According to OECD data, corporate tax revenue increased following Canada’s corporate tax rate cuts that began in 2000. The first chart below shows the data. Corporate tax revenue as a share of GDP in Canada has averaged 3.3 percent since 2000, while it averaged 2.9 percent over the years 1988 to 2000, when Canada’s corporate tax rate was 43 percent.

Source: Tax Foundation *** For 15 years straight, Canada has raised more corporate tax revenue than the U.S., as a share of GDP. Since 2000, U.S. corporate tax revenue as a share of GDP has averaged 2.3 percent, compared to 3.3. percent in Canada.

Source: Tax Foundation

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Friday, August 29, 2014

Canada Raises More Corporate Tax Revenue With A Lower Tax Rate Than US With A Higher Tax Rate

Posted By Milton Recht

From Tax Foundation, "Canada's Lower Corporate Tax Rate Raises More Tax Revenue" by William McBride:

Wednesday, August 27, 2014

Increasing Interest Cost On US Debt Will Account For A Quarter Of The Next Decade's Increase In Federal Expenditures: CBO

Posted By Milton Recht

AS one can see from slide 4 of CBO's updated presentation on the US budget and economic outlook, interest cost increases on US debt will account for a quarter of all increases of federal outlays over the next decade, according to CBO's projections:

From Congressional Budget Office, "Press Briefing on An Update to the Budget and Economic Outlook" Presentation, August 27, 2014, by Douglas W. Elmendorf, Director:

|

| Source: CBO, slide 4 |

From Congressional Budget Office, "Press Briefing on An Update to the Budget and Economic Outlook" Presentation, August 27, 2014, by Douglas W. Elmendorf, Director:

Wednesday, August 20, 2014

Routine Pelvic Examinations Not Recommended For Asymptomatic, Non-Pregnant, Adult Women: Health Benefit To Routine Screening Not Found

Posted By Milton Recht

From Medscape Medical News, "Value of Screening Pelvic Exam for Women Debated" by Lara C. Pullen, PhD:

The American College of Physicians (ACP) has issued new clinical guidelines recommending against screening pelvic examination in asymptomatic, nonpregnant, adult women. The college describes the recommendation as strong, with moderate-quality evidence.*** ACP has reviewed the literature and determined that the screening pelvic examination does not benefit adult women. Although the recommendations advise against pelvic examinations, the recommendation for Papanicolaou smears remains.*** The authors reviewed the evidence and found that the harms associated with screening pelvic examination outweigh the benefits. The guidelines also explain that screening for chlamydia and gonorrhoea, sometimes done by pelvic examination, can be reliably performed using nucleic acid amplification tests on self-collected vaginal swabs or urine. “[N]ucleic acid amplification tests on self-collected vaginal swabs or urine have been shown to be highly specific and sensitive, and this technique is supported by several organizations,” the authors write.

In their recommendation, they add, "With the available evidence, we conclude that screening pelvic examination exposes women to unnecessary and avoidable harms with no benefit (reduced mortality or morbidity rates).

Tuesday, August 19, 2014

Low Effective Corporate Tax Rates Masked The True Cost of High Marginal Corporate Tax Rates

Posted By Milton Recht

As USC Gould School of Law Professor Edward Kleinbard discusses in his paper and as Andrew Ross Sorkin discusses in his DealB%%k Blog post, "Tax Burden in U.S. Not as Heavy as It Looks, Report Says" by Andrew Ross Sorkin, there are tax planning ways to lower the high US corporate marginal tax rate and create a low effective US corporate tax rate on repatriated earnings.

Kleinbard and Sorkin ignore the costs, effort and diversion of resources necessary to achieve the results of low effective tax rates through sophisticated tax and financial planning.

Imagine a world without a corporate tax. A chief financial officer of a corporation with a large overseas holding of cash from foreign profits wants to put the money into a US bank to pay for new plants and equipment in the US. The cfo contacts the foreign bank directly or contacts an overseas subordinate and has the funds electronically transferred to the US account.

