The bidding war over Barack and Michelle Obama’s book deal skyrocketed to more than $60 million before Penguin Random House was crowned the winner on Tuesday night

The publisher announced that the pair had signed with them after reportedly delivering the highest bid earlier in the day.*** By contrast, publishers only plunked down $15 million for Bill Clinton’s 2004 autobiography, “My Life,” and $10 million for George W. Bush’s memoir, “Decision Points,” according to past reports.

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Tuesday, February 28, 2017

Barack and Michelle Obama Sign With Penguin Random House For $60 Million Book Deal

Posted By Milton Recht

From New York Post, "Penguin Random House crowned winner of $60M Obama book war" by Natalie O'Neill:

Monday, February 27, 2017

Chart By Industry Of Unemployed Versus Job Openings: Economic Policy Institute

Posted By Milton Recht

From MarketWatch, "Don’t quit your job if you work in 1 of these 5 industries" by Catey Hill, Editor:

| Source: MarketWatch |

Sunday, February 19, 2017

Median Rents And Year Over Year Change In Top 100 US Rental Markets

Posted By Milton Recht

From Zumper, "Zumper National Rent Report: January 2017" by Stephen Cho:

|

| Source: Zumper |

|

| Source: Zumper |

|

| Source: Zumper |

|

| Source: Zumper |

Friday, February 17, 2017

Gluten-Free Eaters Have Higher Levels Of Arsenic And Mercury In Their Bodies

Posted By Milton Recht

From National Institutes of Health, US National Library of Medicine, MedlinePlus, "Possible Drawback to Gluten-Free: Toxic Metals: Higher levels of arsenic, mercury found in people who follow this eating plan, study finds" by Robert Preidt [Alternate working weblink: https://www.webmd.com/digestive-disorders/celiac-disease/news/20170216/possible-drawback-to-gluten-free-toxic-metals]:

Gluten-free products often contain rice flour as a substitute for wheat, rye and barley. And rice is known to accumulate arsenic and mercury from fertilizers, soil and water, said [Maria] Argos, an assistant professor of epidemiology in the [University of Illinois at Chicago (UIC)] School of Public Health.

For the study, the researchers analyzed U.S. National Health and Nutrition Examination Survey data from thousands of Americans, aged 6 to 80. The investigators identified 73 people who said they ate a gluten-free diet.

Compared to other survey participants, those who ate gluten-free diets had nearly twice the levels of arsenic in their urine, and 70 percent higher levels of mercury in their blood, according to the study.*** Arsenic and mercury, which occur naturally in the environment, raise the risk of heart disease, cancer and neurological problems at certain levels, the researchers said.

Expected Changes In Consumer Demand Over The Next Decade Due To Changing Demographics: More Dog Wakers, Fewer Teachers

Posted By Milton Recht

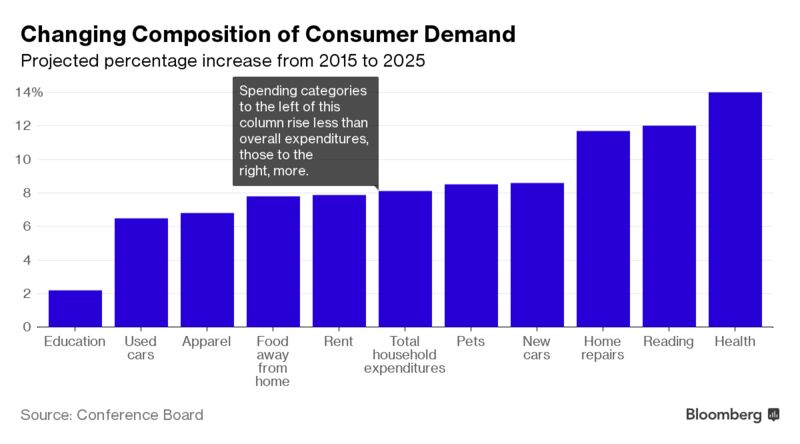

From BloombergMarkets, "Dog Walkers to Be More in Demand Than Teachers in Next Decade: Demographics to drive changes in spending patterns, report says" by rich Miller:

Its [a new report from the New York-based Conference Board] focus is on demographics, both the well-known aging of the Baby Boom generation and the less-publicized baby bust that began during the Great Recession as fertility rates dropped.

