Four years after the recession officially ended, U.S. per capita economic output has finally returned to its pre-crisis peak.

| Source: The Wall Street Journal |

Correcting misconceptions about markets, economics, asset prices, derivatives, equities, debt and finance

Four years after the recession officially ended, U.S. per capita economic output has finally returned to its pre-crisis peak.

| Source: The Wall Street Journal |

The ACA [Affordable Care Act aka Obamacare] has not been introduced into a tax-free economy, so its marginal tax rate hikes add to marginal tax rates already in effect. I estimate that, by 2015, the average marginal after-tax share among household heads and spouses with near-median weekly earnings will have fallen to 0.50 from 0.60 in 2007, largely from the ACA but also from other expansions in safety net programs. That is a massive 17 percent reduction in the reward to working – akin to erasing a decade of labor productivity growth without the wealth effect – that would be expected to significantly depress the amounts of labor and consumer spending in the economy even if the wage elasticity of labor supply were small (but not literally zero). The large tax rate increases are the primary reason why it is unlikely that labor market activity will return even near to its pre-recession levels as long as the ACA’s work disincentives remain in place.

In that sense, the shale boom has been green. Natural gas emits roughly half the carbon that coal does, so to the extent that it displaces coal, it is decreasing US emissions. But the economic ripples are also hitting nuclear power—a zero-emissions energy source: This week a Vermont nuclear plant was forced to shut down.*** But leaving aside the emotionalism of public opinion about nuclear power versus, say, coal, the Vermont [nuclear power plant] shuttering is a reminder that economics rules the energy roost. If natural gas stays dirt-cheap, we will see more nuclear plants close unless researchers figure out a way to cut down on the capital and operating costs of such facilities. Similarly, cheap gas will continue to undercut wind and solar, given current technologies. Leaders interested in weaning nations off of dirty-burning, high-emitting energy sources would do better to invest government dollars in research and development rather than fighting market currents with subsidies.

Consider the facts about the minimum wage. The majority of workers who earn a minimum wage in the United States work outside of the restaurant industry. In reality, only 5% of the 10 million restaurant employees earn the minimum wage. Those who do are predominantly teenagers working part-time jobs. According to the Bureau of Labor Statistics, 71% of minimum-wage employees in the restaurant industry are under the age of 25; 47% are teenagers.

Washington politicians, labor unions and the media often portray service jobs as inferior or less valuable to society than other kinds of employment. Instead of degrading this type of hard work, critics might consider the pride that many restaurant workers take in their jobs and the skills they learn.

The U.S. restaurant industry is vital to the country's economic growth and has helped fuel the recovery now underway. While employment nationwide grew by 1.7% in 2012, restaurant industry employment grew 3.4%—making 2012 the 13th consecutive year that the restaurant industry has outperformed overall U.S. employment growth.

Many Americans rely on the additional income and flexibility these jobs offer as they seek to balance their careers with family responsibilities. Most industry workers, some 57%, are students with irregular schedules, teenagers saving for school or people who need a job with flexible hours that fit their busy lives. Part-time, entry-level work fills a critical need in the nation's workforce.

In the paper, researchers from the Centre of Excellence for Climate System Science and others used a range of ocean simulations to track the path of the radiation from the Fukushima incident.

The models identified where it would likely travel through the world’s oceans for the next 10 years.

"Observers on the west coast of the United States will be able to see a measurable increase in radioactive material three years after the event," said one of the paper’s authors, Dr Erik van Sebille.

"However, people on those coastlines should not be concerned as the concentration of radioactive material quickly drops below World Health Organisation safety levels as soon as it leaves Japanese waters."

Across the country, a growing number of single-family rentals provides an option for many who lost their homes in the housing crash through foreclosure and for those who cannot obtain a mortgage under today’s tougher credit conditions. But the decline in homeownership is also changing many neighborhoods in profound ways, including reduced home values, lower voter turnout and political influence, less social stability and higher crime.

"When there are fewer homeowners, there is less ‘self-help,’ like park and neighborhood cleanup, neighborhood watch,” said William M. Rohe, a professor at the University of North Carolina at Chapel Hill who has just completed a review of current research on homeownership’s effects. Even conscientious landlords and tenants invest less in their property than owner-occupants, he said. “Who’s going to paint the outside of a rental house? You’d almost have to be crazy."*** In hundreds of neighborhoods that once attracted first-time home buyers, investors have stepped in, buying up tens of thousands of homes for the rental market. That has helped put paying tenants in a number of homes that were vacant or becoming eyesores.

Do violent video games such as ‘Mortal Kombat,’ ‘Halo’ and ‘Grand Theft Auto’ trigger teenagers with symptoms of depression or attention deficit disorder to become aggressive bullies or delinquents?

No, according to Christopher Ferguson of Stetson University and independent researcher Cheryl Olson from the US in a study published in Springer’s Journal of Youth and Adolescence. On the contrary, the researchers found that the playing of such games actually had a very slight calming effect on youths with attention deficit symptoms and helped to reduce their aggressive and bullying behavior.

