Source: The Wall Street Journal, Real Time Economics

New Yorkers, for example, need to work around 24 hours to make enough money to buy an iPhone 6. That’s up from 20.6 hours for residents of Geneva, but much lower than 163.8 hours for residents of Shanghai or 334.2 hours for residents of Manila.

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Wednesday, September 23, 2015

Number Of Work Hours Needed To Buy An IPhone 6 In Different Cities Internationally

Posted By Milton Recht

From The Wall Street Journal, Real Time Economics. "The Most Expensive Place in the World to Live" by Nick Timiraos:

Tuesday, September 22, 2015

Non-Bank Lenders Take Biggest Share Of Mortgages Since 1995

Posted By Milton Recht

From The Wall Street Journal, "Number of New Mortgages in 2014 Plunges 31% From Year Before: Nonbank lenders accounted for biggest share of lending since at least 1995" by Joe Light:

Nonbank lenders in 2014 took their biggest share of the mortgage market since at least 1995, new data show, as several large banks pulled back on lending to all but the most pristine borrowers.

According to federal government data released Tuesday, nondepository independent mortgage companies in 2014 accounted for 47% of loans to buy homes for owner-occupants and 42% of refinancing loans. Those market shares increased from 43% and 31%, respectively, in 2013.

The home-purchase share last year was 12 percentage points higher than in 2010.

Saturday, September 19, 2015

Map Of Areas Of US That Most Benefit From Deduction For State And Local Taxes

Posted By Milton Recht

From Tax Foundation, "The Biggest Loser of the Presidential Campaign So Far: the State and Local Tax Deduction" by Alan Cole:

[T]he deductibility of state and local taxes (including property taxes) is expected to result in $81 billion of lost revenue for the federal government in 2015, according to the latest OMB estimates. For another, the policy only benefits particular kinds of taxpayers. For example, it benefits those who itemize their deductions, rather than opting for the standard deduction. This is often characterized as regressive, because itemizers tend to be much wealthier than those who take the standard deduction. Furthermore, its value often varies heavily from place to place. This can be seen on a map we recently published of the values of state and local deductions taken per return.

Source: Tax Foundation

This policy is a kind of ad-hoc, incomplete, and arbitrary subsidy for state and local tax revenues. It benefits federal taxpayers extremely unequally, and it costs a lot of money that could be used for lower rates.

Wednesday, September 16, 2015

Low Income And Wealthier Children Eat About The Same Percentage of Fast Food Calories: Casting Doubt That Fast Food Causes Obesity In The Poor

Posted By Milton Recht

From BloombergBusiness, "Rich Kids Eat a Ton of Fast Food Too: Income doesn't matter." by John Tozzi:

Kids from low-income families are more likely to be obese than wealthier children, research suggests. But the relationship is complex, and scientists are still trying to untangle the links between income and such factors as diet and exercise that contribute to obesity.

New data make those connections even more complicated. Low-income kids—from households earning less than $31,500 for a family of four—got about the same percentage of their calories from fast food as wealthier kids, according to a federal survey of more than 5,000 people, including children of all ages, from the Centers for Disease Control (CDC).

***

Source: BloombergBusiness

Other recent research has questioned the notion of food deserts' role in diet and weight. In Los Angeles, for example, little evidence supports the idea that living near junk food outlets increases obesity rates, according to another recent CDC study.

