Inequality doesn’t mean you have no food; no home; no access to medical care; no indoor plumbing; no cellphone; no flatscreen tv; no opportunity for schooling for your children. Inequality and poverty are two different concepts. Inequality means there are some people that have more expensive versions than other people. Inequality measurements are used as motivation to create government dependencies; to increase taxes on the rich; to redistribute income and wealth. Inequality will always exist because wages are not age and skill adjusted. Someone just starting out will earn less than the other worker who has worked for 10, 20, 30 years and developed skills, experience and achieved wage raises and promotions. Someone working part-time will make less than someone working full time. Someone choosing to work at a non profit will usually make less than someone working for a non-government profit making company. Inequality measurements in today’s society are an attempt to motivate the citizenry to accept a socialist agenda of government income redistribution. Unfortunately, the more socialistic an economy becomes, the slower the growth rate of the economy and the poorer the nation and future generations become over time compared to a capitalistic entrepreneurial society.

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Friday, December 30, 2022

Wage Inequality Will Always Exist: Inequality And Poverty Are Two Different Concepts: My Comment To WSJ Article, "Wage Inequality May Be Starting to Reverse"

Posted By Milton Recht

My posted comment to The Wall Street Journal article, "Wage Inequality May Be Starting to Reverse: Remote work, deglobalization, stalled technology have started eroding some advantages of higher-skilled workers. The question is whether it will last." by Greg Ip:

Tuesday, December 27, 2022

Inequality Measures Promote Socialism, Income Redistribution, Continual Taxation Of The Rich: Comment To WSJ Book Review

Posted By Milton Recht

My published comment to The Wall Street Journal, Books & Arts, "‘The Myth of American Inequality’ Review: Believe Your Eyes, Not the Statistics: Official government measures greatly exaggerate income inequality by ignoring taxation and noncash sources of income." by Charles W. Calomiris:

Inequality is not poverty. An inequality statistic does not measure the standard of living of those in the bottom rungs of the income distribution. It measures the income gap between the rich and those with lower incomes. Instead of calling it an inequality measure, it should be called an envy measure. Inequality compares an owner of a 4 year old Chevy, Ford, Toyota, Honda, Subaru against an owner of a new top of the line Tesla, BMW, Mercedes. It compares a renter of a modest apartment or owner of a modest size condo or home against a multi million dollar mansion. Inequality measures promote socialism, income redistribution and continual taxation of the rich, but fails to measure the needs and standard of living (consumption) of those in a lower quintile or decile.

Saturday, December 24, 2022

US One-Year Population Growth By State: 2021-2022: Chart

Posted By Milton Recht

From The Wall Street Journal, "Real Time Economics" newsletter email by Jeff Sparshott, "U.S. Population Growth Remains Sluggish:"