Ferguson and Olson studied 377 American children, on average 13 years of age, from various ethnic groups who had clinically elevated attention deficit or depressive symptoms. The children were part of an existing large federally funded project that examines the effect of video game violence on youths.*** Regarding concerns about some young mass homicide perpetrators having played violent video games, Ferguson stated, "Statistically speaking it would actually be more unusual if a youth delinquent or shooter did not play violent video games, given that the majority of youth and young men play such games at least occasionally."

Source: Political Calculations

Here's an idea: let's require that the federal, state and local government agencies responsible for dispensing welfare benefits issue 1099 tax forms to welfare recipients documenting the full value of the benefits they received and also to the IRS.

The welfare recipients would then have to report this unearned income on their federal tax returns. Any amount provided in excess of the difference between the federal poverty level that applies in their state and any regular income they may have earned should then be taxed at the same rates that apply for unearned income.

All 20 cities in the index showed a year-over-year increase, paced by gains of 24.9 percent in Las Vegas and 24.5 percent in San Francisco. New York showed the smallest increase at 3.3 percent.

But we wondered how does the productivity of federal civilian employees compare with that of employees in the private sector?*** This summer, as part of the cost-cutting measures related to the budget sequester required by the Budget Control Act of 2011, President Obama acted to discontinue the operations of the Department of Labor's International Labor Comparisons (ILC) program, which converts the economic statistics produced by other nations' governments to adhere to U.S. standards and definitions, which allows for direct apples-to-apples comparisons to be made between the nations' economic data.*** On 27 June 2013, the non-profit Conference Board announced that it would take over reporting the international labor comparisons.*** As best as we can tell from its job postings since its announcement, the private sector Conference Board will hire at least two and possibly three people to do the work that would appear to have required 16 dedicated bureaucrats when the same work was done by the U.S. federal government.*** That would mean that the federal government employees who were previously doing the work would appear to be less than one-fifth as productive as their private sector peers in working to produce the same output.

Late last week, Justice asked a federal court to stop 34 school districts in the Pelican State from handing out private-school vouchers so kids can escape failing public schools. Mr. Holder's lawyers claim the voucher program appears "to impede the desegregation progress" required under federal law. Justice provides little evidence to support this claim, but there couldn't be a clearer expression of how the civil-rights establishment is locked in a 1950s time warp.

Passed in 2012, Louisiana's state-wide program guarantees a voucher to students from families with incomes below 250% of poverty and who attend schools graded C or below. The point is to let kids escape the segregation of failed schools, and about 90% of the beneficiaries are black.*** In any case, segregation is hardly the main obstacle to learning that it was for minority children in the days of "separate but equal." Today's civil-rights outrage is the millions of poor kids who can't escape failing schools whatever their racial make up.

Our guess—confirmed by sources in Louisiana—is that this lawsuit isn't really about integration. It's about helping the teachers union repeal the voucher law by any legal means, and the segregation gambit is the last one available. Justice gives this strategy away when it claims "jurisdiction over Louisiana" even for vouchers for students in districts without desegregation orders.

The problem with aggregated wage data is that it does not correct for the effect of an aging workforce, or look at the wages of the workers who are the most productive.

With the post-WWII baby boom bubble entering retirement years, more older people are giving up full-time higher paying jobs for lower paying part-time work. This effect depresses the average hourly wage. Productive workers are getting raises and this effect offsets the decline in average real wages from older workers. The two effects together make wages look stagnant.

With fewer future workers in the pipeline, companies have invested in more capital, making workers much more productive.

Given the slowdown in US birthrates since the 1960s, it is not at all surprising that in the last decade as we get to baby boom retirement age, average wages for the entire workforce will look like they are stagnating.

Averages hide many wage increases. As an example of averages hiding effects, suppose the average age of a workforce is constant over a decade, does that mean that [there] aren't many workers who are a decade older? Of course not! Likewise, a retiring but working workforce, along with new inexperienced entrants at lower wages in conjunction with more capital investment will makes wages look stagnant and far behind productivity growth.