Now, imagine a world as it currently is with the US tax code. The cfo must involve tax lawyers, tax accountants and others to insure that the transfer of funds from overseas to the US do not trigger any unexpected and unwanted US corporate taxes. Kleinbard seems to minimize the effort, cost and loss of future borrowing capacity (see excerpt of paper below) of a repatriation tax avoidance scheme that involves the corporation borrowing funds and other devices. What if every time (or just once a year maybe a larger sum) you wanted to write a check or use your debit card to buy something, you had to negotiate for a loan from a bank? Convenient? What if you wanted to borrow funds to buy a house but your outstanding previous bank loan used up part of your available credit and you are denied the loan or are approved for a lower amount? Corporations negotiate loans, and their covenants and have limits on their borrowing capacity.

A high comparative corporate marginal tax rate motivates CEOs and CFOs to engage in sophisticated tax and financial planning. It results in the hiring of extra lawyers, accountants and financial planners and strategists. It increases the risk of IRS tax audits, SEC charges, future back tax payments and tax illegalities. It increases the barriers that must be overcome to move available corporate funds into the US. The comparatively high US marginal corporate tax rate is equivalent to forcing someone to go over a mountain when there is quicker tunnel passage through the mountain. Yes, going over a mountain will get you to the same place as going through the tunnel, but it will increase the effort, time, cost and risk to accomplish something that can be done much more easily.

From "'Competitiveness' Has Nothing to Do with it" by Edward D. Kleinbard, USC Gould School of Law, August 5, 2014:

Kleinbard and Sorkin ignore the costs, effort and diversion of resources necessary to achieve the results of low effective tax rates through sophisticated tax and financial planning.

Imagine a world without a corporate tax. A chief financial officer of a corporation with a large overseas holding of cash from foreign profits wants to put the money into a US bank to pay for new plants and equipment in the US. The cfo contacts the foreign bank directly or contacts an overseas subordinate and has the funds electronically transferred to the US account.

Now, imagine a world as it currently is with the US tax code. The cfo must involve tax lawyers, tax accountants and others to insure that the transfer of funds from overseas to the US do not trigger any unexpected and unwanted US corporate taxes. Kleinbard seems to minimize the effort, cost and loss of future borrowing capacity (see excerpt of paper below) of a repatriation tax avoidance scheme that involves the corporation borrowing funds and other devices. What if every time (or just once a year maybe a larger sum) you wanted to write a check or use your debit card to buy something, you had to negotiate for a loan from a bank? Convenient? What if you wanted to borrow funds to buy a house but your outstanding previous bank loan used up part of your available credit and you are denied the loan or are approved for a lower amount? Corporations negotiate loans, and their covenants and have limits on their borrowing capacity.

A high comparative corporate marginal tax rate motivates CEOs and CFOs to engage in sophisticated tax and financial planning. It results in the hiring of extra lawyers, accountants and financial planners and strategists. It increases the risk of IRS tax audits, SEC charges, future back tax payments and tax illegalities. It increases the barriers that must be overcome to move available corporate funds into the US. The comparatively high US marginal corporate tax rate is equivalent to forcing someone to go over a mountain when there is quicker tunnel passage through the mountain. Yes, going over a mountain will get you to the same place as going through the tunnel, but it will increase the effort, time, cost and risk to accomplish something that can be done much more easily.

From "'Competitiveness' Has Nothing to Do with it" by Edward D. Kleinbard, USC Gould School of Law, August 5, 2014:

U.S. firms incur costs to operate their stateless income tax machinery, which is wasteful, but at the same time enjoy an essentially unfettered tax planning environment in which to strip income from high-tax foreign jurisdictions to very low-taxed ones. And this sits on top of transfer pricing, selective leverage of group members, and other devices used to move income that economically is earned in the United States to foreign affiliates.

*** It is true of course that the federal corporate tax rate – nominally, 35 percent – is too high relative to world norms, and that the ersatz territorial system requires firms to waste money in tax planning and structuring, but effective marginal tax rates and overall effective tax rates reach the level of the U.S. headline rate only when firms studiously ignore the feast of tax planning opportunities laid out before them on the groaning board of corporate tax expenditures.*** large multinational firms often can access their offshore earnings without incurring a tax cost, simply by borrowing in the United States and using the earnings on the offshore cash to pay the interest costs. (The interest earned on a firm’s offshore cash hoard is includible in the U.S. parent’s income as subpart F income, and therefore can be repatriated free of any additional tax cost.) The U.S. parent’s income inclusion on its offshore cash offsets the tax deduction for the interest expense on the firm’s U.S. borrowing, and the firm is left in the same economic position as if it had simply repatriated the cash tax-free (plus or minus a spread for differences in interest rates between the two streams.)

