Undeniable progress has been made: Although New Orleans public schools serve one-third fewer students than they did before Katrina, they send twice as many to college. But further progress, in a city rife with poverty and social stratification, has also required transforming the district’s central office from a disorganized instrument of political interests to a focused regulator protecting the rights of disadvantaged children*** Each [nonprofit organization that operates a charter] school signs a contract with its regulator—either the state or the local board—that includes performance objectives and requirements for responsible operation. Nonprofit groups that miss academic targets or prove unable to capably serve students with disabilities, for example, have lost their license to operate and been replaced.

This approach has evolved beyond assuring compliance toward aggressively protecting individual students’ civil rights. In 2011, school leaders and regulators created a citywide enrollment process whereby all families complete one application for admission to New Orleans’s charter schools. Parents can apply to any school in any neighborhood, and schools must accept all assigned students.

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Tuesday, May 31, 2016

Is The New Orleans School System The Template For Fixing Other Inner City Schools?

Posted By Milton Recht

From The Wall Street Journal, Opinion, "A Fresh Turn in the New Orleans Charter School Miracle: Oversight will revert to the city from the state, but with safeguards to ensure that gains remain intact." by John White:

Thursday, May 26, 2016

For Most College Loan Borrowers, The Increase In Earnings Easily Offsets Monthly Student Loan Payments

Posted By Milton Recht

From Federal Reserve Bank Of Cleveland, "Is There a Student Loan Crisis? Not in Payments" by Joel Elvery:

In the second quarter of 2015, the average student loan payment for those in the 20- to 30-year-old range was $351, according to the Federal Reserve Bank of New York’s Consumer Credit Panel data. This amount is just more than 50 percent higher than it was in 2005 ($227 when adjusted for inflation).Link to PDF of article.*** Fifty percent of the borrowers had payments of $203 or lower, and another 25 percent had payments between $203 and $400. This means that 75 percent of student loan borrowers in this age range would be, in the simplest sense, better off with a student loan if going to college increased their monthly take home earnings by $401 or more. In 2014, labor force participants aged 20 to 30 who had at least some college on average earned $2,353 per month, $750 more than people the same age with just a high school degree. This is more than double the average monthly student loan payment, suggesting that the increase in earnings from going to college more than offsets the cost of student loan payments for most borrowers.

Household Debt Reaching Pre-Recession Peak, But Lower Debt Payments From Low Interest Rates

Posted By Milton Recht

From The Wall Street Journal, "Trillions in Debt—but for Now, No Reason to Worry: U.S. household borrowing nears precrisis peaks; global debt has already topped 2008 levels" by Ken Brown:

Global debt has already topped 2008 levels and keeps rising. That’s pretty astonishing so soon after debt-driven crises in the U.S. and Europe and endless worries about too much borrowing in Japan, China and emerging markets.

But for all the hand-wringing, a near-term debt crisis is unlikely. Lower interest rates mean debt payments are far lower than they were before the crisis. In the U.S., household debt compared with the overall economy is way down. And overseas, loans can easily be rolled over.

*** U.S. households owed $12.25 trillion at the end of the first quarter, up 1.1% from the end of 2015, according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit, released Tuesday. If the first quarter repeats itself through the end of the year, U.S. household debt will approach its peak of $12.68 trillion, which it hit in the third quarter of 2008.

***

Source: The Wall Street Journal

Wednesday, May 25, 2016

Slowdown In Temporary Worker Hiring Generating Fears Of Another Recession

Posted By Milton Recht

From The Wall Street Journal, "Temp-Worker Freeze Bodes Ill for Economy: Flat staffing suggests broader job-market slowdown may be ahead" by Eric Morath:

One of the labor market’s early-warning signs may be flashing trouble.

Hiring by staffing agencies has ground to a halt so far in 2016, a worrisome sign because the category fell off before a broader job-market slowdown ahead of the past two recessions. Many economists look at the sector as a leading indicator because cautious firms tend to first hire temps when an expansion begins and dismiss those nonpermanent workers when they sense the economy is faltering.