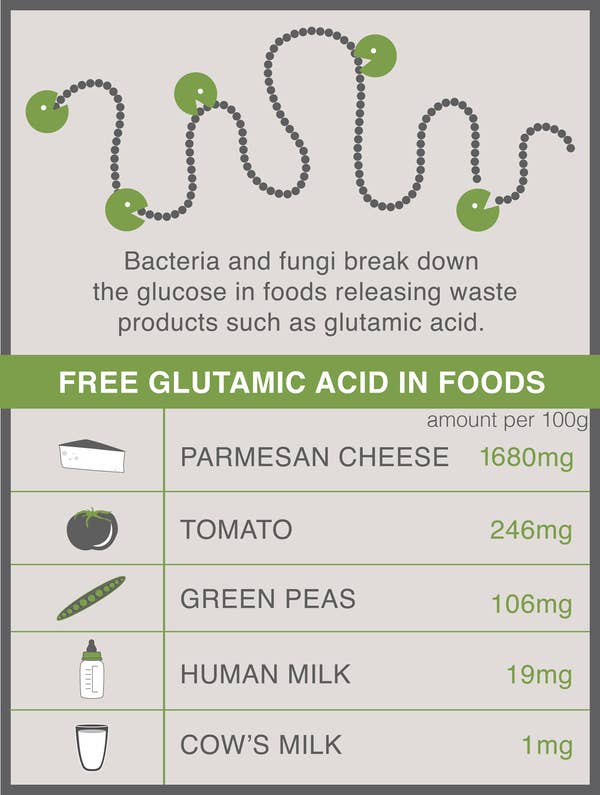

According to FDA estimates, we consume 13 grams of glutamic acid [glutamate ion of MSG] in food every day, and it comes to us in one of three ways: Proteins are long chains of amino acids bound together, and most proteins contain some glutamic acid. Some foods, like Parmesan cheese, tomatoes, seaweed, or soy sauce also contain “free” glutamic acid, which is not bound with other aminos in proteins and is what our tongue reacts to when we taste umami. Fermentation can also significantly increase the amount of free glutamic acid found in a food.

The third way we typically consume glutamic acid is from MSG — the FDA estimates that most of us eat a little over a half a gram of it every day. If you eat Doritos, you’ve just eaten MSG. Same with practically any other snack with cheese powder, Kentucky Fried Chicken, many types of cold cuts, canned soups, soy sauce, and hundreds of other processed foods. MSG is made by pairing a single glutamic acid ion with a single sodium ion to form a salt — hence the full name, monosodium glutamate. When we eat MSG, our saliva dissolves the sodium ion from the glutamate ion, releasing free glutamic acid almost immediately and signaling to our brains that we’re eating something tasty and protein-rich.

|

| Source: BuzzFeed |

The bar chart below shows the largest cities in America, arrayed from most integrated to most segregated. The cities with the most sprawl are colored red; the most compact are colored teal. We can see that compact New York and sprawling Atlanta have similarly high levels of income segregation, as do Chicago and Detroit. At the lower end of the spectrum, dense Portland and sprawling Tampa are similarly well-integrated.

| Source: Federal Reserve Bank of Atlanta |

22%: The share of U.S. manufacturing jobs lost during the recent downturn that has been regained during the recovery.

American manufacturing was creamed in the recession. From December 2007 to December 2009, factories shed nearly 2.3 million jobs, or 16.5% of the sector’s total. Of course, the recession ended in June of 2009—but factories kept dumping workers for months thereafter. The rest of the economy suffered big job losses in the downturn too, but nowhere near the bloodbath in manufacturing. Jobs in all other categories combined fell about 5% during the same two-year period.

| Source: The Wall Street Journal |

Since December of 2009, factories have added 504,000 jobs—a tidy gain, to be sure, but one that represents less than a quarter of the jobs lost during the meltdown. The rest of the economy, meanwhile, has done considerably better. The U.S. has regained 6.2 million non-manufacturing jobs since December of 2009—which means the rest of the economy has regained more than 96% of the jobs lost.

Driving school instructor gives advice on encountering a wrong way driver: Steve Mochel, owner of Fresh Green Light driving school, talks about what to do to avoid a collision with a wrong way driver. (Video by Ricky Flores/The Journal News)

An estimated 360 people each year are killed in wrong-way collisions on the nation’s highways, the National Transportation Safety Board said in a recent report. Some 60 percent of those crashes involve alcohol and nearly 80 percent occur between 6 p.m. and 6 a.m. Wrong-way crashes on highways are relatively rare, but they are often fatal when they do occur because they usually involve head-on collisions, the agency noted.

Today, only about 7% of recent college grads come from the bottom-income quartile compared with 12% in 1970 when federal aid was scarce. All the government subsidies intended to make college more accessible haven't done much for this population, says Mr. [Richard] Vedder. They also haven't much improved student outcomes or graduation rates, which are around 55% at most universities (over six years).

But the whole premise of the EEOC's [Equal Employment Opportunity Commission] campaign against criminal-background checks may be off-base if the goal is to increase job opportunities for minorities, ex-offenders or anyone with a spotty work history.

On the contrary, an October 2006 study in the Journal of Law and Economics, "Perceived Criminality, Criminal Background Checks, and the Racial Hiring Practices of Employers," found that "employers that check criminal backgrounds are in general more likely to hire African Americans," according to Harry Holzer of Georgetown University and his two co-authors. "[T]he adverse consequence of employer-initiated background checks on the likelihood of hiring African Americans is more than offset by the positive effect of eliminating statistical discrimination." These researchers surmise that employers who can screen for prison records are less likely to rely on prejudice when hiring.

Blacks aren't the only beneficiaries. Analyzing "employer willingness to hire other stigmatized groups of workers (such as workers with gaps in their employment history)," they found the same pattern.

There are 3,200 utilities that make up the U.S. electrical grid, the largest machine in the world. These power companies sell $400 billion worth of electricity a year, mostly derived from burning fossil fuels in centralized stations and distributed over 2.7 million miles of power lines. Regulators set rates; utilities get guaranteed returns; investors get sure-thing dividends. It’s a model that hasn’t changed much since Thomas Edison invented the light bulb. And it’s doomed to obsolescence.