Thus the choice of profession suggested by the business membership and research association's report. Spending on pets is forecast to rise strongly as boomers -- perhaps pining for children who have flown the coop -- shower their attention and money on new-found furry friends.

Outlays on education will lag, though, as the potential student population comprising five- to 24-year-olds grows very slowly due to the downsized, post-Millennial Generation Z.

|

| Source: BloombergMarkets |

Tuesday, February 14, 2017

Share Of Elderly Workers By Occupation: Bureau of Labor Statistics

Posted By Milton Recht

From Bureau of Labor Statistics, Monthly Labor Review, February 2017, "Occupational choices of the elderly:"

***

See original BLS article for additonal information about full-time and part-time employment of seniors.

From 1990 to 2010, the U.S. civilian labor force showed a substantial increase in average age. Over this 20-year period, the percentage of workers in the labor force ages 65 and older rose at an average annual rate of 3.4 percent, in contrast with a 0.9-percent average annual increase for those under 65. This difference was due partly to the difference in average annual population growth for the two age groups, 1.4 percent for the 65-and-older group and 1.1 percent for the under-65 group. But it was due largely to the increase in the labor force participation rate of the 65-and-older group: from 11.8 percent in 1990 to 17.4 percent in 2010. This increase contrasts with a slight decline in the labor force participation rate for those under 65: from 76.6 percent in 1990 to 73.9 percent in 2010. As a result, the percentage of older workers grew from 2.8 percent to 4.6 percent, even as their unemployment rate remained below that of younger workers. Similar increases for elderly workers are projected to continue at least through 2020. What impact does this aging of the labor have on the structure of occupations?

*** Table 1 {below] shows the share of workers from the elderly and 45–65 age groups in the major occupational groups. Among the occupational groups, the one with the greatest difference (both absolute and relative) in the share of workers from the two age groups is the food preparation and serving related group: 25.3 percent of the elderly work in this group, while only 3.1 percent of 45–65-year-olds do. Occupations in the group employ predominantly women, have a large share of part-time employment, and require relatively little education or strenuous activity. The group with the second-greatest absolute difference in the share of workers from the two age groups is management. Surprisingly, this occupational group has considerable part-time employment for the elderly (but not for younger workers).