*** "It’s the first sector that really begins to lose jobs," said Donald Grimes, a labor economist at the University of Michigan. "If you start seeing those numbers go negative, you’ve got a real problem."

Source: The Wall St Journal

In Memoriam Of Sarah Breedlove (Madam C. J. Walker), Died May 25, 1919: Successful Entrepreneur, Philanthropist, Activist Who Rose From Washerwoman To One Of The Wealthiest African American Women In Early 1900s

Posted By Milton Recht

From Wikipedia, "Madam C. J. Walker:"

Continue reading at "Madam C. J. Walker" on Wikipedia.Sarah Breedlove (December 23, 1867 – May 25, 1919), known as Madam C. J. Walker, was an African American entrepreneur, philanthropist, and a political and social activist. Eulogized as the first female self-made millionaire in America, she became one of the wealthiest African American women in the country. Walker made her fortune by developing and marketing a line of beauty and hair products for black women through Madame C.J. Walker Manufacturing Company, the successful business she founded. Walker was also known for her philanthropy and activism. She made financial donations to numerous organizations and became a patron of the arts. Villa Lewaro, Walker’s lavish estate in Irvington-on-Hudson, New York, served as a social gathering place for the African American community. The Madame Walker Theatre Center opened in Indianapolis in 1927 to continue her legacy. Both of these properties are listed on the National Register of Historic Places. [Footnotes omitted.]

Source: Wikipedia

Monday, May 23, 2016

Capitalism Is Not About Greed

Posted By Milton Recht

From The Wall Street Journal, "Dear Grads, You Need a P&L: Even if you don’t like capitalism, you’d better draw up a personal profit-and-loss statement if you want to change the world." by Andy Kessler:

When I buy something from you (assuming you’re not a rent-seeking crony capitalist), your profit is how much I am willing to pay over what it costs to produce the item. In a truly competitive world, your profit is the value of my delight in your invention, or I’d simply make the thing myself. To put it in Facebook speak: Your profit is the social value of the transaction. Profits create wealth not only for you but for the collective “me” of society.*** Hollywood movies notwithstanding, capitalism is not about greed. It is a system that weeds out dumb ideas from smart ones. The former generate disdain and losses; the latter generate delight and profits.

Friday, May 20, 2016

New CEOs Use Same Strategies To Improve Results At Well-Performing, Poorly Performing, And Stable Companies: McKinsey & Co

Posted By Milton Recht

From McKinsey & Company, Mckinsey Quarterly, May 2016, "How new CEOs can boost their odds of success" by Michael Birshan, Thomas Meakin, and Kurt Strovink:

We expected that CEOs taking the helm at poorly performing companies, feeling compelled to do something to improve results, would have a greater propensity to make strategic moves than those who joined well-performing organizations. To learn whether this idea was true, we looked at how each company had been performing relative to its industry counterparts prior to the new CEO’s arrival and then subdivided the results into three categories: well-performing, poorly performing, and stable companies. When we reviewed the moves by companies in each of these categories, we found that new CEOs act in similar ways, with a similar frequency, whether they had joined well- or poorly performing organizations. CEOs in different contexts made bold moves—such as M&A, changing the management team, and launching new businesses and products—at roughly the same rate (Exhibit 1). [Emphasis added].

Exhibit 1

Source: McKinsey & Co

Thursday, May 19, 2016

Forget That Job Promotion Under The New Overtime Rules

Posted By Milton Recht

In civil service, job promotions are based on test scores. In union jobs, seniority is the basis for job promotions. In the private sector, where over 93 percent of jobs are non-union, a manager selects who gets promoted.

The new overtime rules will make it more difficult for employees to show the qualities that make them a valuable worker and worthy of a promotion.

Private sector managers promote employees who are hardworking, trustworthy and loyal. Managers form their opinions to promote employees through observations and interactions with workers.