That’s the opinion of David Crane, chief executive officer of NRG Energy, a wholesale power company based in Princeton, N.J. What’s afoot is a confluence of green energy and computer technology, deregulation, cheap natural gas, and political pressure that, as Crane starkly frames it, poses “a mortal threat to the existing utility system.” He says that in about the time it has taken cell phones to supplant land lines in most U.S. homes, the grid will become increasingly irrelevant as customers move toward decentralized homegrown green energy. Rooftop solar, in particular, is turning tens of thousands of businesses and households into power producers. Such distributed generation, to use the industry’s term for power produced outside the grid, is certain to grow.*** An unusually frank January report by the Edison Electric Institute (EEI), the utilities trade group, warned members that distributed generation and companion factors have essentially put them in the same position as airlines and the telecommunications industry in the late 1970s. "U.S. carriers that were in existence prior to deregulation in 1978 faced bankruptcy," the report states. "The telecommunication businesses of 1978, meanwhile, are not recognizable today." Crane prefers another analogy. Like the U.S. Postal Service, he says, "utilities will continue to serve the elderly or the less fortunate, but the rest of the population moves on."

The nation’s fourth-largest employer [United Parcel Service Inc. (UPS)] said yesterday that it will no longer offer health coverage beginning Jan. 1 to spouses who can get it though another company. UPS cited the 2010 health-care law as part of its thinking, saying it would increase costs and provide other insurance options for spouses.While it makes economic sense for UPS not to offer health insurance to a spouse of a worker, if the spouse can obtain insurance from their own employer. The spouse may see an increase in the cost of their health insurance coverage if their employer's benefits are more expensive, have higher deductibles, etc.

The shift is a sign of corporate America’s increasing willingness to make deep changes to benefits once taken as a given by workers. The health-care overhaul, estimated to boost business expenses by 2 percent to 4 percent next year, is adding to the momentum that has already spurred higher deductibles and surcharges for covering dependents.

| Source: The Washington Post |

This graph is from Branko Milanovic, the lead economist at the World Bank’s research group. Dylan Matthews explains:

... if you’re in the United States, the mere fact that you live there means that you are not (with some exceptions) poor in the global sense. The bottom fifth of Americans are still well above the middle of the world income distribution.

The decline in youth employment is part of a broader shift in working patterns. Americans are entering the workforce later and staying in it longer than at any time in history. Andrew Sum, a Northeastern University economist and expert in youth employment, points to a remarkable statistic: A decade ago, a 16- or 17-year-old boy was twice as likely to have a job as his 70-year-old grandfather. Today, the grandfather is actually more likely to have a job than the boy. That’s an amazing shift in so short a period of time.

| Source: The Wall Street Journal |

Preliminary estimates released by the Centers for Disease Control and Prevention indicate that the number of Americans diagnosed with Lyme disease each year is around 300,000. The preliminary estimates were presented Sunday night in Boston at the 2013 International Conference on Lyme Borreliosis and Other Tick-Borne Diseases.

This early estimate is based on findings from three ongoing CDC studies that use different methods, but all aim to define the approximate number of people diagnosed with Lyme disease each year. The first project analyzes medical claims information for approximately 22 million insured people annually for six years, the second project is based on a survey of clinical laboratories and the third project analyzes self-reported Lyme disease cases from a survey of the general public.

Each year, more than 30,000 cases of Lyme disease are reported to CDC, making it the most commonly reported tick-borne illness in the United States. The new estimate suggests that the total number of people diagnosed with Lyme disease is roughly 10 times higher than the yearly reported number. This new estimate supports studies published in the 1990s indicating that the true number of cases is between 3- and 12-fold higher than the number of reported cases. [Emphasis added]

Fannie Mae and Freddie Mac, which have reported record profits after a taxpayer bailout, are ignoring billions of dollars in potential losses on overdue loans as they take three years to adopt a new accounting system, a government auditor said in a letter made public today.

The accounting change should be made immediately and could have a material impact on the companies’ finances, according to the Aug. 5 letter to Federal Housing Finance Agency Acting Director Edward J. DeMarco from Steve Linick, the regulator’s inspector general.

"Three years appears to be an inordinately long period," Linick wrote in the letter posted on his office’s website today.*** “A substantial percentage of the GSEs’ recent earnings and the subsequent dividend paid to Treasury was a result of decreasing loan-loss reserves,” said Tim Rood, a former Fannie Mae (FNMA) executive and now managing director at Collingwood Group LLC, a financial services consulting firm based in Washington. "If the new accounting standard being imposed on them stopped or slowed the release of those reserves, it would have a direct and negative effect on the amount of dividend payments."

Delinquency Deadline

Fannie Mae and Freddie Mac buy mortgages from lenders and package them into securities on which they guarantee principal and interest payments. The FHFA, which oversees Washington-based Fannie Mae and McLean, Virginia-based Freddie Mac, ordered the companies in April 2012 to start writing off all loans delinquent for at least 180 days, a standard practice for regulated financial institutions.