Visual Instructions For Using Chip Embedded Credit Cards

Posted By Milton Recht

From The Wall Street Journal, "Banks, Retailers Speed Up Drive to Add Chips to Credit, Debit Cards: Data Breaches Spur Effort to Boost Security; End of the Swipe?" by Robin Sidel:

| Source: The Wall Street Journal |

Wednesday, August 13, 2014

"Nobel Prize Of Mathematics" Awarded To First Woman

Posted By Milton Recht

From Stanford News, "Stanford's Maryam Mirzakhani wins Fields Medal: Maryam Mirzakhani is the first woman to ever win the Fields Medal – known as the "Nobel Prize of mathematics" – in recognition of her contributions to the understanding of the symmetry of curved surfaces." by Bjorn Carey:

Maryam Mirzakhani, a professor of mathematics at Stanford, has been awarded the 2014 Fields Medal, the most prestigious honor in mathematics. Mirzakhani is the first woman to win the prize, widely regarded as the "Nobel Prize of mathematics," since it was established in 1936.*** Officially known as the International Medal for Outstanding Discoveries in Mathematics, the Fields Medal will be presented by the International Mathematical Union on Aug. 13 at the International Congress of Mathematicians, held this year in Seoul, South Korea. Mirzakhani is the first Stanford recipient to win this honor since Paul Cohen in 1966.

The award recognizes Mirzakhani's sophisticated and highly original contributions to the fields of geometry and dynamical systems, particularly in understanding the symmetry of curved surfaces, such as spheres, the surfaces of doughnuts and of hyperbolic objects. Although her work is considered "pure mathematics" and is mostly theoretical, it has implications for physics and quantum field theory.

Sunday, August 10, 2014

Farm To Table Is Economically Unsustainable

Posted By Milton Recht

From The New York Times, "Don’t Let Your Children Grow Up to Be Farmers" by Bren Smith:

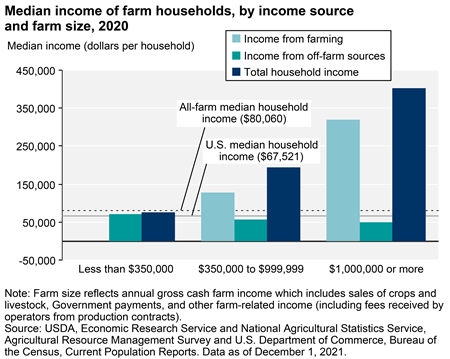

AT a farm-to-table dinner recently, I sat huddled in a corner with some other farmers, out of earshot of the foodies happily eating kale and freshly shucked oysters. We were comparing business models and profit margins, and it quickly became clear that all of us were working in the red.From United States Department of Agriculture, Economic Research Service, "Farm Household Well-being:"

The dirty secret of the food movement is that the much-celebrated small-scale farmer isn’t making a living. After the tools are put away, we head out to second and third jobs to keep our farms afloat. Ninety-one percent of all farm households rely on multiple sources of income. Health care, paying for our kids’ college, preparing for retirement? Not happening. With the overwhelming majority of American farmers operating at a loss — the median farm income was negative $1,453 in 2012 — farmers can barely keep the chickens fed and the lights on.

Others of us rely almost entirely on Department of Agriculture or foundation grants, not retail sales, to generate farm income.

|

| Source: US Dept of Agriculture |

Wednesday, August 6, 2014

Cash For Clunkers Reduced Auto Industry Revenue By $3 Billion And Did Not Increase Auto Sales

Posted By Milton Recht

From NBER Working Paper Series, "Cash For Corollas: When Stimulus Reduces Spending" by Mark Hoekstra, Steven L. Puller, Jeremy West, Working Paper 20349:

A major objective of the [The Car Allowance Rebate System (CARS), better known as "Cash for Clunkers"] program – and arguably the primary one – was to provide economic stimulus to U.S. vehicle and parts manufacturers (and therefore to the U.S. economy) by shifting expenditures “...from future periods when the economy is likely to be stronger, to the present...” [Romer and Carroll, 2010].

