabriel Leite-Mariante, NBER Working Paper No. 31649, August 2023, Revised February 2024:

ABSTRACTThis paper builds a world atlas of child penalties in employment based on micro data from 134 countries. The estimation of child penalties is based on pseudo-event studies of first child birth using cross-sectional data. The pseudo-event studies are validated against true event studies using panel data for a subset of countries. Most countries display clear and sizable child penalties: men and women follow parallel trends before parenthood, but diverge sharply and persistently after parenthood. While this pattern is pervasive, there is enormous variation in the magnitude of the effects across different regions of the world. The fraction of gender inequality explained by child penalties varies systematically with economic development and proxies for structural transformation. At low levels of development, child penalties represent a minuscule fraction of gender inequality. But as economies develop — incomes rise and the labor market transitions from subsistence agriculture to salaried work in industry and services — child penalties take over as the dominant driver of gender inequality. The relationship between child penalties and development is validated using historical data from current high-income countries, back to the 1700s for some countries. Finally, because parenthood is often tied to marriage, we also investigate the existence of marriage penalties in female employment. In general, women experience both marriage and child penalties, but their relative importance depends on the level of development. The development process is associated with a substitution from marriage penalties to child penalties, with the former gradually converging to zero.