...May 2013 Census Bureau study on "The Diversifying Electorate—Voting Rates by Race and Hispanic Origin in 2012 (and Other Recent Elections)."

The study, based on data from the November 2012 Current Population Survey, shows that minority voter turnout nationwide has been rising—dramatically so. Take blacks, who as recently as 1996 had a low voter turnout rate of 53%.

As the nearby chart shows, black turnout has jumped in each of the last four presidential elections. In 2012, black turnout as a share of all eligible voters exceeded the turnout of non-Hispanic white voters—66.2% to 64.1%. Nearly five million more African-Americans voted in 2012 (17.8 million) than voted in 2000 (12.9 million). In both 2008 and 2012, black voters even exceeded their share of the eligible black voting age population. In 2012, blacks made up 12.5% of the eligible electorate but 13.4% of those voting.

Source: The Wall Street Journal

How much energy does it take to power your smartphone addiction?

The average iPhone uses more energy than a midsize refrigerator, says a new paper by Mark Mills, CEO of Digital Power Group, a tech investment advisory. A midsize refrigerator that qualifies for the Environmental Protection Agency's Energy Star rating uses about 322 kW-h a year, while your iPhone uses about 361 kW-h if you stack up wireless connections, data usage, and battery charging.

The paper, rather ominously titled "The Cloud Begins With Coal: Big Data, Big Networks, Big Infrastructure, and Big Power," details how the world's Information Communication Technology (ITC) ecosystem — which includes smartphones, those high-powered Bloomberg terminals on trading floors, and server farms that span the size of seven football fields — are taking up a larger and larger slice of the world's energy pie.

The slice right now, according to Mills, is about 10 percent, or 1,500 terawatt hours of energy per year.

Michael Hobbes explains the obvious in his discussion of Michael Moss's book, "Salt Sugar Fat: How the Food Giants Hooked Us"that stuff is in it because without it, your food will quickly go bad, and/or taste terrible.

*** Hobbes blames capitalism, which has forced companies to sell us salt-sugar-and-fat-laden foods because if they don’t, they’ll lose market share. But a more accurate culprit would be “women who would like to do something other than spending the equivalent of a full modern workweek preparing food.” That’s right -- in the Victorian era, keeping the family fed took well north of 30 hours a week. Getting out of the kitchen meant that the industrial supply chain had to take over many of the tasks that women used to do by hand, from plucking chickens to baking bread.

These innovations are the reason that the average modern woman spends only four to five hours a week on food. If we were making everything from fresh, raw, unprocessed ingredients, our food would contain much less sugar and fat and salt, and it would contain many more hours of our lives. Clearly, most of us are not willing to make that trade-off.

I don’t mean to say that the industrialization of our supply chain was caused by the women’s movement -- 1950s housewives were big fans of packaged and processed food. Rather, the causation goes the other way: no pre-packaged foods, no women’s liberation. We’d still be in the kitchen, making marinara from the fresh tomatoes we’d grown in our own gardens.*** Besides, most people don’t feel they can afford to spend $20 a week just on bread, that being what it would cost to procure a daily fresh loaf from my nearest bakery. You can similarly multiply the costs of other foods, if you want them absolutely fresh -- so fresh that they don’t require preservation and flavor enhancement.

U.S. households are holding less debt and are behind on fewer bills than at any time since before the recession began, putting consumers on a sounder footing to support a stronger economic recovery.

Total household debt, including mortgages, credit cards and auto loans, fell by $78 billion in the second quarter to $11.15 trillion, the lowest level since 2006, according to a report released Wednesday by the Federal Reserve Bank of New York.

The amount of bills 30 or more days late fell by $3.3 billion during the quarter, also reaching the lowest level in seven years.

Animation updates every second.

Source: Calculated Risk

Although investors paid a premium for dual ratings, AAA CDO tranches rated by both Moody's and S&P defaulted more frequently than tranches rated by only one of them, which is inconsistent with pure rating shopping. Rating agencies made upward adjustments beyond their model when their competitor had more lenient assumptions.

The following chart shows the percentages of job gains sorted by low-wage, middle-wage, and high-wage sectors for each of the U.S. expansion periods dating back to 1970:

Source: Federal Reserve Bank of Atlanta

I've dated the current recovery from March 2010: the month that employment gains turned positive. It should also be noted that the cross-recovery comparisons are not quite apples-to-apples given changes in the way sectoral employment is reported by the U.S. Bureau of Labor Statistics. (There are only 11 sectors, for example, in the recovery periods prior to 1991.)

But I don't think this materially alters the basic picture: The lowest-wage sectors have consistently produced 40 percent to 50 percent of the job gains in recent recoveries. Though the percentage was slightly higher in July, it was not materially so. And this recovery does not look at all unusual when taken as a whole.