Friday, September 11, 2015

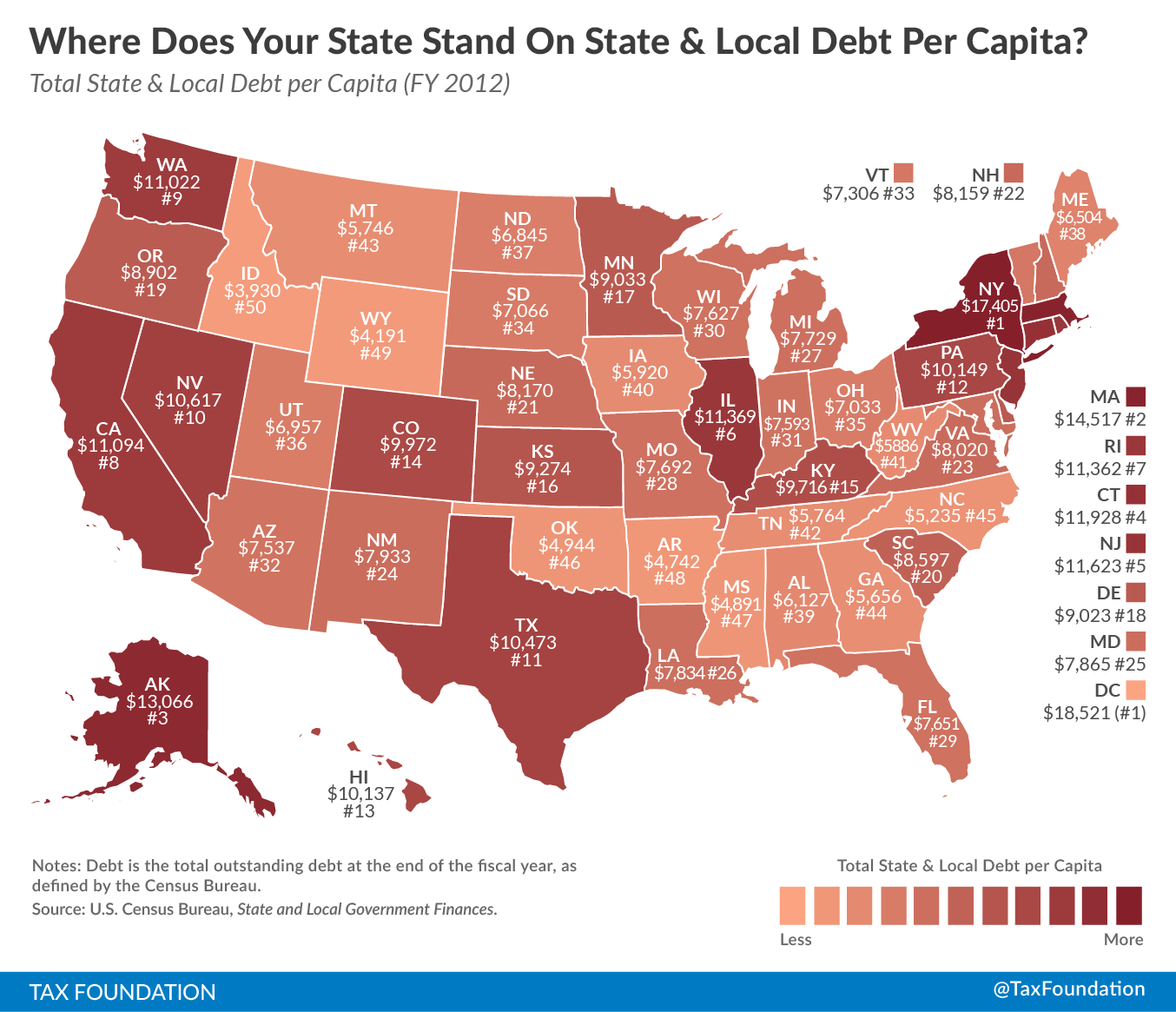

NY Has The Highest State And Local Debt Per Person; Followed By Massachusetts

Posted By Milton Recht

From Tax Foundation, "Where Does Your State Stand on State & Local Debt Per Capita?" by Jared Walczak and Liz Malm:

|

| Source: Tax Foundation |

States with the highest amount of state and local debt per capita in the 2012 fiscal year (the most recent data available from the Census Bureau) were New York ($17,405 per person), Massachusetts ($14,517 per person), Alaska ($13,066 per person), Connecticut ($11, 928 per person), and New Jersey ($11,623 per person).

On the other end of the spectrum, states with the lowest state and local debt per capita were Idaho ($3,930 per person), Wyoming ($4,191 per person), Arkansas ($4,742 per person), Mississippi ($4,891 per person), and Oklahoma ($4,944 per person).

Chart Of Number Of US Children Born To Illegal Immigrants: 1992-2013

Posted By Milton Recht

From The Wall Street Journal, "Fact-Checking the Figures on ‘Anchor Babies’: Note to presidential candidates: Estimate of some 400,000 such births is outdated" by Jo Craven McGinty:

Still, the numbers disturb Mr. Trump and others who favor cracking down on illegal immigration because as citizens, these children automatically get access to education, health care and other services. At age 21, they can also apply for legal status for their undocumented parents and siblings, which is why critics refer to them as anchors.

For those and other reasons, different groups have tried to pin down their number. The Migration Policy Institute, the Center for Migration Studies and the Pew Research Center, in addition to the Center for Immigration Studies, have all published estimates.