*** However, another priority for the Obama Administration at that time was to improve the fuel efficiency of the U.S. vehicle fleet.... As a result, the policy was written to achieve multiple goals: to accelerate the purchase of new vehicles to increase revenues to the auto industry, and to increase the fuel efficiency of the fleet by requiring new vehicles purchased under the program to have sufficiently high fuel economy.

The fuel efficiency restrictions imposed by the program could have either enhanced or undermined the stimulus effect of the policy. On one hand, lowering the relative price of fuel efficient vehicles might induce buyers to increase spending by selecting vehicles with more expensive fuel-saving technologies, such as hybrids. On the other hand, the restrictions could induce households to purchase smaller, less expensive vehicles in order to meet the fuel efficiency criteria, which would decrease overall new vehicle spending. The net impact of these restrictions on the stimulus effect of the program is an empirical question.*** [W]e find that although Cash for Clunkers significantly increased new car purchases during the two months of the program, all of this increase represented a shift forward from the subsequent seven to nine months.*** On net, the program did not result in any more vehicle purchases than otherwise would have occurred over the nine to eleven month period that includes the two program months.

*** [T]he program’s fuel efficiency restrictions could have shifted both the type and price of vehicles purchased, which would have important implications for the program’s effect on auto industry revenues.*** Strikingly, we find that Cash for Clunkers actually reduced overall spending on new vehicles during the period beginning with the first month of the program and ending eight months after the program. [H]ouseholds tended to purchase less expensive and smaller vehicles such as the Toyota Corolla, which was the most popular new vehicle purchased under the program. Estimates indicate that each household purchasing under the program spent an average of $4,600 less on a new vehicle than they otherwise would have.

Thus, we estimate that this stimulus program – which dispensed three billion dollars in subsidies toward the purchase of 677,000 new vehicles nationally – actually reduced revenues to the auto industry by around three billion dollars over the course of less than one year. This highlights how – even over a relatively short period of time – a conflicting policy objective can cause a stimulus program to instead have a contractionary net effect on the targeted industry. [Emphasis added. Footnotes omitted.]

Monday, August 4, 2014

Since 2000, NYC Payments For Workers' Pensions Increased From 2 Percent To 11 Percent of The City's Budget

Posted By Milton Recht

From The New York Times, "New York City Pension System Is Strained by Costs and Politics" by David W Chen and Mary Williams Walsh:

For years, New York City has been dutifully pumping more and more money into its giant pension system for retired city workers.

Next year alone, the city will set aside for pensions more than $8 billion, or 11 percent of the budget. That is an increase of more than 12 times from the city’s outlay in 2000, when the payments accounted for less than 2 percent of the budget.

But instead of getting smaller, the city’s pension hole just keeps getting bigger, forcing progressively more significant cutbacks in municipal programs and services every year.

Friday, August 1, 2014

Ancient People Had Clogged Arteries Despite Lack Of Sugar, Fat-laden Diets, Inactivity, Smoking And Widespread Obesity.

Posted By Milton Recht

From "No TV or Obesity, But Ancient People Still Had Heart Disease: Mummy study shows that, just like today, inflammation spurred blood vessel blockages" on National Institutes of Health, MedlinePlus:

Using CT scans of mummified remains from ancient Egypt, Peru, the Aleutian Islands and the American Southwest, researchers have found evidence of widespread atherosclerosis -- the hardening of heart arteries from fatty substances that build up, eventually leading to heart attack or stroke.

That's despite the fact that those ancient groups were largely free of today's perilous lifestyle factors, such as sugar- and fat-laden diets, inactivity, smoking and widespread obesity.

"Our team has evaluated mummies from five different continents. We have yet to find a culture that didn't have atherosclerosis," said cardiologist Dr. Gregory Thomas, the lead author of a review published in the current issue of the journal Global Heart.

Subscribe to:

Comments (Atom)