Published in the American Economic Journal: Economic Policy, the study uses data from a major cellphone provider and accident reports to contradict previous findings that connected cellphone use to increased crash risk. Such findings include the influential 1997 paper in the New England Journal of Medicine, which concluded that cellphone use by drivers increased crash risk by a factor of 4.3 — effectively equating its danger to that of illicit levels of alcohol. The findings also raise doubts about the traditional cost-benefit analyses used by states that have, or are, implementing cellphone-driving bans as a way to promote safety.

"Using a cellphone while driving may be distracting, but it does not lead to higher crash risk in the setting we examined," said Saurabh Bhargava, assistant professor of social and decision sciences in CMU’s Dietrich College of Humanities and Social Sciences. "While our findings may strike many as counterintuitive, our results are precise enough to statistically call into question the effects typically found in the academic literature. Our study differs from most prior work in that it leverages a naturally occurring experiment in a real-world context."

For the study, Bhargava and the London School of Economics and Political Science’s Vikram S. Pathania examined calling and crash data from 2002 to 2005, a period when most cellphone carriers offered pricing plans with free calls on weekdays after 9 p.m. Identifying drivers as those whose cellphone calls were routed through multiple cellular towers, they first showed that drivers increased call volume by more than 7 percent at 9 p.m. They then compared the relative crash rate before and after 9 p.m. using data on approximately 8 million crashes across nine states and all fatal crashes across the nation. They found that the increased cellphone use by drivers at 9 p.m. had no corresponding effect on crash rates. Additionally, the researchers analyzed the effects of legislation banning cellphone use, enacted in several states, and similarly found that the legislation had no effect on the crash rate.

Abstract:Using new household-level data, we quantitatively assess the roles that job loss, negative equity, and wealth (including unsecured debt, liquid assets, and illiquid assets) play in default decisions. In sharp contrast to prior studies that proxy for individual unemployment status using regional unemployment rates, we find that individual unemployment is the strongest predictor of default. We find that individual unemployment increases the probability of default by 5–13 percentage points, ceteris paribus, compared with the sample average default rate of 3.9 percent. We also find that only 13.9 percent of defaulters have both negative equity and enough liquid or illiquid assets to make one month's mortgage payment. This finding suggests that "ruthless" or "strategic" default during the 2007–09 recession was relatively rare and that policies designed to promote employment, such as payroll tax cuts, are most likely to stem defaults in the long run rather than policies that temporarily modify mortgages. [Emphasis added.]Link to 50 page research paper.

In the case of a Texas man accused of massive Bitcoin-based fraud, a federal judge has ruled that bitcoins are “a currency or form of money," and are therefore subject to relevant US laws.

The case revolves around Bitcoin Savings and Trust (BTCST), a virtual Bitcoin-based hedge fund that many suspected of being a scam. BTCST shut down in August 2012, and the Securities and Exchange Commission (SEC) last month formally charged founder Trendon Shavers with running a Ponzi scheme.

However, it’s important not to fall prey to what economists call the “broken window fallacy.” It argues that the activity associated with fixing a broken window—or replacing a refrigerator—does little to raise economic well-being and, at best, simply brings the window, and the economy, back to where it was before the window was broken—even if this money comes from an outside source. Much of the economic activity generated by Sandy will be used to restore what was lost from the storm’s damage. As we discuss in a previous post, the region’s economic costs from the storm are substantial, difficult to measure, and need to be weighed against any benefits of an increase in activity. So while economic activity may have been boosted from such spending, the region’s net wealth hasn’t changed.

The Potential for Productivity Gains

Of course, some of the spending that will occur is for more than just replacing things like broken windows. In fact, even when a new window replaces an old one, it’s likely to be one that’s better—for example, one that’s more energy-efficient. Thus, in the case of replacing things damaged from the storm, there’s some potential for improvements to the region’s productivity. Along these lines, much of the spending will be used to rebuild and upgrade the region’s critical public infrastructure, making it more productive. For example, Sandy destroyed sizable electrical and signal infrastructure of New York’s Metropolitan Transportation Authority (MTA) that was old and in need of repair. Given the MTA’s budget constraints, it’s not clear whether the agency would have upgraded the electrical and signal equipment without the $3.8 billion in Sandy relief funds. Notably, studies indicate that such investments in public infrastructure can increase the attractiveness of an area and raise its productivity for many years. So any investments that upgrade and reduce the risk to the region’s critical public infrastructure could provide a form of longer-term economic stimulus. While these longer-term benefits of disaster aid are easy to conceive, they’re hard to measure.