| Occupational group | Number of cases | Percent share | ||

|---|---|---|---|---|

| 45–65 | Over 65 | 45–65 | Over 65 | |

| Management | 3,529 | 332 | 13.5 | 9.4 |

| Business and financial operations | 1,289 | 139 | 4.9 | 3.9 |

| Computer and mathematical sciences | 687 | 36 | 2.6 | 1.0 |

| Architecture and engineering | 525 | 45 | 2.0 | 1.3 |

| Life, physical, and social sciences | 256 | 30 | 1.0 | .8 |

| Community and social services | 493 | 59 | 1.9 | 1.7 |

| Legal | 374 | 48 | 1.4 | 1.4 |

| Education, training, and library | 1,620 | 184 | 6.2 | 5.2 |

| Arts, design, entertainment, sports, and media | 435 | 67 | 1.7 | 1.9 |

| Healthcare practitioner and technical | 1,439 | 153 | 5.5 | 4.3 |

| Healthcare support | 568 | 59 | 2.2 | 1.7 |

| Protective service | 471 | 51 | 1.8 | 1.4 |

| Food preparation and serving related | 806 | 896 | 3.1 | 25.3 |

| Building, grounds cleaning, and maintenance | 1,225 | 110 | 4.7 | 3.1 |

| Personal care and services | 732 | 130 | 2.8 | 3.7 |

| Sales and related | 2,480 | 346 | 9.5 | 9.8 |

| Office and administrative support | 3,326 | 350 | 12.7 | 9.9 |

| Farming, fishing, and forestry | 196 | 22 | .7 | .6 |

| Construction and extraction | 1,338 | 87 | 5.1 | 2.5 |

| Installation, maintenance, and repair | 923 | 59 | 3.5 | 1.7 |

| Production | 1,685 | 131 | 6.4 | 3.7 |

| Transportation and material moving | 1,756 | 203 | 6.7 | 5.7 |

| Total civilian | 26,153 | 3,537 | 100.0 | 100.0 |

| Source: U.S. Bureau of Labor Statistics, Current Population Survey. | ||||

See original BLS article for additonal information about full-time and part-time employment of seniors.

Friday, February 10, 2017

New High In Citizens Renouncing US Citizenship: Upward Trend Since Foreign Account Tax Compliance Act (FACTA) Passage

Posted By Milton Recht

From Bloomberg, "Americans Renouncing Citizenship at Record High: It all goes back to the Civil War" by Suzanne Woolley:

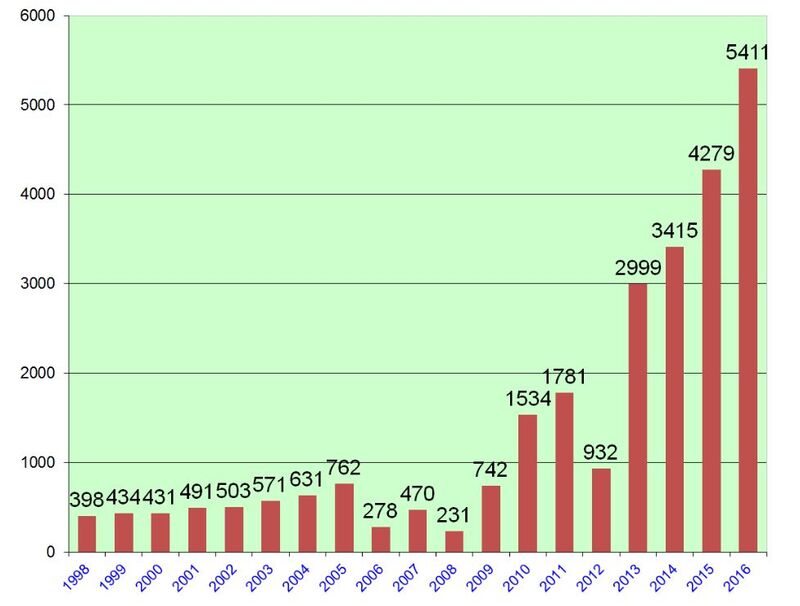

The number of Americans renouncing their citizenship rose to a new record of 5,411 last year, up 26 percent from 2015, according to the latest government data.

*** The rules got trickier in 2010, when, in an effort to cut down on tax evasion, the Foreign Account Tax Compliance Act (fabulously, Fatca, for short) was passed into law. It basically said foreign institutions holding assets for U.S. citizens had to report the accounts or withhold a 30 percent tax on them if the information wasn't provided. That led some foreign banks to shy away from opening accounts for expats.

Since Fatca came into being, annual totals for Americans renouncing citizenship have reached their four highest historic levels, as shown in the chart below from Andrew Mitchel LLC and its International Tax Blog.

Source: Bloomberg

Thursday, February 9, 2017

CBO Slide Presentation On 2017 US Budget And Next Decade Economic Outlook

Posted By Milton Recht

From the Congressional Budget Office, February 9, 2017, Presentation, "The 2017 Budget and Economic Outlook" by Keith Hall, CBO Director, to the National Economists Club:

Summary

In fiscal year 2016, for the first time since 2009, the federal budget deficit increased in relation to the nation’s economic output. The Congressional Budget Office projects that over the next decade, if current laws remained generally unchanged, budget deficits would eventually follow an upward trajectory—the result of strong growth in spending for retirement and health care programs targeted to older people and rising interest payments on the government’s debt [slide 7 in the CBO presentation below], accompanied by only modest growth in revenue collections. Those accumulating deficits would drive debt held by the public from its already high level up to its highest percentage of gross domestic product (GDP) since shortly after World War II.

