High-Income Americans Pay The Majority of Federal Taxes And Pay The Highest Average Tax Rates

From Tax Foundation, "

Summary of the Latest Federal Income Tax Data, 2015 Update" by Scott Greenberg:

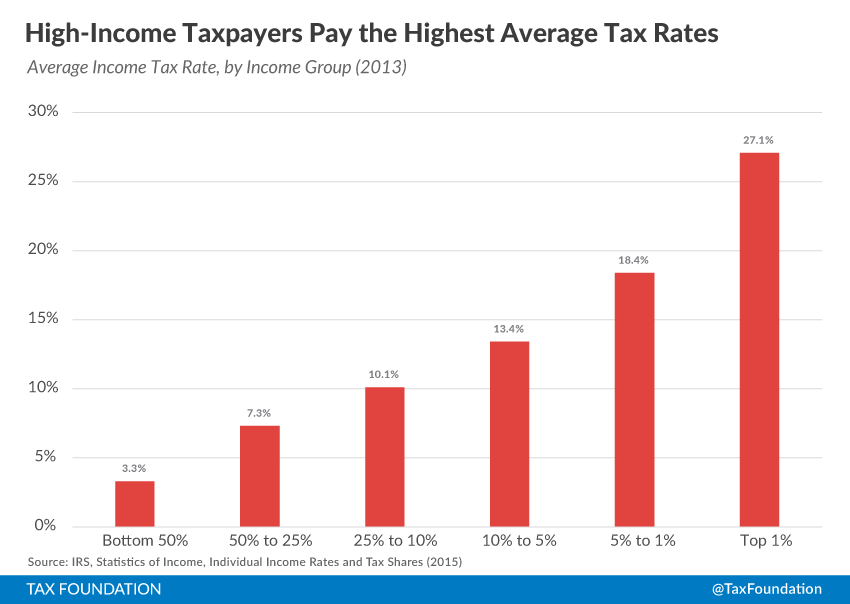

High-Income Americans Paid the Majority of Federal Taxes

In 2013, the bottom 50 percent of taxpayers (those with AGIs below $36,841) earned 11.49 percent of total AGI. This group of taxpayers paid approximately $34 billion in taxes, or 2.78 percent of all income taxes in 2013.

In contrast, the top 1 percent of all taxpayers (taxpayers with AGIs of $428,713 and above), earned 19.04 percent of all AGI in 2013, but paid 37.80 percent of all federal income taxes.

In 2013, the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined. The top 1 percent of taxpayers paid $465 billion, or 37.80 percent of all income taxes, while the bottom 90 percent paid $372 billion, or 30.20 percent of all income taxes.

Chart 1.

***Chart 2.

Your contents are moving ahead with days persevere guys.

ReplyDeleteWix website

I would never crave to lose out any chance to look throughout your contents.

ReplyDeleteProgressive Money Loans