|

| Source: WSJ, Real Time Economics |

Friday, December 23, 2022

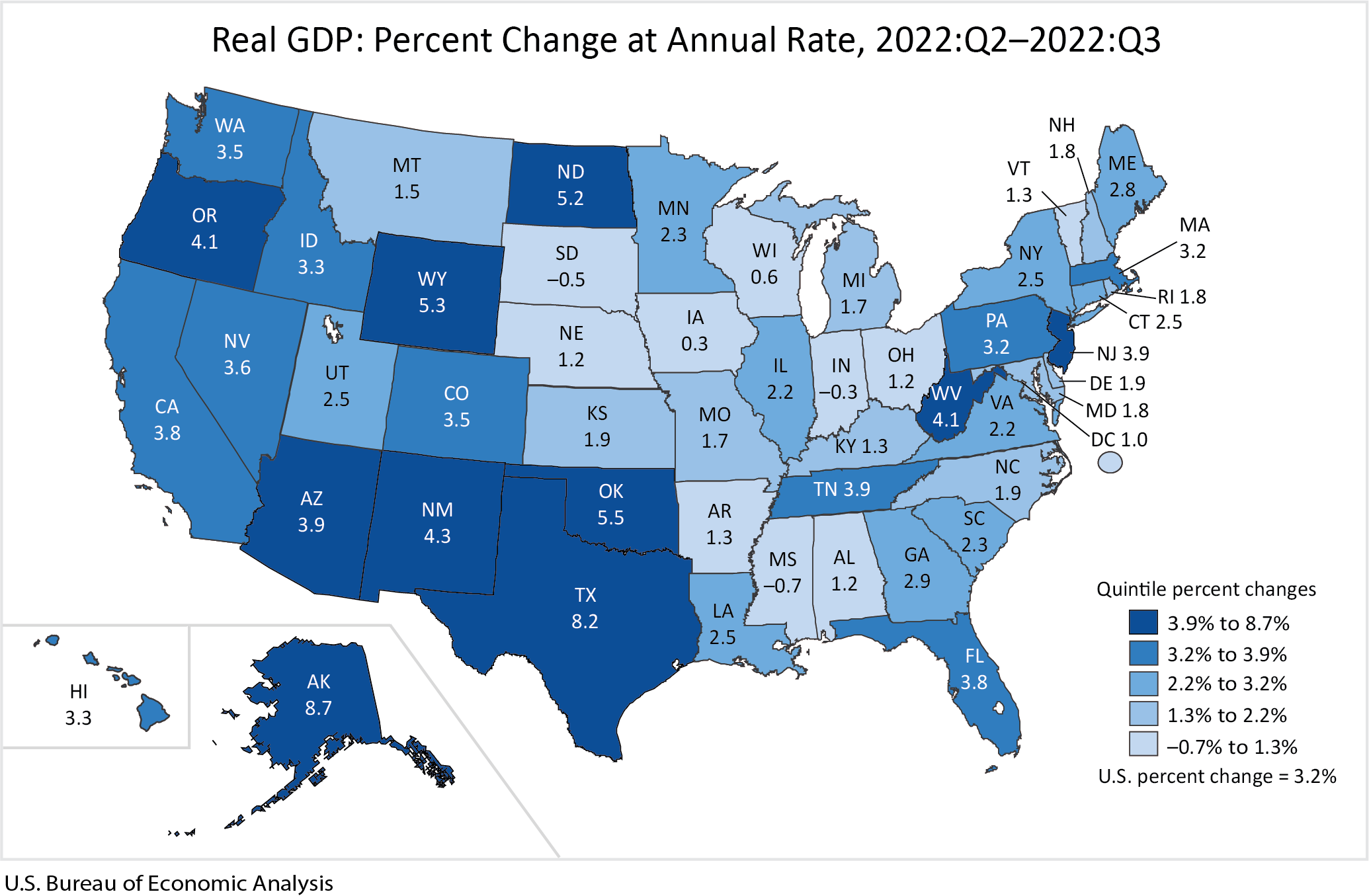

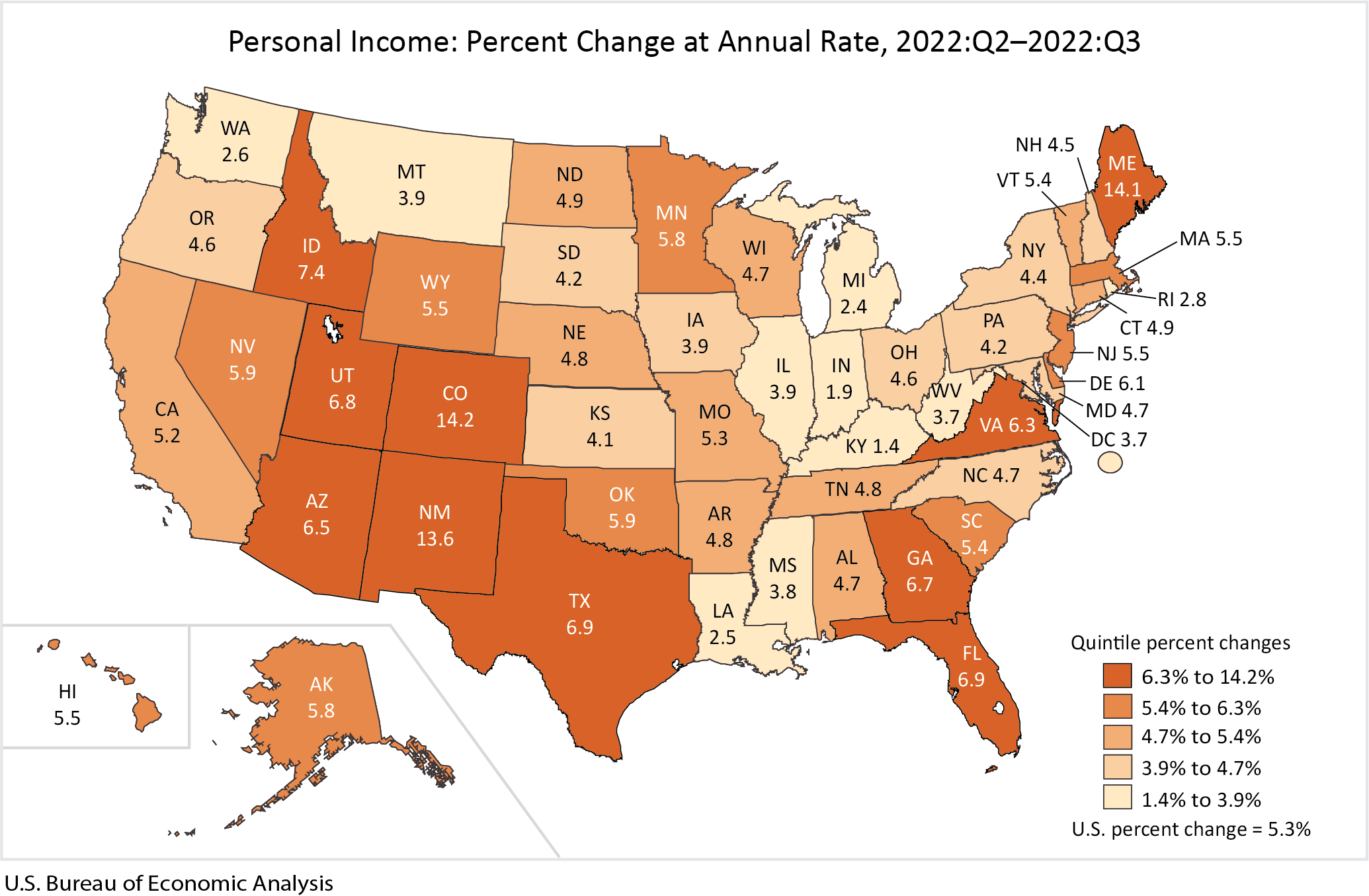

Gross Domestic Product And Personal Income By State, 3rd Quarter 2022: BEA Maps

Posted By Milton Recht

From Bureau of Economic Analysis, News Release, "Gross Domestic Product by State and Personal Income by State, 3rd Quarter 2022:"

***

Real gross domestic product (GDP) increased in 47 states and the District of Columbia in the third quarter of 2022, with the percent change in real GDP ranging from 8.7 percent in Alaska to –0.7 percent in Mississippi (table omitted), according to statistics released today by the U.S. Bureau of Economic Analysis (BEA).*** Personal income increased in all 50 states and the District of Columbia in the third quarter, with the percent change ranging from 14.2 percent in Colorado to 1.4 percent in Kentucky (table omitted).

|

| Source: Bureau of Economic Analysis |

Personal income In the third quarter of 2022, state personal income increased at an annual rate of 5.3 percent across all 50 states and the District of Columbia.

|

| Source: Bureau of Economic Analysis |

Monday, December 19, 2022

Friday, December 16, 2022

US Consumer Oct-Nov 2022 Retail Sales Change By Category: Chart

Posted By Milton Recht

From The Wall Street Journal, "Real Time Economics" newsletter email by Jeff Sparshott:

|

| Source: Real Time Economics, WSJ Newsletter |

Tuesday, December 13, 2022

Import Shipping Points Of Entry Moving Away From West Coast: Chart

Posted By Milton Recht

From The Wall Street Journal, "California Long Ruled U.S. Shipping. Importers Are Drifting East.