In a salaried job without extra overtime pay, an employer can gather more information about a worker's potential as a higher level employee. Obama, by increasing the size of the overtime group of workers from 7 percent of the salaried workforce to 35 percent, has remove the ability of many workers to signal to their employers that they are loyal, committed, trustworthy and deserving of a promotion.

Imagine two employees at a job with overtime pay where approval is needed for overtime, as is usual for most employers, otherwise workers would have strong financial incentives to extend the time to complete tasks to earn overtime. With required overtime pay, independent of the amount of work that needs to be done, both workers will show up at the start of the scheduled workday, not earlier, and leave at the end of the workday, not later, to avoid unapproved overtime.

Imagine two employees at a salaried job without overtime pay. A hardworking, loyal, trustworthy employee realizing there is extra work to be done, might come in a little earlier or stay a little later, to complete the unfinished work. A worker who sees the job just as a job and is not committed to the employer will not care about the unfinished work and will come in and leave at the scheduled time.

The government’s expansion of the class of overtime eligible workers five-fold, from 7 percent to 35 percent of the salaried workforce, deprives managers of valuable employee information to decide who to promote. With less information about a worker, companies will be more at risk of making a mistake, will be more careful and slower to promote, and will promote fewer employees to avoid the risk of a mistake.

Before the new overtime rules, employees had an option to work harder to show their employers they wanted a promotion. Under the new rules, employees lost that valuable option.

As an aside, the financial loss to employees of the new overtime rules can be computed. The expanded numbers of overtime employees were buying a call option on a promotion with extra salary, using the unpaid extra work as payment to buy that call option. The expanded class of overtime employees lost a call option whose value can be computed if one knew the estimated average number of extra hours these employees worked and the expected rate and extra salary of a promotion. If salaried employees had not valued the call option positively, they would not have put in the extra unpaid hours.

The new overtime rules will make it more difficult for employees to show the qualities that make them a valuable worker and worthy of a promotion.

Private sector managers promote employees who are hardworking, trustworthy and loyal. Managers form their opinions to promote employees through observations and interactions with workers.

In a salaried job without extra overtime pay, an employer can gather more information about a worker's potential as a higher level employee. Obama, by increasing the size of the overtime group of workers from 7 percent of the salaried workforce to 35 percent, has remove the ability of many workers to signal to their employers that they are loyal, committed, trustworthy and deserving of a promotion.

Imagine two employees at a job with overtime pay where approval is needed for overtime, as is usual for most employers, otherwise workers would have strong financial incentives to extend the time to complete tasks to earn overtime. With required overtime pay, independent of the amount of work that needs to be done, both workers will show up at the start of the scheduled workday, not earlier, and leave at the end of the workday, not later, to avoid unapproved overtime.

Imagine two employees at a salaried job without overtime pay. A hardworking, loyal, trustworthy employee realizing there is extra work to be done, might come in a little earlier or stay a little later, to complete the unfinished work. A worker who sees the job just as a job and is not committed to the employer will not care about the unfinished work and will come in and leave at the scheduled time.

The government’s expansion of the class of overtime eligible workers five-fold, from 7 percent to 35 percent of the salaried workforce, deprives managers of valuable employee information to decide who to promote. With less information about a worker, companies will be more at risk of making a mistake, will be more careful and slower to promote, and will promote fewer employees to avoid the risk of a mistake.

Before the new overtime rules, employees had an option to work harder to show their employers they wanted a promotion. Under the new rules, employees lost that valuable option.

As an aside, the financial loss to employees of the new overtime rules can be computed. The expanded numbers of overtime employees were buying a call option on a promotion with extra salary, using the unpaid extra work as payment to buy that call option. The expanded class of overtime employees lost a call option whose value can be computed if one knew the estimated average number of extra hours these employees worked and the expected rate and extra salary of a promotion. If salaried employees had not valued the call option positively, they would not have put in the extra unpaid hours.