The figures peaked in 2007-10. In that span, the Migration Policy Institute put the high number at 321,000; the Center for Migration Study pegged it at just under 350,000; and the Pew Research Center put it at 370,000.

The numbers vary because each group uses a slightly different approach.***

Source: The Wall Street Journal

Unionized Workers Significantly Less Satisfied Than Non-Union Employees With Job Security, Workplace Safety, Supervisor, Recognition, Hours Flexibility

Posted By Milton Recht

From Gallup, "Union Members Less Content With Safety, Recognition at Work" by Andrew Dugan:

In the U.S., employed Americans who report being members of labor unions are significantly less likely than nonunion employees to say they are "completely satisfied" with six of 13 job aspects. These include workplace safety, recognition for accomplishments, flexibility of hours and job security. In only one job aspect, employer-provided health insurance, are union workers significantly more likely than nonunion workers to say they are completely satisfied.

Wednesday, September 9, 2015

New Start-Up Businesses Are A Declining Share Of US Companies And US Employment Over The Past 35 Years

Posted By Milton Recht

From The Wall Street Journal, "Starting a Business is Easy (for Harvard Business Grads)" by Jeffrey Sparshott:

But separate Commerce Department data show startups–firms less than a year old–make up a significantly smaller share of all companies and employment than during 1980s or 1990s. The authors worry that may be limiting one historical path to the middle class.

Source: The Wall Street Journal

Source: The Wall Street Journal

Thursday, September 3, 2015

Making The Case That Humanities Majors Make Better Programmers

Posted By Milton Recht

From the Atlantic, "You Don't Have to Be Good at Math to Learn to Code: Learning to program involves a lot of Googling, logic, and trial-and-error—but almost nothing beyond fourth-grade arithmetic." by Olga Khazan:

In order to figure out what your program should say, you’re going to need some basic logic skills. You’ll also need to be skilled at copying and pasting things from online repositories and tweaking them slightly. But humanities majors, fresh off writing reams of term papers, are probably more talented at that than math majors are.

I know plenty of people with bachelor’s, master’s, and even doctorate degrees in philosophy or international relations who have taught themselves to code. It’s true that some types of code look a little like equations. But you don’t really have to solve them, just know where they go and what they do. The programmer and entrepreneur Emma Mulqueeny puts it well:

In most cases you can see that the hard maths (the physical and geometry) is either done by a computer or has been done by someone else. While the calculations do happen and are essential to the successful running of the program, the programmer does not need to know how they are done.

Wednesday, September 2, 2015

Highest US Entrepreneurship Rate In At Least 16 Years

Posted By Milton Recht

From MarketWatch, "Entrepreneurship study finds highest recorded levels" by Caitlin Huston:

Entrepreneurship in the United States is at its highest rate in at least 16 years, a new study reports.

According to a study released Wednesday by Babson College and Baruch College, 14% of the United States working age population, about 24 million people, reported being entrepreneurs in 2014. But they weren’t all like Mark Zuckerberg starting Facebook in a Harvard dorm — 6.5% were forming businesses within established companies and 11% were between the ages of 55 and 64, the highest rate of entrepreneurship activity for that age group among 29 developed economies in the study.

The results were the strongest since the colleges began the study in 1999. The study surveys a representative sample of the U.S. population to extrapolate the results and defines entrepreneurship as businesses less than 3.5 years old.

Tuesday, September 1, 2015

Highest Student Loan Default Rates For Borrowers With Lowest Debt Amounts

Posted By Milton Recht

From The New York Times, The Upshot, "Why Students With Smallest Debts Have the Larger Problem" by Susan Dynarski:

*** Defaults are concentrated among the millions of students who drop out without a degree, and they tend to have smaller debts. That is where the serious problem with student debt is. Students who attended a two- or four-year college without earning a degree are struggling to find well-paying work to pay off the debt they accumulated.***

Source: The New York Times

Most borrowers have small debts, according to the Federal Reserve Bank of New York; 43 percent borrowed less than $10,000, and 72 percent less than $25,000. And borrowers with the smallest debts are most likely to default. Of those borrowing under $5,000 for college, 34 percent end up in default. The default rate steadily drops as borrowing increases. Among the small group (just 3 percent) of those borrowing more than $100,000, the default rate is just 18 percent.

What does this all mean for loan policy? Getting students to borrow less is not an obvious path to reducing default, since 51 percent of defaulters left college with less than $10,000 in student loans.

Subscribe to:

Comments (Atom)