Companies that depended on the West Coast as a point of entry for their goods are turning to other parts of the country as global trade gets upended" by Paul Berger and photographs by David Walter Banks:

***

The hierarchy of U.S. ports is getting shaken up. Companies across many industries are rethinking how and where they ship goods after years of relying heavily on the western U.S. as an entry point, betting that ports in the East and the South can save them time and money while reducing risk.

Their reasons range from fears of a dockworkers strike along the West Coast and a repeat of the bottlenecks that roiled supply chains early in the pandemic to a reduced dependence on Chinese production and the need to get products to all parts of the country faster.

In August, Los Angeles lost its title as busiest port in the nation to the Port of New York and New Jersey as measured by the number of imported containers. It trailed its East Coast rival again in that measure during September and October, according to the Pacific Merchant Shipping Association and ports data.

Monday, December 12, 2022

Reprint: Political Nonsense Of Linking Specific Taxes To Specific Programs

Posted By Milton Recht

Reprint of my 11 year old, December 5, 2011 post, "Political Nonsense Of Linking Specific Taxes To Specific Programs."

Posted By Milton Recht

Monday, December 5, 2011

Political Nonsense Of Linking Specific Taxes To Specific Programs

Posted By Milton Recht

All tax revenues and fees go into a general revenue pot to pay for all government programs and expenses. To say that a specific tax is for a specific program is just silly political theater and under Obama, divisive class warfare.

Identifying taxes for targeted programs is like putting cash into a bank account, then making a withdrawal a few weeks later and expecting the serial numbers on the currency withdrawn to be the same as on the cash previously deposited.

It is like going on a driving trip and noticing that the gas tank is half full, filling the tank up and expecting to use the new gas for the later part of the trip and the gas that was originally in the tank for the beginning part of the trip, as if the gas did not mix in the tank.

The government works the same way. No specific tax can pay for any specific program. The government takes in a total sum of money from taxes and fees and spends that money on all its programs and expenses. Any extra money left over is a surplus and any shortfall of funds is a deficit that must be borrowed.

Opportunity Cost of Taxes And Programs

Any new tax or revenue increase whether linked to a new program or not is deficit reducing. Any new program whether linked to a specific tax or not is deficit increasing. By joining taxes and programs together as a single item, politicians are hiding from the public and media that new programs are spending and deficit increases and that new taxes and ending existing programs are deficit reductions.

New taxes justified as the basis for new programs, ignores the lost opportunity of using the new taxes to reduce the deficit. Likewise, failing to end an existing program, ignores that the termination of that program would also reduce the budget deficit.

All existing programs are deficit increases because ending any program would reduce the deficit. Likewise, any new tax revenue is deficit reducing and failing to increase revenues is an increase in the deficit.

Identifying taxes for targeted programs is like putting cash into a bank account, then making a withdrawal a few weeks later and expecting the serial numbers on the currency withdrawn to be the same as on the cash previously deposited.

It is like going on a driving trip and noticing that the gas tank is half full, filling the tank up and expecting to use the new gas for the later part of the trip and the gas that was originally in the tank for the beginning part of the trip, as if the gas did not mix in the tank.

The government works the same way. No specific tax can pay for any specific program. The government takes in a total sum of money from taxes and fees and spends that money on all its programs and expenses. Any extra money left over is a surplus and any shortfall of funds is a deficit that must be borrowed.

Opportunity Cost of Taxes And Programs

Any new tax or revenue increase whether linked to a new program or not is deficit reducing. Any new program whether linked to a specific tax or not is deficit increasing. By joining taxes and programs together as a single item, politicians are hiding from the public and media that new programs are spending and deficit increases and that new taxes and ending existing programs are deficit reductions.

New taxes justified as the basis for new programs, ignores the lost opportunity of using the new taxes to reduce the deficit. Likewise, failing to end an existing program, ignores that the termination of that program would also reduce the budget deficit.

All existing programs are deficit increases because ending any program would reduce the deficit. Likewise, any new tax revenue is deficit reducing and failing to increase revenues is an increase in the deficit.

Subscribe to:

Comments (Atom)