Monday, May 16, 2016

Wind Energy Allowed To Kill 4200 Bald Eagles Per Year By US Fish And Wildlife Proposal: Wind Industry Reporting Of Bird Kills Not Required

Posted By Milton Recht

From The Wall Street Journal, "An Ill Wind: Open Season on Bald Eagles: Sacrificing 4,200 of the birds a year for green energy sounds fine to regulators." by Robert Bryce:

Two weeks ago the [U.S. Fish and Wildlife Service] agency opened public comment on “proposed improvements” to its eagle conservation program. It wants to extend the length of permits for accidental eagle kills from the current five years to 30 years. The changes would allow wind-energy producers to kill or injure as many as 4,200 bald eagles every year. That’s a lot. The agency estimates there are now about 72,434 bald eagles in the continental U.S.

*** A 2013 study in the Wildlife Society Bulletin estimated that wind turbines killed about 888,000 bats and 573,000 birds (including 83,000 raptors) in 2012 alone. But wind capacity has since increased by about 24%, and it could triple by 2030 under the White House’s Clean Power Plan. “We don’t really know how many birds are being killed now by wind turbines because the wind industry doesn’t have to report the data,” says Michael Hutchins of the American Bird Conservancy. "It’s considered a trade secret."*** The double standard is stunning. In 2011 the Fish and Wildlife Service convinced the Justice Department to file criminal indictments against three oil companies working in North Dakota’s Bakken field for inadvertently killing six ducks and one phoebe.

Thursday, May 12, 2016

My WSJ Posted Comment To Google's Ad Ban For Payday Lenders

Posted By Milton Recht

My posted comment to The Wall Street Journal article, "Google Bans Ads for Payday Lenders: Alphabet’s subsidiary says such loans ‘can result in unaffordable payment and high default rates’" by Yuka Hayashi:

Google’s ad ban for payday lending is a sad day for the working poor. A private business trying to meet the needs of the cash-strapped lower income worker living paycheck to paycheck must be bad if it is not part of the lobbying, ex-regulator hiring system called Banking.

Payday lenders for a few dollars meet the needs of the unbanked who have jobs but have bad or no credit histories and probably no bank accounts. Unfortunately, mathematically converting the cost of a business fee into an annual interest expense makes the fee seem astronomical.

I guess Google thinks a $35 overdrawn bank fee every week or two plus interest on an overdraft loan at a bank is preferable because the US says so. Why aren’t bank overdraft fees treated like Payday loans and banned?

If banks were a competitive alternative to payday lenders, payday lenders would not exist. Without payday lenders to meet short-term cash needs, what else is legally available to the workers who are living paycheck to paycheck?

Wednesday, May 11, 2016

After Washington State Legalized Marijuana, Number Of Fatal Car Crashes Involving Marijuana Doubled

Posted By Milton Recht

From the National Library of Medicine, the National Institutes of Health, MedlinePlus, "Pot-Linked Fatal Car Crashes Doubled in One State After Legalization :Experts say Washington state's experience could be a lesson for rest of country" by Mary Elizabeth Dallas:

The number of fatal car crashes involving marijuana more than doubled after Washington state legalized the sale of the drug, a new study finds.

Marijuana became legal in Washington in December 2012, researchers said. Between 2013 and 2014, the percentage of drivers in Washington involved in fatal car accidents after using marijuana rose from 8 percent to 17 percent, according to the study from the AAA Foundation for Traffic Safety.

In 2014 alone, one in six drivers involved in a deadly crash had recently used the drug, researchers found.

For The First Time Since 2009, The Federal Budget Deficit Will Increase, In Relation To The Size Of The Economy

Posted By Milton Recht

From Congressional Budget Office, "The 2016 Budget Outlook Presentation" by Keith Hall, CBO Director, at the Peter G. Peterson Foundation’s 2016 Fiscal Summit:

In 2016, the federal budget deficit will increase, in relation to the size of the economy, for the first time since 2009, according to CBO’s estimates. If current laws generally remained unchanged, the deficit would grow over the next 10 years, and by 2026 it would be considerably larger than its average over the past 50 years, CBO projects. Debt held by the public would also grow significantly from its already high level.