CBO’s estimate of the deficit for 2017 has decreased since August 2016, when the agency issued its previous estimates, primarily because mandatory spending is expected to be lower than earlier anticipated. However, the current projection for the cumulative deficit for the 2017–2026 period is about the same as that reported in August.

CBO’s economic forecast—which underlies its budget projections—indicates that under current law, economic growth over the next two years would remain close to the modest rate observed since the end of the recession in 2009. Nevertheless, economic growth would continue to outpace growth in potential (maximum sustainable) GDP and thus continue to reduce the amount of underused resources, or slack, in the economy. The result would be increases in hiring, employment, and wages, along with upward pressure on inflation and interest rates. In the later part of the 10-year projection period, output growth would be constrained by a relatively slow increase in the nation’s supply of labor.

2016 Federal Budget Infographic

Posted By Milton Recht

From the Congressional Budget Office, "The Federal Budget in 2016: An Infographic:"

The federal deficit in 2016 was $587 billion, equal to 3.2 percent of gross domestic product.

Wednesday, February 8, 2017

Sources Of 2016 US Trade Deficit By Product Categories

Posted By Milton Recht

From MarketWatch, "Why the U.S. has a huge trade deficit" by Jeffry Bartash:

The trade gap rose slightly in 2016 to a four-year high of $502 billion, marking the 41st deficit in a row. The last time the U.S. ran a surplus was in 1975, according to U.S. Census figures.***

Source: MarketWatch

Monday, February 6, 2017

To Lower Medical Care And Insurance Costs Increase The Number Of Medical Providers: My Wall St Journal Comment

Posted By Milton Recht

My posted comment to The Wall Street Journal, Opinion, "It’ll Take More Than a Band-Aid to Fix Medicaid: Save the program by giving states money to provide high-deductible plans with health savings accounts." by Regina Herzlinger and Richard Boxer:

Like all other goods and services, medical care availability and prices follow supply and demand rules. To realize the potential that high-deductible insurance plans and consumer-controlled HSA's have to lower medical care cost, changes also must be made to increase the supply of medical providers.

The high barriers to entry in the medical profession must be lowered to increase the supply of providers. Give incentives to states to lower restrictions on the use of physician assistants and nurses to allow for independent routine diagnosis and care. Increase the number of visas for well-trained foreign doctors and nurses and allow for their quick licensing without burdensome additional training. Remove state level unmet need based criteria for opening a new hospital.

Health insurance is only a reimbursement for medical costs. As consumers gain medical care buying control and as the supply of medical providers increases, prices and usage will decline and create lower insurance premiums.

Thursday, February 2, 2017

Business Startups Concentrated In Fewer Cities

Posted By Milton Recht

From The Wall Street Journal, "The Five Megacities Where Business Startups Have Boomed: New York, Miami, Los Angeles, Houston and Dallas house half of new businesses created after the recession" by Janet Adamy:

Consider that in the mid-1980s, 29 metropolitan areas that contained 45% of the country’s jobs were home to half of the national increase in companies after an earlier recession.

Now look at what happened after the painful 2007-09 economic downturn. The aforementioned five metro areas [New York, Miami, Los Angeles, Houston and Dallas] housed half of the nation’s net increase in new firms and accounted for 17% of employment between 2010 and 2014. Left behind are thousands of small towns and rural areas that stitch together much of America.

Source: The Wall Street Journal

Economists say this is particularly worrisome because it is businesses starting from scratch—and not older companies—that are the primary drivers of job growth. Even after the economy was five years into its recovery from the latest recession, three out of five metropolitan areas were seeing more firms close than open.

Subscribe to:

Posts (Atom)