At $52,098, median income is above this year’s low point of $51,422 in February, yet 8% below its post-dot-com peak of $56,648 in February 2002.

| Source: The Wall Street Journal |

[T]he time of day we eat can have a big impact on the way our bodies process food, says Prof. Daniela Jakubowicz of TAU’s Sackler Faculty of Medicine and the Diabetes Unit at Wolfson Medical Center. In a recent study, she discovered that those who eat their largest daily meal at breakfast are far more likely to lose weight and waist line circumference than those who eat a large dinner. And the benefits went far beyond pounds and inches. Participants who ate a larger breakfast — which included a dessert item such as a piece of chocolate cake or a cookie — also had significantly lower levels of insulin, glucose, and triglycerides throughout the day, translating into a lower risk of cardiovascular disease, diabetes, hypertension, and high cholesterol. These results, published recently in the journal Obesity, indicate that proper meal timing can make an important contribution towards managing obesity and promoting an overall healthy lifestyle.*** By the end of the study, participants in the “big breakfast” group had lost an average of 17.8 pounds each and three inches off their waist line, compared to a 7.3 pound and 1.4 inch loss for participants in the “big dinner” group. According to Prof. Jakubowicz, those in the big breakfast group were found to have significantly lower levels of the hunger-regulating hormone ghrelin, an indication that they were more satiated and had less desire for snacking later in the day than their counterparts in the big dinner group.

Just a few years ago, most experts estimated that state and local governments owed about $2.5 trillion, mostly in the form of municipal bonds and other debt securities. But late last year, the States Project, a joint venture of Harvard’s Institute of Politics and the University of Pennsylvania’s Fels Institute of Government, projected that if you also count promises made to retired government workers and money borrowed without taxpayer approval, the figure might be higher than $7 trillion.

Most states have restrictions on debt and prohibitions against running deficits. But these rules have been no match for state and local governments, which have exploited loopholes and employed deceptive accounting standards in order to keep running up debt.*** Today, states and localities engineer most of their borrowing through what [Columbia Law School’s Richard] Briffault calls “non-debt debt,” a term for bonds designed to avoid legal restrictions on borrowing.*** Briffault estimates that such evasions are responsible for three-quarters of state debt and two-thirds of municipal obligations incurred through bond offerings. The growth of this kind of borrowing helps explain why state and local debt outstanding from municipal securities has blasted from $2 trillion (in today’s dollars) in 2000 to nearly $3 trillion today—real growth of 50 percent in little over a decade.*** If you define municipal debt simply as what states and localities have borrowed, the total nationwide comes to about $3 trillion. Nevertheless, these governments actually owe more than twice that much, according to estimates from groups like the States Project. The reason for the discrepancy is that states and localities carry another kind of debt—promises of retirement benefits to public-sector workers—and they have radically underfunded the systems that must pay for it. As Boston University Law School professor Jack Michael Beermann wrote recently in the Washington and Lee Law Review, the situation is a “double whammy” for future taxpayers, who not only will have to pay for “the consumption of prior generations” but also will receive “reduced government services” as increased spending on retirement debt crowds out other programs.

| Source: City Journal |

Estimates of state and municipal debt have been growing for another reason: more and more independent experts are exposing local governments’ faulty accounting standards. The Chicago-based Institute for Truth in Accounting observes that governments are balancing their budgets using “antiquated budgeting rules and accounting standards,” adding that “hundreds of billions of dollars of unfunded retirement systems’ liabilities are not reported on the face of states’ balance sheets.”

Who serves in the active-duty ranks of the U.S. all-volunteer military? Conventional wisdom holds that military service disproportionately attracts minorities and men and women from disadvantaged backgrounds. Many believe that troops enlist because they have few options, not because they want to serve their country. Others believe that the war in Iraq has forced the military to lower its recruiting standards.[HT: Al Roth, Market Design]***

- U.S. military service disproportionately attracts enlisted personnel and officers who do not come from disadvantaged backgrounds....

- Members of the all-volunteer military are significantly more likely to come from high-income neighborhoods than from low-income neighborhoods....

- American soldiers are more educated than their peers....

- Contrary to conventional wisdom, minorities are not overrepresented in military service....

Only 44 percent of teens are now getting a driver’s license within a year of being eligible — nearly half of the number of high-school seniors who had a license in the 1990s, according to the AAA study released yesterday.

Even as Americans' support for legalizing marijuana has doubled, and more than 20 states have loosened marijuana restrictions in various ways, Gallup finds relatively little increase throughout the past three decades in the percentage of U.S. adults who say they have tried marijuana.*** Gallup's trend by age reveals that widespread experimentation with marijuana first occurred among adults aged 18 to 29 between 1969 and 1973, rising from 8% to 35%. It then continued to mount, reaching 56% by 1977, and remained at that level in 1985. Since then, however, marijuana use among young adults has progressively declined. At the same time, as the bulge of young adults who tried marijuana in the 1970s ages and replaces older Americans who never tried it, the rate of all Americans who have ever tried the drug has increased slightly.

Source: Gallup

Although more than one-third of American adults have tried marijuana, a much smaller percentage admit to currently using it. Seven percent of U.S. adults in the July 10-14 survey -- a separate half-sample from the one asked if they have ever tried it -- say they smoke marijuana.

Consider the 2010 BusinessWeek innovation survey of thousands of senior leaders in dozens of countries. It identified the following as the greatest challenges to making innovation happen in their companies:

Ironically, during the worst recession in nearly a century, money wasn’t among the top barriers. Similarly, strategy, technology and competencies, the usual excuses for why innovation isn’t happening, were not among the main concerns of these executives. Instead, the primary challenges are essentially leadership issues of coordinating and integrating innovation throughout the enterprise and beyond.