To analyze the state of the budget in the long term, CBO has extrapolated its 10-year baseline projections an additional two decades. If current laws governing taxes and spending remain in place, the outlook for the budget would steadily worsen over the long term, with revenues falling well short of spending. CBO is in the process of completing a detailed update of its long-term projections; but in January the agency did a simplified update. On that basis, budget deficits are projected to rise steadily and federal debt held by the public is projected to exceed 130 percent of GDP by 2040.

Law Enforcement Can Legally Compel A Suspect To Use A Finger To Unlock A Smartphone: Cannot Compel A Suspect To Provide The Password To Unlock A Smartphone

Posted By Milton Recht

From Bloomberg, "The Fingerprint Lock on Your Phone Isn’t Cop-Proof: Law enforcement has an end run around smartphone encryption. For now." by Kartikay Mehrotra:

For the 250 million phones sold around the world with fingerprint authentication since 2013, law enforcement may be able to compel suspects to press their fingers to the devices and unlock them.

With minimal litigation on the books in the U.S., police and prosecutors require only a judge’s blessing on a warrant for a suspect’s fingerprints. So far they’ve used the power sparingly. But as the number of fingerprint scanners in hip pockets grows, district attorneys across the country say the technology is poised to become a major engine of evidence-gathering. "It is likely to be just a matter of time till this does become a primary gateway to accessing phones," says Micheal O’Connor, an Alameda County assistant district attorney in Oakland, Calif.*** Los Angeles and Oakland are among the cities that have already granted or received warrants for the use of a finger to unlock a phone. The next step may be a lawsuit that determines whether a fingerprint is off-limits.

Legal scholars say law enforcement is likely to win that fight.

Current US Birth Rate Below Pre-Recession Levels: Expected To Stay At Lower Level

Posted By Milton Recht

From The Wall Street Journal, "Baby Lull Promises Growing Pains for Economy: Slow rebound in post-recession birth rates challenges businesses, poses long-term test for government programs" by Janet Adamy:

The U.S. is experiencing a baby lull that looks set to last for years, a shift demographers say will likely ripple through the U.S. economy and have an impact on everything from maternity wards to federal social programs.

*** ...the U.S. may not soon return to its pre-recession average of about two babies for every adult woman. Some demographers have pared their forecasts for future births because an expected post-recession baby boom has been smaller than anticipated.

The leveling-off in births is weighing on sales at children’s stores, prompting hospitals to rework their birth wards and putting pressure on builders of single-family homes, executives and economists say.***

Source: The Wall Street Journal

Substantial Decline In Minimum Wage And Involuntary Part Time Jobs Since 2010: Most Of The Increase In Minimum Wage And Involuntary Part Time Jobs Occurred During The Recession in 2008 And 2009

Posted By Milton Recht

From The Wall Street Journal, Real Time Economics, "Just How Good (or Bad) Are All the Jobs Added to the Economy Since the Recession? We take a closer look at employment and wage data to see the makeup of newly created jobs" by Lam Thuy Vo and Josh Zumbrun:

Overall, the data also show that more people work minimum wage or involuntarily part time than prior to the recession. But most of this increase occurred during the recession in 2008 and 2009.

The number of minimum wage and part time workers has declined over the past five years. There are currently about 2.6 million workers earning the minimum wage. That’s up from 1.7 million in 2007, but down substantially from 4.4 million in 2010. There are currently about six million people who work part time but want full-time hours. That’s up from about four million in 2007, but down substantially from nine million in 2009 and 2010.

Monday, May 9, 2016

Share Of Young Men Jobless Or Incarcerated By Education Level: CBO

Posted By Milton Recht

From Congressional Budget Office, May 9, 2016, "Trends in the Joblessness and Incarceration of Young Men:"

In 2014, 16 percent of men in the United States between the ages of 18 and 34 were jobless or incarcerated, up from 11 percent in 1980. Those numbers and related longer-term trends have significant economic and budgetary implications.View CBO Document

In 2014, there were 38 million men in the United States between the ages of 18 and 34; about 5 million of those young men were jobless, and 1 million were incarcerated. Those numbers and some related longer-term trends have significant economic and budgetary implications. Young men who are jobless or incarcerated can be expected to have lower lifetime earnings and less stable family lives, on average, than their counterparts who are employed or in school. In the short term, their lower earnings will reduce tax revenues and increase spending on income support programs, and the incarceration of those in federal prison imposes costs on the federal government. Farther in the future, they will probably earn less than they would have if they had gained more work experience or education when young, resulting in a smaller economy and lower tax revenues.

The share of young men who are jobless or incarcerated has been rising. In 1980, 11 percent of young men were jobless or incarcerated; in 2014, 16 percent were (see figure below). Specifically, 10 percent of young men were jobless in 1980, and 1 percent were incarcerated; those shares rose to 13 percent and 3 percent in 2014.

Layoffs Have Negative Effects On Rehired Workers: Lower Future Earnings And Lower Home Ownership

Posted By Milton Recht

From The Wall Street Journal, "The Recession’s Economic Trauma Has Left Enduring Scars: Effects of losing a job linger, from lower wages and home ownership rates to psychological problems" by Ben Leubsdorf:

Even for the millions of Americans back at work, the effects of losing a job will linger, the research suggests. They will earn less for years to come. They will be less likely to own a home. Many will struggle with psychological problems. Their children will perform worse in school and may earn less in their own jobs.[Emphasis added.]

*** Labor Department data show 40 million layoffs and other involuntary discharges during the recession that began in December 2007 and ended in June 2009. The official unemployment rate peaked at 10%. Princeton University economist Henry Farber calculated that the rate of job loss from 2007 through 2009 was 16%.

Wage scarring

As in previous recessions, millions of Americans faced a phenomenon economists sometimes call wage scarring. People who lose a job, even during economic expansions, usually earn less money when they re-enter the workplace. They are out of work for a time and often take a pay cut as the price of returning to work at a new employer or even in a new career.

***

Source: The Wall Street Journal

Saturday, May 7, 2016

Quarter Of Home Energy Use Is From Devices Turned Off

Posted By Milton Recht

From The New York Times, "Just How Much Power Do Your Electronics Use When They Are ‘Off’?" by Tatiana Schlossberg:

Once upon a time, there was a difference between on and off. Now, it’s more complicated: Roughly 50 devices and appliances in the typical American household are always drawing power, even when they appear to be off, estimates Alan Meier, a senior scientist at the Department of Energy’s Berkeley Lab.

It adds up. About a quarter of all residential energy consumption is used on devices in idle power mode, according to a study of Northern California by the Natural Resources Defense Council.