- Lengthy development times

- Lack of coordination

- Risk adverse culture

- Limited customer insight

*** Remember innovation is a game of attrition. Every venture capitalist knows that you take multiple shots on goal because you never know what project is going to score and what isn’t until you take the shot. So hedge first and optimize later. Forget the 80/20 rule. That’s for efficiency wonks. It has nothing to do with making things amazingly new. Use the 20/80 rule instead. That is, it’s easier to change 20% of your company 80% than it is to change 80% of your company 20%. View your company’s performance on a bell curve and start at the tails where crisis or outstanding performance prevails. These are the places outside the norm where the risk of innovating and the reward of keeping things the same are reversed. Momentum is the key when connecting the dots of innovation. Find existing projects with lawyers, guns and money and hide your revolutionaries inside these Trojan Horses. They already have political capital and the means for propulsion. Use them to keep moving forward. Work out of sight and prototype your project until it starts to look like something that might actually succeed. Show, don’t tell.

Yet four years later, only about one third of the 4 million homeowners estimated to potentially benefit from HAMP during its initial lifespan (through December 2012) have received modifications through the program.*** Servicers with lower renegotiation activity had existing organizational designs that were much less conducive to mortgage modification. These organizations had smaller, less trained, and overloaded servicing staff, and servicing call-centers that were unable to efficiently handle a large number of calls. One of the most important differences among servicers is their ability to deal with distressed loans: some servicers have expertise in dealing with non-performing mortgages, while others only specialize in efficient processing of checks from borrowers.

These differences across servicers are economically important. Piskorski and his co-authors find that about 75 percent of loans are in the hands of servicers with organizational designs that were less conducive to renegotiations. This makes some sense because during “normal” times, it may have been efficient to just specialize in the mass processing of checks from borrowers.*** However, their results also suggest that such programs targeted at distressed borrowers may not necessarily result in a sizeable increase in non-durable or durable consumption, at least in the near term.

Why is that the case? It appears that distressed borrowers use additional resources from debt reduction to pay down their other debt in lieu of spending on new consumer goods. These findings are consistent with arguments that the large accumulation of household debt prior to the crisis is an important factor limiting household consumption.

The analysis offers a lesson for policy makers and servicers: any policy intervention in response to foreclosure or other crises may face similar organizational hurdles and should be accounted for in its design. In the case of HAMP, for instance, modification rates might have been higher if the program had allowed servicing for modifications to be shifted to servicers that were better prepared to review, negotiate, and process modifications.

Some 26 million U.S. golfers helped the industry generate $69 billion in revenue in 2011, according to the latest data from market researcher SRI International. While that's down from $76 billion in a 2005 SRI study, it tops revenue from such professional spectator sports as baseball, basketball, football and hockey combined, according to the Census Bureau. Add in the spillover effect on industries such as tourism, and the golf economy expands to $177 billion.

Treasury announced today that it will hold the inaugural Floating Rate Notes (FRNs) auction in January 2014, making FRNs the first new Treasury security since we introduced Treasury Inflation-Protected Securities (TIPS) more than 15 years ago.

NEWTOWN, Conn.—The number of people seeking permits to buy guns has surged in this town [Newtown, Ct.] following the December massacre of schoolchildren by a local man, even as the parents of some victims had urged stricter weapons laws nationwide.

Through July 24, more than 200 people in Newtown have received new local pistol permits, according to a review of local records, surpassing the 171 new permits issued for all of last year.*** "I think people realize that you can't call the police all the time and expect them to save you," said Newtown resident Bill Stevens, 48 years old, an avid hunter who owns more than a dozen firearms. "It's sinking in to some folks that 'I need to take responsibility for keeping my family safe.' "

| Source: The Wall Street Journal |

The tragic difference is how poorly the economy has emerged from this last recession. In the 1980s, growth averaged about 5% in the first four years of expansion compared with 2.2% since the current recovery began in mid-2009. If this had been a normal post-World War II expansion, the economy would be $1.3 trillion larger now.

The Commerce [Department] calculators found that the beginning stages of the Obama recovery were stronger than first estimated, but growth dipped to 1.8% in 2011, rising to 2.8% in the election year, only to decelerate again in the last nine months to average about 1%.

The question is why the setbacks?*** The data suggest that a major cause of the recent slowdown has been the Obama tax increase. The uncertainty about whether and how much taxes would rise caused business to seize up in 2012's fourth quarter, and the arrival of the increase in January has slammed business investment. Residential investment has rebounded with the housing recovery, but real nonresidential fixed investment fell by 4.6% in the first quarter and rose a modest 4.6% in the second, for a net of zero in the first half.

Without business investment, wages and incomes won't rise. The tax hike raised rates on capital gains, dividends and small-business income—that is, on the returns from investment—at a time when nurturing more private investment and risk-taking should be a priority. In other words, the growth gap on President Obama's watch is best explained by policy blunders that have added risk, uncertainty and new tax and regulatory burdens on investment, hiring and risk-taking.