Friday, May 6, 2016

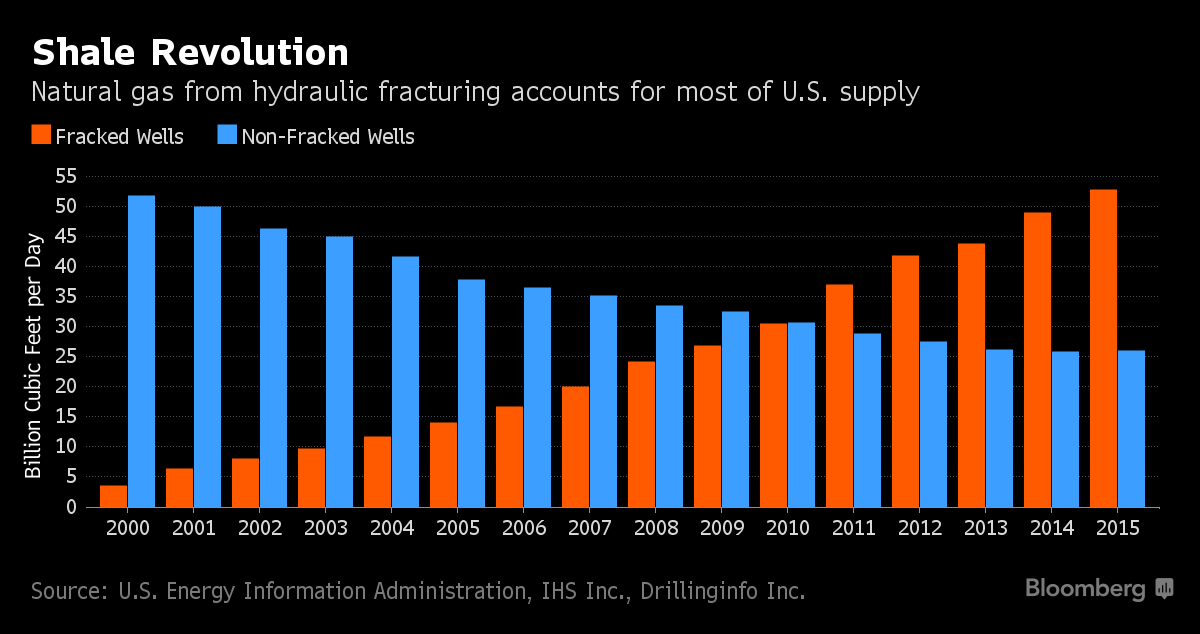

67 Percent Of US Natural Gas Supply From Fracked Wells

Posted By Milton Recht

From Bloomberg, "Two-Thirds of U.S. Gas Supply Now Comes From Fracking" by Christine Buurma:

Source: Bloomberg *** Fracking now accounts for 67 percent of marketed gas output, up from less than 7 percent in 2000, according to the U.S. Energy Information Administration.

Tuesday, May 3, 2016

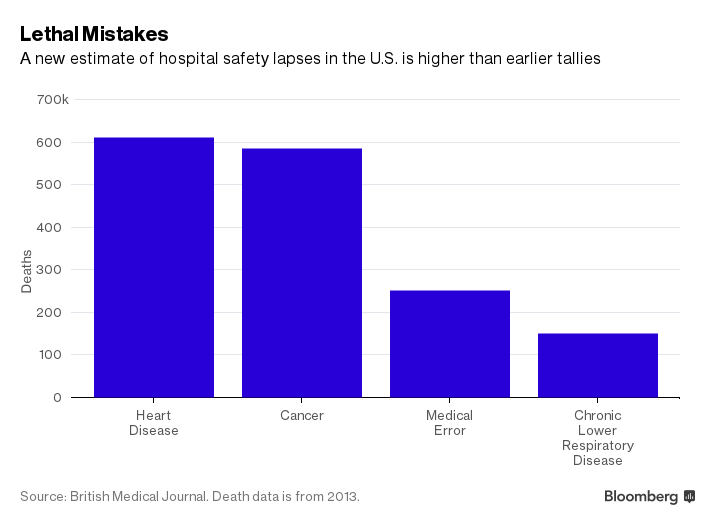

Medical Errors Are Third Leading Cause Of Death, Behind Heart Disease And Cancer Deaths

Posted By Milton Recht

From Bloomberg, "Medical Errors Are Leading Killer After Heart Disease and Cancer, Study Finds: Mistakes cost a quarter of a million lives a year in the U.S., Johns Hopkins reports, up from famous estimate of 100,000 in 1999." by John Tozzi:

After heart disease and cancer, medical errors kill more Americans than anything else, claiming a quarter of a million lives a year, according to a study by researchers at Johns Hopkins University.

If bungles and safety lapses in the hospital were accounted for as deaths from disease and injury are, they would be the third most common cause of death in the U.S., leading to more fatalities than respiratory disease, the report in the British Medical Journal argues.

Source: Bloomberg

Subscribe to:

Posts (Atom)